UBS Sees Wealthy Investors Stockpile Cash Before Fed Rate Hike

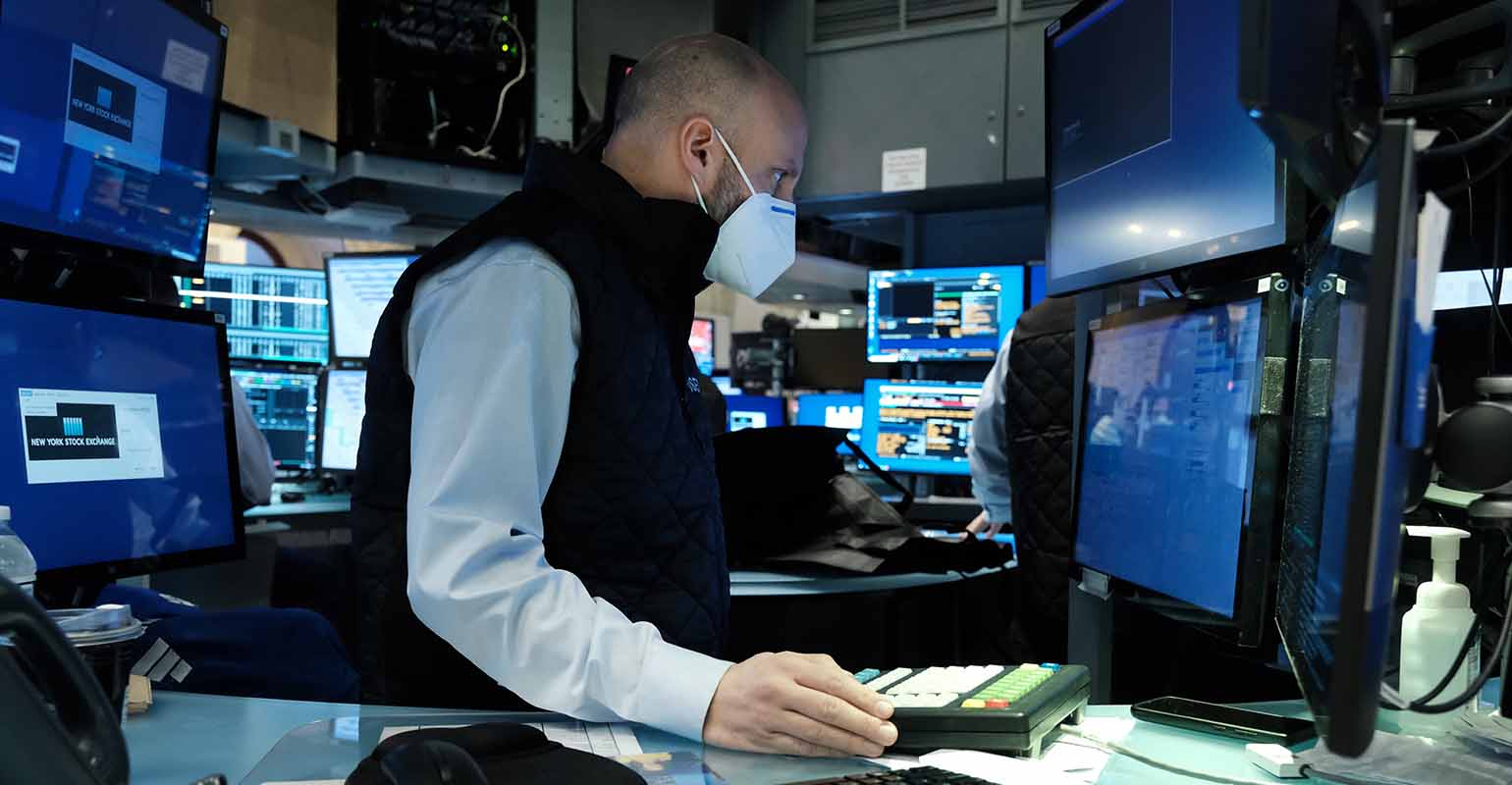

(Bloomberg) — The fall in the US stock market last month is making wealthy investors restless.

According to the UBS Global Wealth Management Survey, nearly half of high-net-worth people globally said they are highly concerned about a market downturn, up from 45% at the same time a year ago. Feedback was collected from Jan. January 4 to 24 – a period in which the S&P 500 index fell as much as 12.4% on an intraday basis. At one point, it was its worst start to a year.

Read more: S&P 500 tumbles to worst start ever in 16 days

In the US, where the Federal Reserve is expected to raise interest rates in March, 61% of those surveyed by UBS said they had more than 10% of their portfolios in cash and equivalents, up from 59% in 2021. Was more. More than 80% said the Biden administration should make controlling inflation a major priority.

According to the UBS report, “against a backdrop of inflation and rate hikes, investors are waiting for the ‘right opportunity’ to invest in sectors such as healthcare and technology.” Owners with $1 million or more in annual revenue.

While US equities have rebounded from last month’s lows, investors are still clueless about how quickly central banks will tighten monetary policy. An unexpectedly strong US jobs report last week raised the odds that the Fed would start next month with a half-percentage hike in its benchmark lending rate.

Read more: Traders raise bets on jobs blowout on super-sized March Fed hike

Meanwhile, according to economists surveyed by Bloomberg, the consumer price index probably rose 7.3% in January from a year earlier, the highest since 1982. That data will be released in February. 10.

According to UBS, high-net-worth American investors are getting ahead of potentially higher interest rates by taking out new mortgages and refinancing existing ones and tapping security-backed loans.