Updating my favorite performance charts for 2021

It’s that time again.

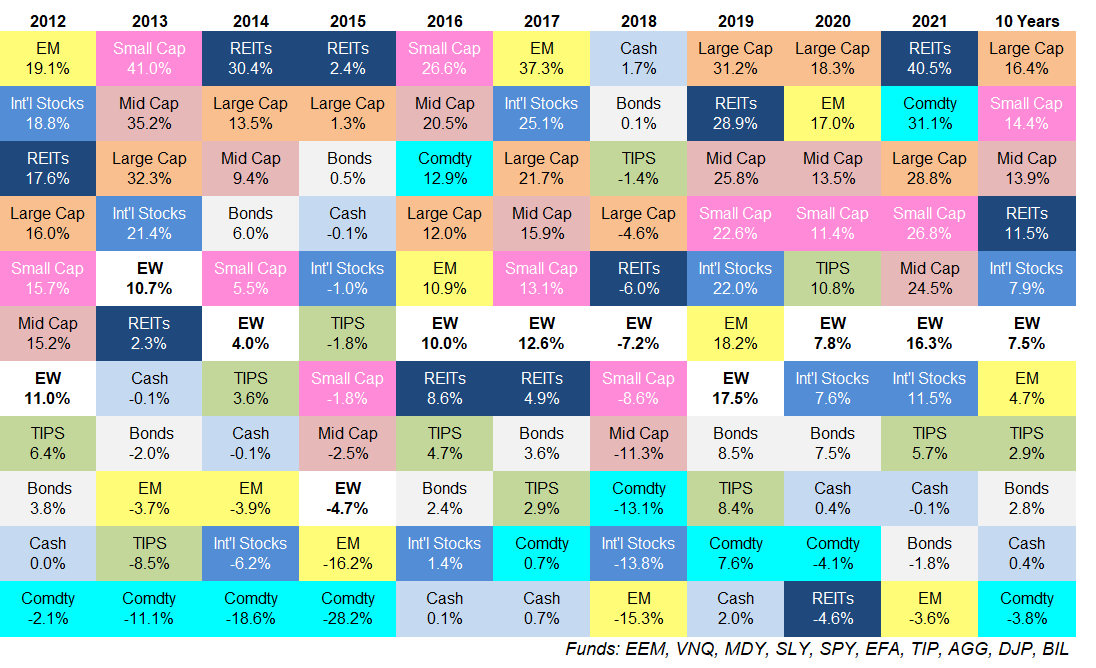

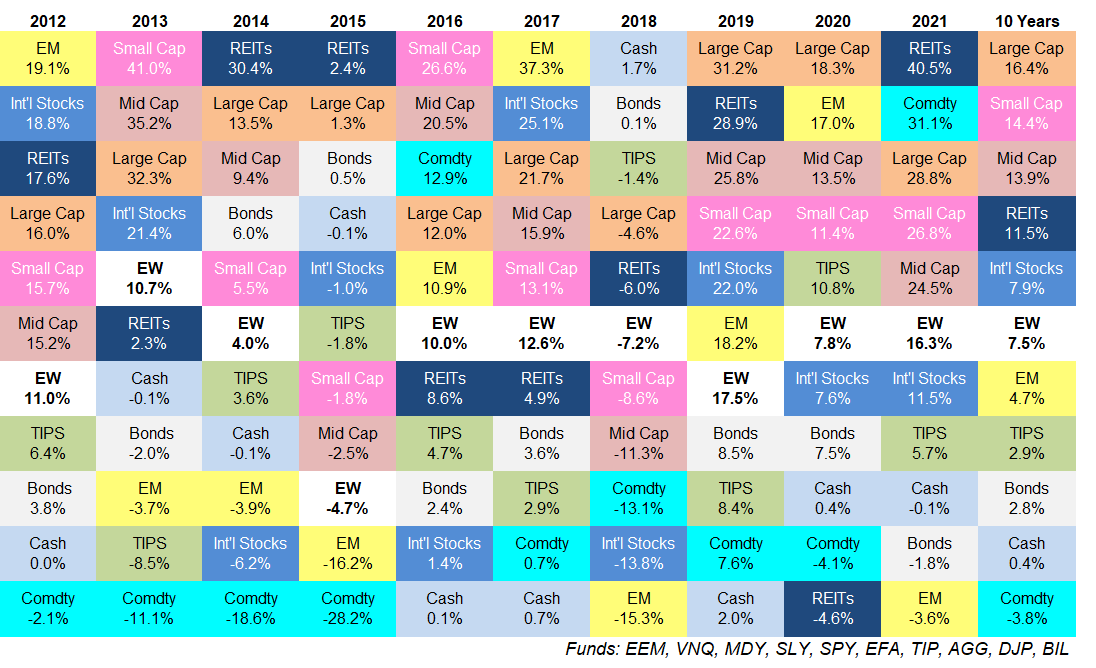

Here’s an update of my asset allocation quilt over the past 10 years:

some ideas:

some ideas:

I was surprised that the REIT did so well last year. I pay attention to this stuff. I track returns for a variety of markets, strategies and asset classes.

Yet somehow I didn’t realize that REITs had such a wonderful year.

I think it makes sense when you consider that real estate investment trusts were at the bottom of the barrel last year.

Sometimes it works, sometimes it doesn’t.

Commodities still have a lot of lost ground to build on. Commodities had a banner year in 2021, up over 30%.

Yet over the past 10 years, a basket of real assets (as defined here by the DJ ETF) is still down more than 32%.

On the one hand, high inflation could keep the good times going.

On the other hand, technology is the biggest deflating force on the planet.

Choose your fighter.

Cash has long been garbage. The highest return in the last 10 years for short-term T-bills (basically cash, savings accounts, money market funds, etc.) is 2%. Tea Average The return during this period is just 0.4%.

Ouch.

Cash can still serve a purpose for its optionality, short-term security and ability to act as a volatility shock absorber. But since 2008, hoarding your money in cash hasn’t yielded anything close to a respectable yield.

It is possible that this situation may persist for a very long time.

The continuation of the S&P 500 is impressive. My quilt covers 10 asset classes. Over the past 10 years, the S&P 500 hasn’t moved from fourth place to worst in terms of performance rank.

Professional investors would kill for this combination of consistency and outperformance.

This is the best way to outperform over the past decade, which requires you to allow the market to do the heavy lifting for you.

And in the next 10 years?

I do not know. we will see.

The 10-year return for US stocks is silly. The S&P 500 has been unbelievable, but small caps and midcaps have also experienced great returns.

I know it sounds like this entire run-up in U.S. stocks is driven by a handful of names, but small and medium-sized companies have given investors annual returns of 14.4% and 13.9%, respectively.

