Historical Returns for Stocks, Bonds and Cash Back as of 1928

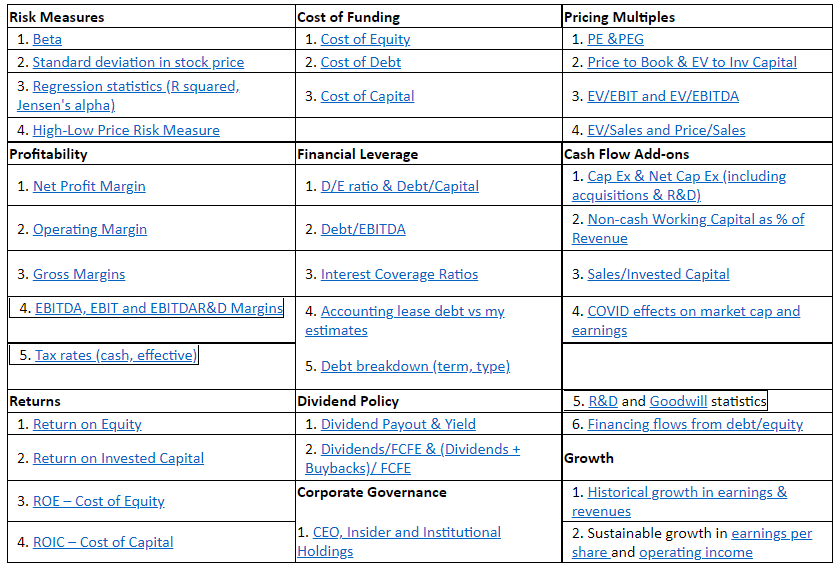

NYU professor Aswath Damodaran offers an impressive range of investment tools available for anyone to use for free:

Most of this data is fairly targeted and is probably only useful for fundamental investors looking to dive deep into the market.

I’m not afraid to get my hands dirty, but when it comes to historical market data I use the simple stuff more often.

