Some Thoughts on Bear Market

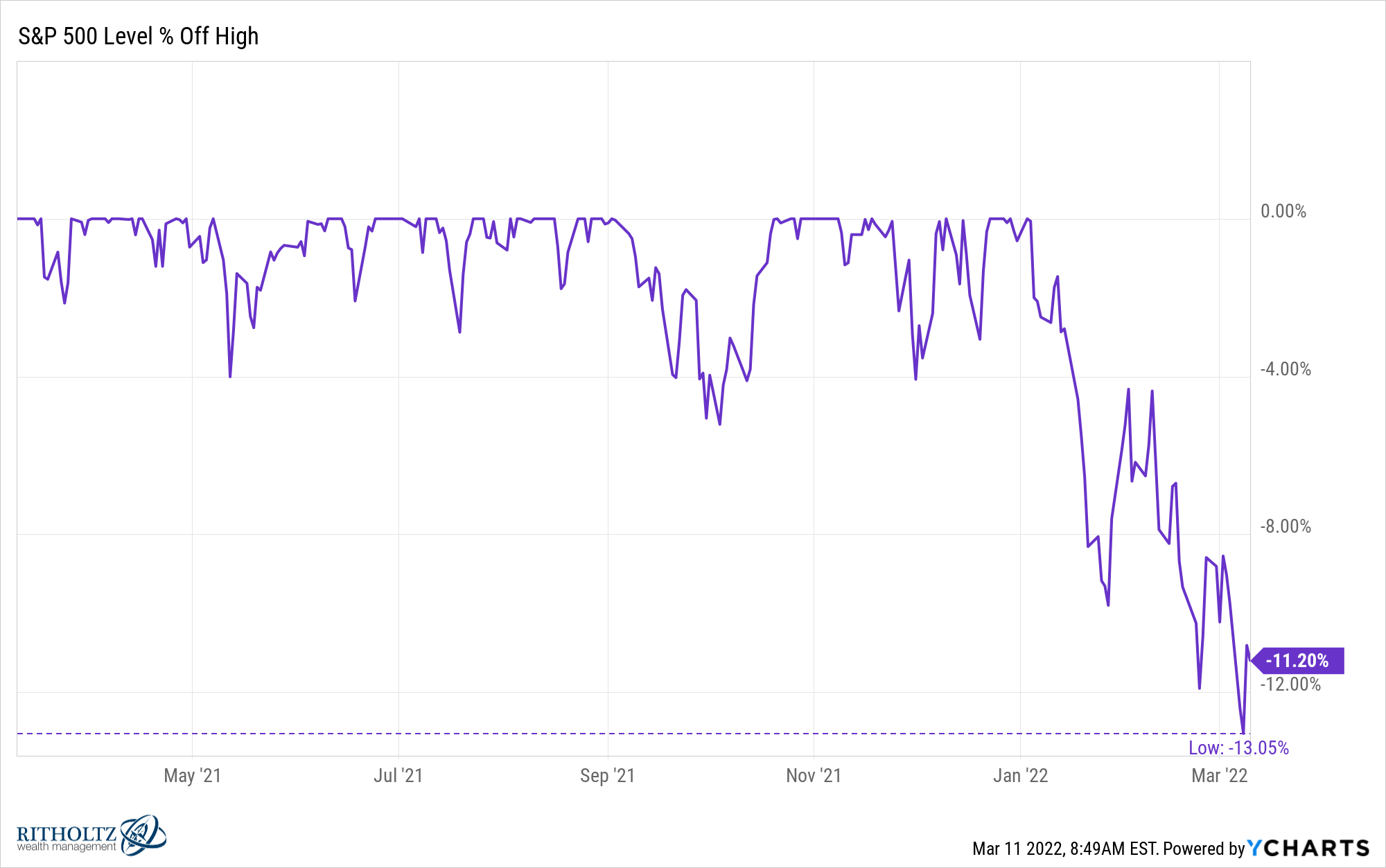

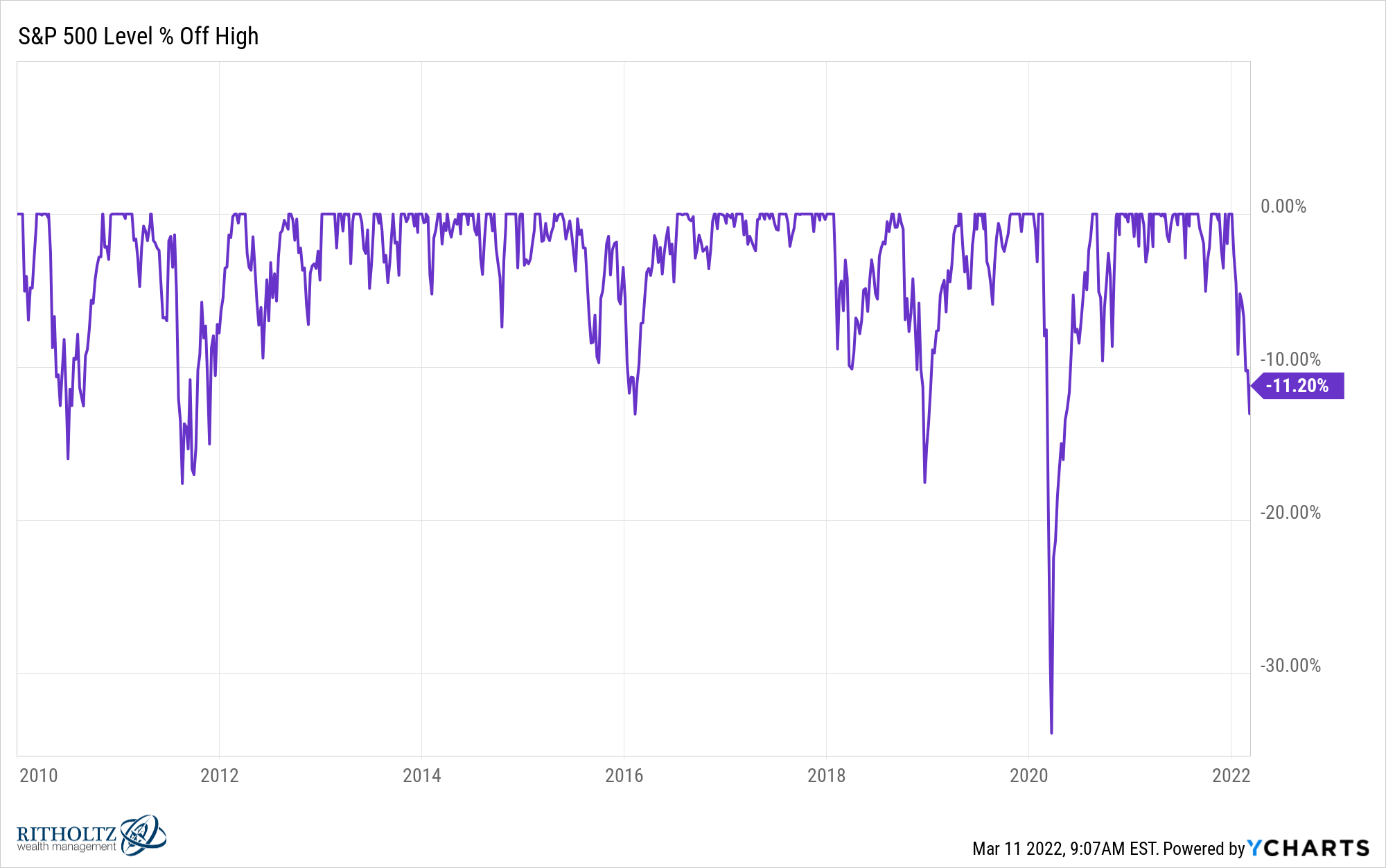

At its worst selling point this year, the S&P 500 was down a little over 13%:

