Investment ideas for 2021 and reopening post covid

Investment ideas for 2021. 2020 was a challenging and transformative year. The world was battling a new virus, which spread across the world without any discrimination. All the countries were closed to protect themselves from the hidden enemy. As always in human history, crisis creates opportunity. Established businesses had to adapt to the new regime, and emerging companies offered innovative solutions.

In my article “Investment Ideas for 2020,” I set my expectations for double-digit growth in e-commerce, cloud computing, cyber security, logistics, work from home, digital payments, 5G, and socially responsible investments Huh. These sectors played a central role in our fight with COVID 19 and will impact the economy in the near future. You can read the full article here.

Today I am presenting you another article in this investment ideas Chain. We will focus on the sectors that will benefit from the reopening of world economies. As we reach more people in more countries, we will observe a coordinated global recovery. Unprecedented global fiscal stimulus and near “boiling” demand will spur higher economic activity and consumer spending,

1. Utilities

Utilities are my top investment ideas for 2021. Utility stocks received little love from the investment community in 2020. They fell out of favor despite being one of the best performing sectors in the last decade. Investors are worried about the reduction in business activity due to the Kovid epidemic and the deteriorating health of consumers. Many of these fears turned out to be unfounded. And most utilities posted steady revenue and earnings in 2020. What happened? More people worked from home, which led to higher household utility bills. Low-income households received various incentive payment and forbearance options, allowing them to pay their bills. Even after a sharp decline in March, US manufacturing and non-manufacturing activity rapidly recovered to pre-Covid levels.

Despite their slow growth, historically, utilities have followed the broader stock market very closely. In addition, most established utility companies pay a steady dividend in the range of 3% to 4%. They are an attractive option for income-seeking investors. Some experts consider utilities to be bond proxies. They have little to do with the rest of the stock market.

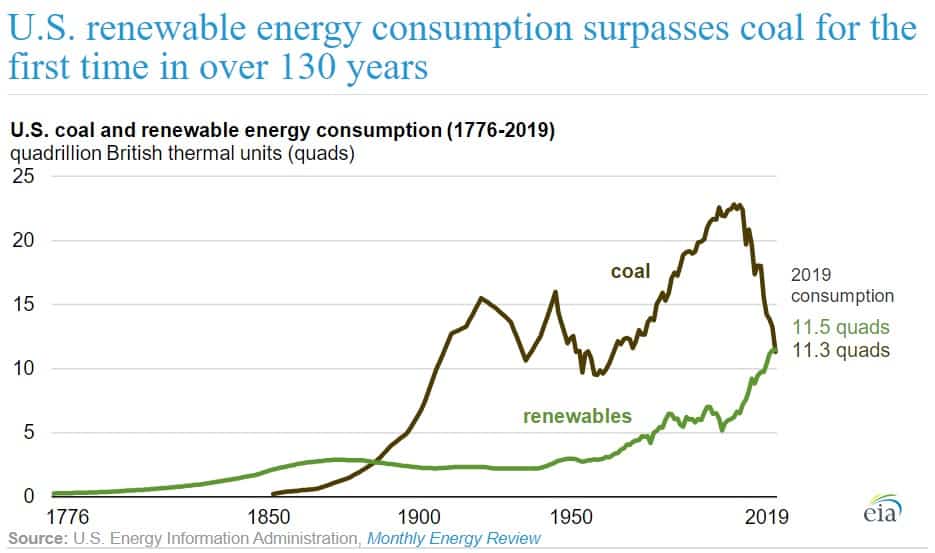

Renewable energy consumption is on the rise in the US

Where we stand today, many facilities are at the fore and center of our fight against climate change and global warming. Many utilities aggressively move to renewable energy sources such as solar panels, hydroelectric dams, wind turbines, geothermal and biomass energy. Renewable energy collectively provides more electricity than coal plants For the first time in 2019.

Utilities rely deeply on natural gas and fossil fuels. However, I believe that further innovations in battery storage and capacity utilization will continue to fuel renewable energy development. Furthermore, for staunch believers in electric vehicles and clean energy, the boring old-fashioned utilities will do the quintessentially moving the needle toward widespread adoption.

2. Health Care and Life Sciences

2020 was both brutal and transformative for the healthcare industry. Health workers around the world are and will be in the frontline battle against COVID-19. We all have seen doctors and nurses sharing pictures after a tiring shift in their COVID unit. I know healthcare workers (including my dad) who lead the fight every day. As someone married to a therapist, I have close experience with the challenges and changes that have happened over the past 12 months.

New chapter for healthcare

telehealth Will become the norm in general medicine. As more professionals and patients become comfortable with the use of technology, telemedicine will provide access to more affordable and better quality care for many people around the world. For the healthcare system, this is an opportunity to cut costs, improve burnout rates among doctors, and keep hiring top talent without the need to relocate.

medical devices, 2021 and 2022 may see a boom in elective and non-essential medical procedures. The global pandemic forced many people and hospitals to delay non-life-threatening, elective and cosmetic surgeries and procedures. I believe that as we get a tighter grip on the virus through vaccination and the rollout of new viral drugs, we may see slow and steady growth in this side of healthcare.

new treatments, The pharmaceutical and biotech industry is in the early innings of developing a new generation of patient treatments. From gene sequencing and immunotherapy to multi-cancer screening, it offers a unique opportunity in the fight against cancer and other rare diseases.

3. Financial

I started writing this article in the first weeks of 2021 before the rally in banks, which was caused by a rise in US Treasury yields. As a result, most banks are now trading close to or above pre-COVID levels. Still, one of our investment ideas for fiscal year 2021.