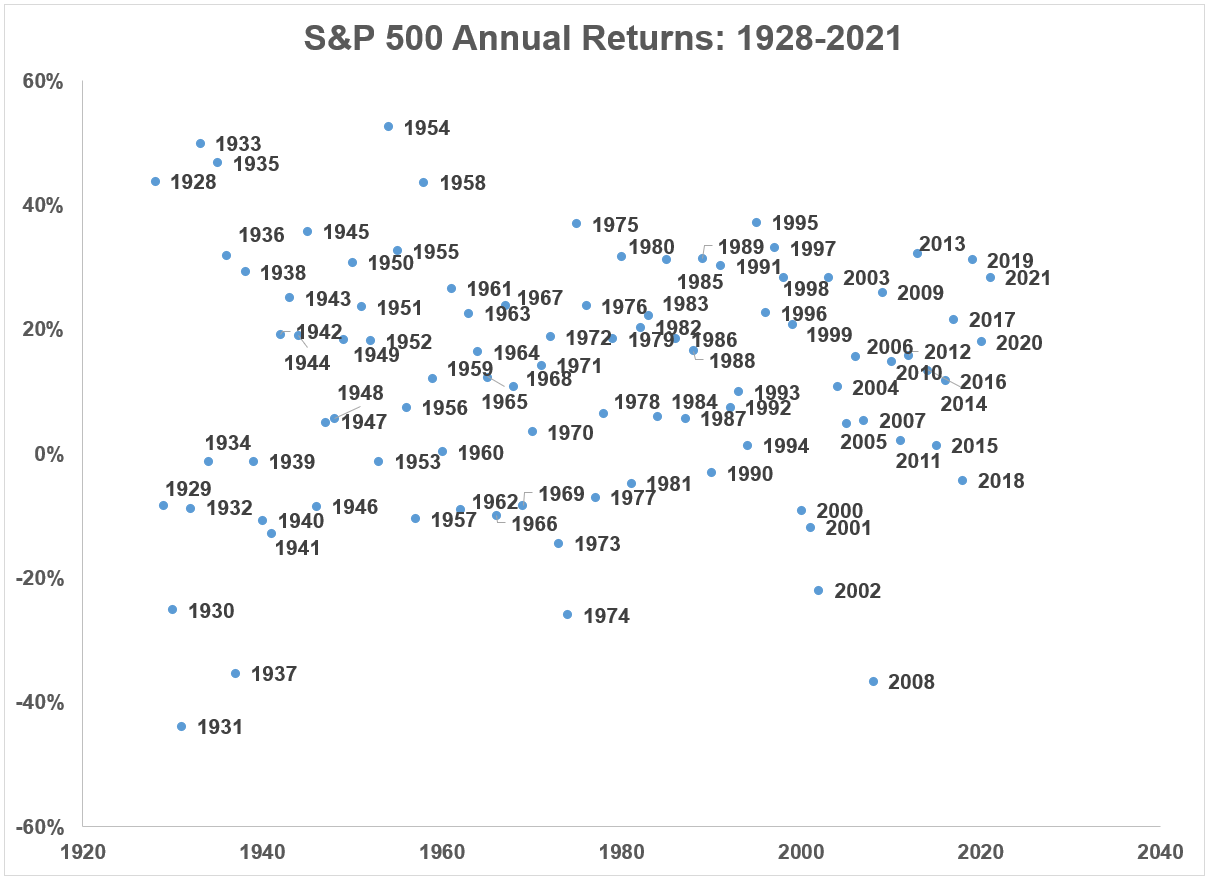

My favorite dataset from Damodaran is his annual update of historical returns on stocks, bonds and cash. It shows total return data for the S&P 500, 10-year Treasury and 3-month T-bills every year going back to 1928.1

Let’s look at some charts and tables we can make from this data:

This scatterplot of calendar year returns shows how widely stock market performance can vary from year to year:

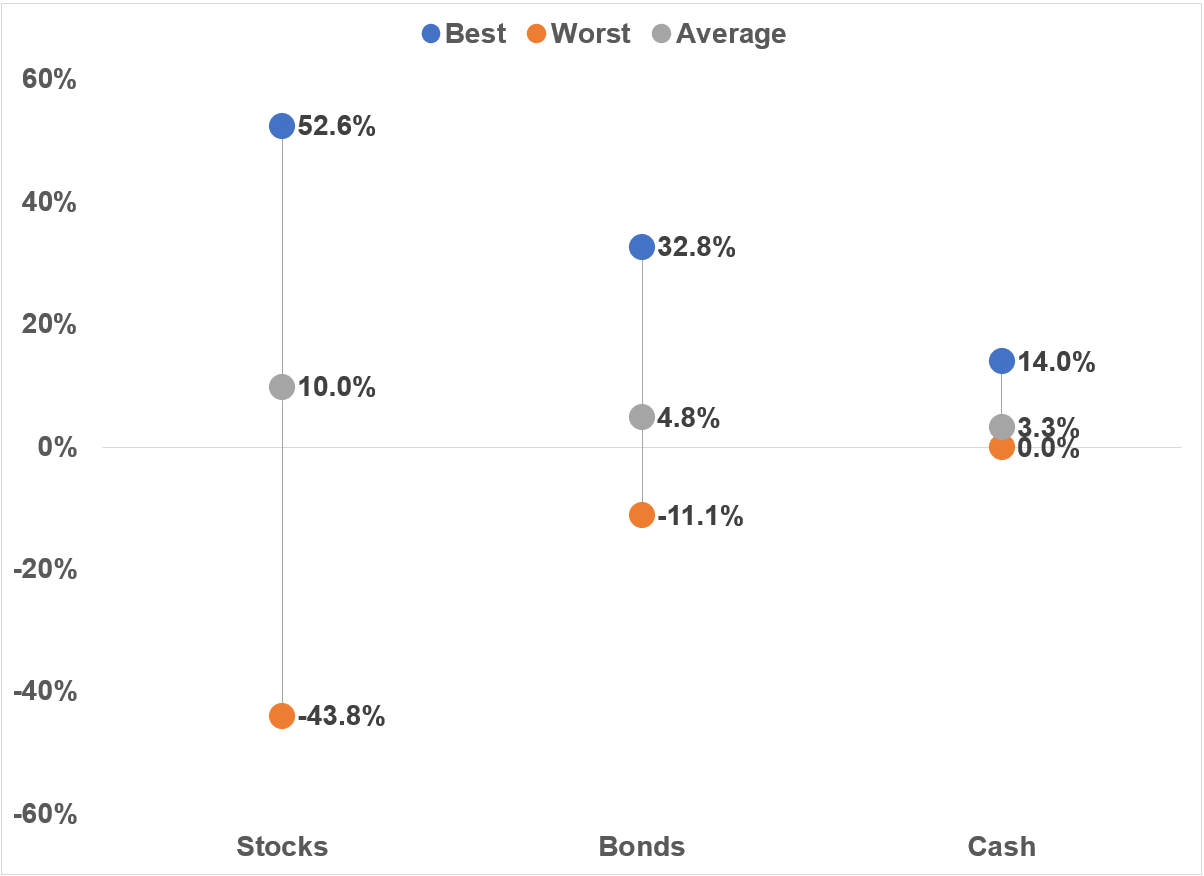

The difference becomes even more apparent when you compare the best, worst and average returns of the stock market against bonds and cash:

The wide range of returns is one of the biggest reasons stocks have much higher average returns than bonds and cash.