It’s not just Apple, Amazon, Microsoft, Google and Facebook that are driving the market higher.

Several other stocks are doing their bit.

2008 is becoming a remote memory for the display number. My Asset Allocation quilt spreadsheet numbers date back to 2008. I add new returns each year when updating a quilt but keep those old returns for posterity.

So I have total returns starting during the worst economic crisis of my lifetime.

The loss of 37% for the S&P 500 in 2008 is the second worst calendar year in the past 100 years.

Yet even with that downright terrifying year, the S&P 500 is still up 300%, or more than 11%, year over year from 2008-2021.

You could invest your money to go through the worst financial crisis since the Great Depression and see above-average returns in the stock market if you kept at it.

That’s how well the US stock market’s returns have been since the 2008 crash.

It is quite possible that we will never see a return like this again in our lifetime.

Maybe I’m wrong but that doesn’t surprise me.

Expect a wide range of results every year. The range of returns between the best- and worst-performing asset classes in 2021 was 44.1% (40.5% for REITs and -3.6% for emerging market stocks).

It sounds vulgar until you look at the other years on this chart. The average difference between the best and worst performing asset classes over the past 10 years is 33%.

There are always relative winners and relative losers in a given year. This is how markets work.

Diversification means you miss out on both home runs and strikes. A few years ago I began including equally weighted returns for all 10 asset classes listed here (named EW for those of you wondering what that box is in).

You can see this very simple form of diversification, which means that you will never be the best performer in any given year. An equal weight portfolio is basically always in the middle of the pack.

But this portfolio has never been the worst performer.

This is the trade-off you make when trying to control risk. Being diversified means always investing in the best and worst performers, but never the best or worst performers in your portfolio.

I think updating this chart every year gives me the biggest advantage.

Further reading:

Updating my favorite performance charts for 2020