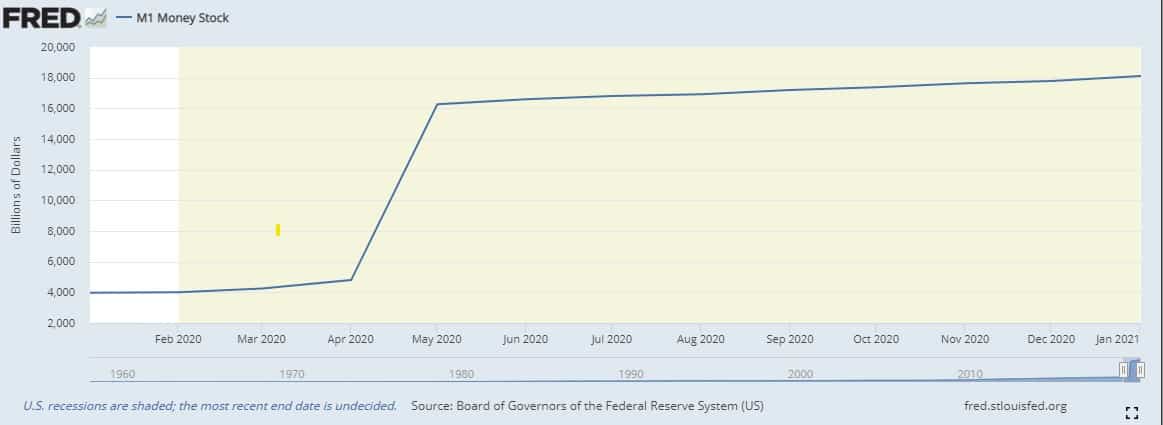

Despite initial concerns over liquidity and loan losses, banks maintained a strong balance sheet and reported revenue and earnings well above analysts’ estimates. The unprecedented stimulus has flooded the financial system with cash. The cash supply of the US economy has grown from $3.9T pre-covid to $18.1T as of January 31, 2021. A large chunk of cash is waiting to be deployed with banks.

US M1 Supply

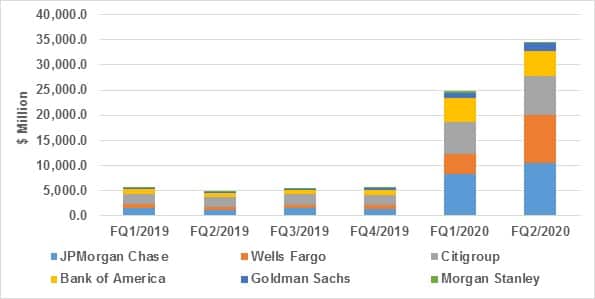

In addition, most banks carried significant loan loss provision reserves. For example, Bank of America alone took in reserves of $11.3 billion in 2020 compared to $3.6 billion in 2019. I expect banks to issue most of these provisions, which they can use to pay higher dividends, share buybacks and improve operational efficiencies.

US Bank Stocks – Provisioning for Debt Losses (2019-2020)

Before you get too excited about investing in banks, remember that the entire financial industry is undergoing massive digital transformation. Old brick and mortar branches are slowly losing their footprint. PayPal and Square are taking market share in the growing digital payments space. For example, PayPal reported 20% more revenue in 2020, with Square doubling it. While Bank of America reported a -5% drop in revenue. Therefore, expect the bank of the future to be leaner, less physical, more personal, more digital and more focused on the user experience.

4. Discretionary Spending

Millions of individuals and families have supported our homes for over a year, Since many of us were unable to travel and spend time with our friends and family, we will see a significant increase in discretionary spending as the COVID vaccine is distributed to more people around the world. In addition, the $1.9 trillion COVID relief bill will put cash in the hands of many struggling American families. The latest round of incentives promises a $1,400 payment and child credit.

Bloomberg Economics estimates that Americans have amassed $1.7 trillion in additional savings since the start of the pandemic in January 2021.

With world economies reopening, discretionary spending will continue to rise. Therefore, I expect consumers to spend more discretionary income on travel, leisure, wellbeing, luxury goods, 5G phones and gadgets, and home improvement. For one, I can’t wait to be able to travel again.

5.Technology

Technology is one of our top investment ideas for 2021. Tech stocks will continue to dominate the stock markets and the US economy. The COVID pandemic has increased the role of technology in our daily lives. Tech giants were in a unique position in 2020. Their strong balance sheet and ability to adapt quickly accelerated their customers’ awareness and adoption. From ordering food and groceries online, to applying for mortgage loans online, to digital signatures, voice control, video calls and 5G, technology is everywhere.

The outbreak of covid pushed every single business sector towards digital transformation. As a result, more private businesses and government organizations are adopting data analytics, cloud computing, cyber security, customer service, experience management to improve their service, understand their customers and strengthen their data. Gartner projects that spending on public cloud services will grow 18.4% to total $304.9 billion in 2021, up from $257.5 billion in 2020. In addition, the expansion of 5G networks will set the stage for significant innovations in autonomous driving, connected devices, smart homes. , artificial intelligence, and virtual/augmented reality.

- Tax Brackets for 2022 – January 12, 2022

- 401k Contribution Limit 2022 – January 8, 2022

- Roth IRA Contribution Limit 2022 – January 8, 2022

- Choosing Between RSUs and Stock Options in Your Job Offering – November 2, 2021

- Getting After Tax Alpha and Higher on Your Investments – June 11, 2021

- 5 reasons to leave your robo-advisor and work with a real person – May 1, 2021

- Step by Step Guide to Planning Initial Stock Options Exercises – January 29, 2021

- Effective Roth Conversion Strategies for Tax-Free Growth – June 23, 2020

- 5 smart 401k moves to make in 2021 – August 4, 2021

- tax saving ideas for 2021 – September 16, 2021

View All Posts