Bonds do not have nearly the same variation in returns as stocks because of the way fixed income is structured. Bond returns are much easier to predict over a longer period of time than stocks.

All you have to do is use the initial return and this gives you a fairly reliable expected return number over the next 5-10 years.

But when rates rise there can be some short-term volatility in bond returns.

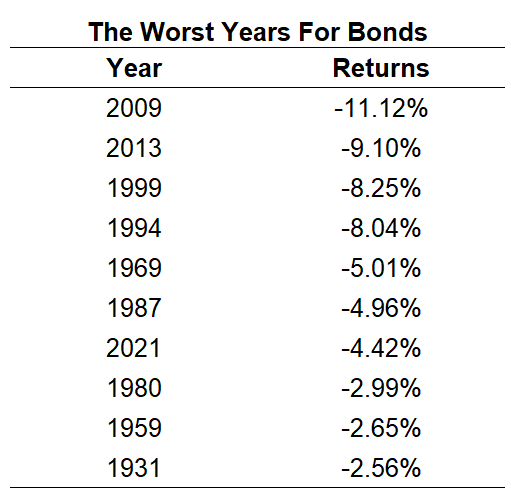

This is a list of the 10 worst calendar year returns for the 10-year Treasury since 1928:

It’s just a double-digit year, compared to 11 years for the stock market at 10% or worse at the same time.

It is interesting to note that 3 of the 10 worst years in the last 94 years have come since 2009. I expect this to continue in the coming years as bonds are more volatile and interest rates are so low.

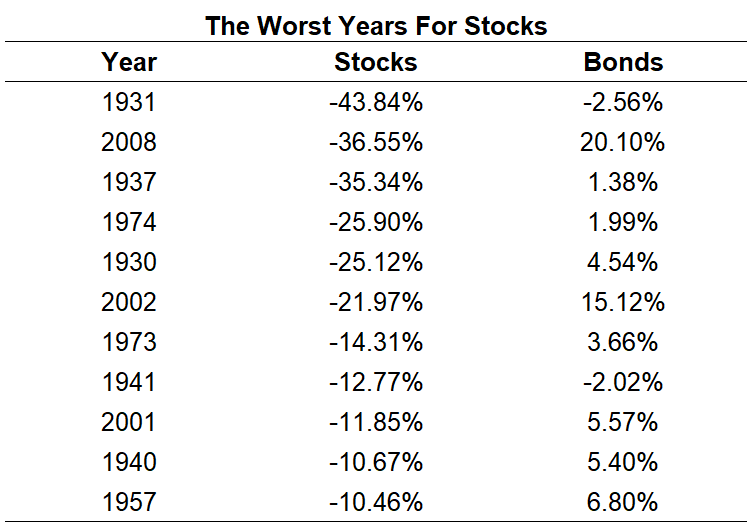

Here are 11 double-digit losses compared to bond returns over the same years:

The average loss in stocks over these years was -23%. In those same years, the jump averaged 5.5%, an outperformance of 28%.

There were two years on this list when bonds fell at the same time as stocks, but “bad” years in fixed income were a bad afternoon in the stock market.

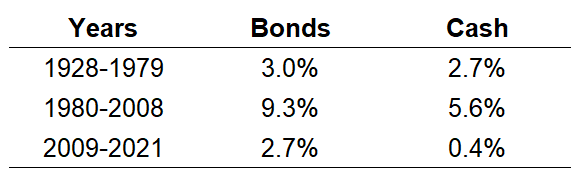

You can break these returns down into separate cycles to show why historical returns for bonds and cash were much higher in the past than they are likely to be in the future:

Interest rates became so high in the early 1980s that bond and cash returns went out of sight for decades to come.

Never say never, but it is highly unlikely that we will see such high returns on secured assets again for such a long time.

And finally as a reminder to keep a long-term perspective we go through yet another market correction.

Damodaran also published an increase in $100 invested in stocks, bonds and cash starting in 1928. This period includes the Great Depression, several wars, 15 recessions and a handful of 50%+ market crashes.

Yet in that time, $100 invested in the stock market in 1928 grew to more than $760,000 by the end of 2021.

not bad.

Michael and I talked about Damodaran’s data and more on this week’s Animal Spirits video:

Subscribe to Compound so you never miss an episode.

Further reading:

Updating my favorite performance charts for 2021

Now here’s what I’ve been reading lately:

1Damodaran has also added corporate bonds and real estate in recent years.