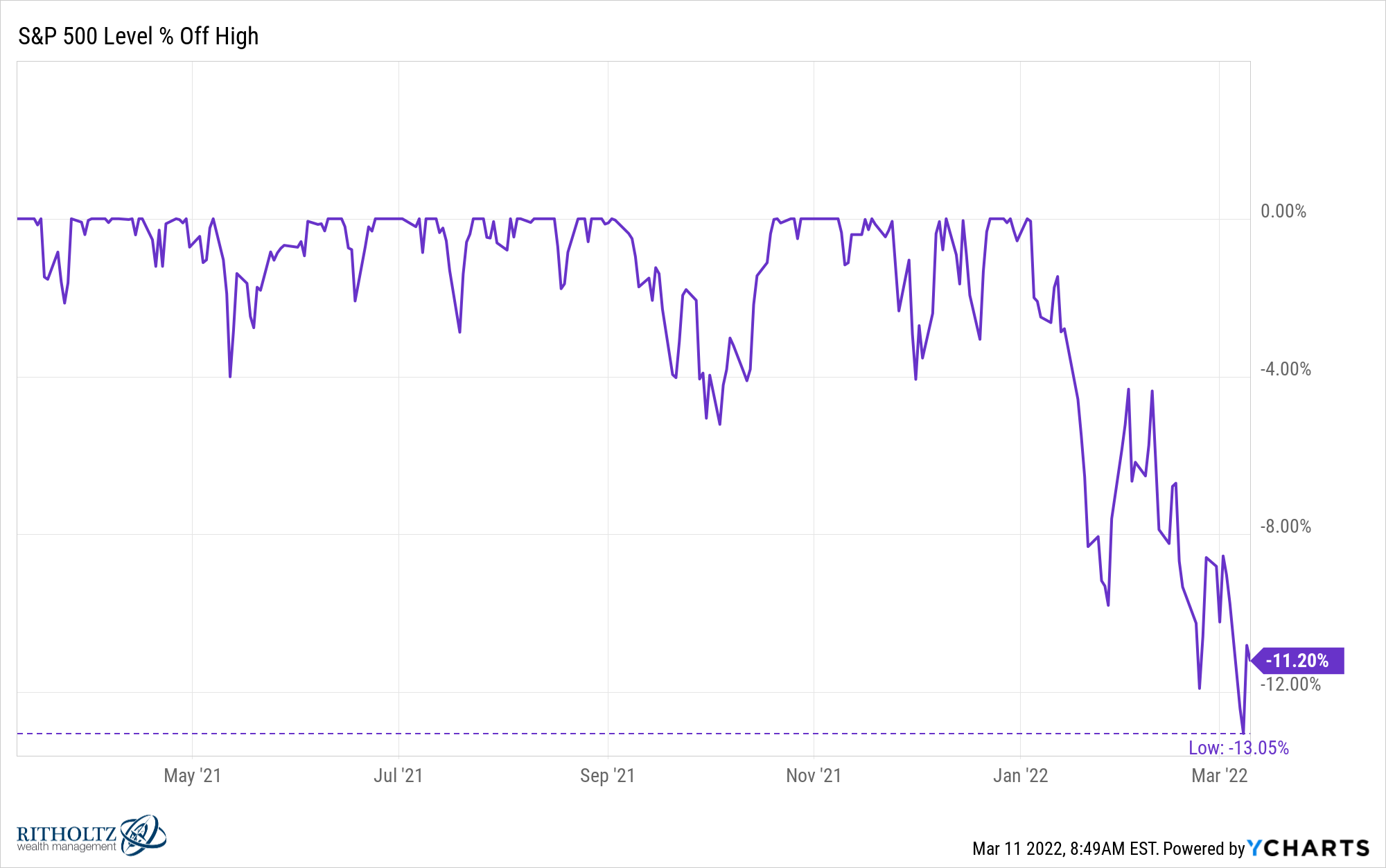

Going back to 1950, the average peak-to-trough drawdown in a given year is -13.6%:

So we’re right around the average. No year is ever average when it comes to the stock market and this year is clearly far from over but I like to keep these things in perspective when things look scary.

It’s always something.

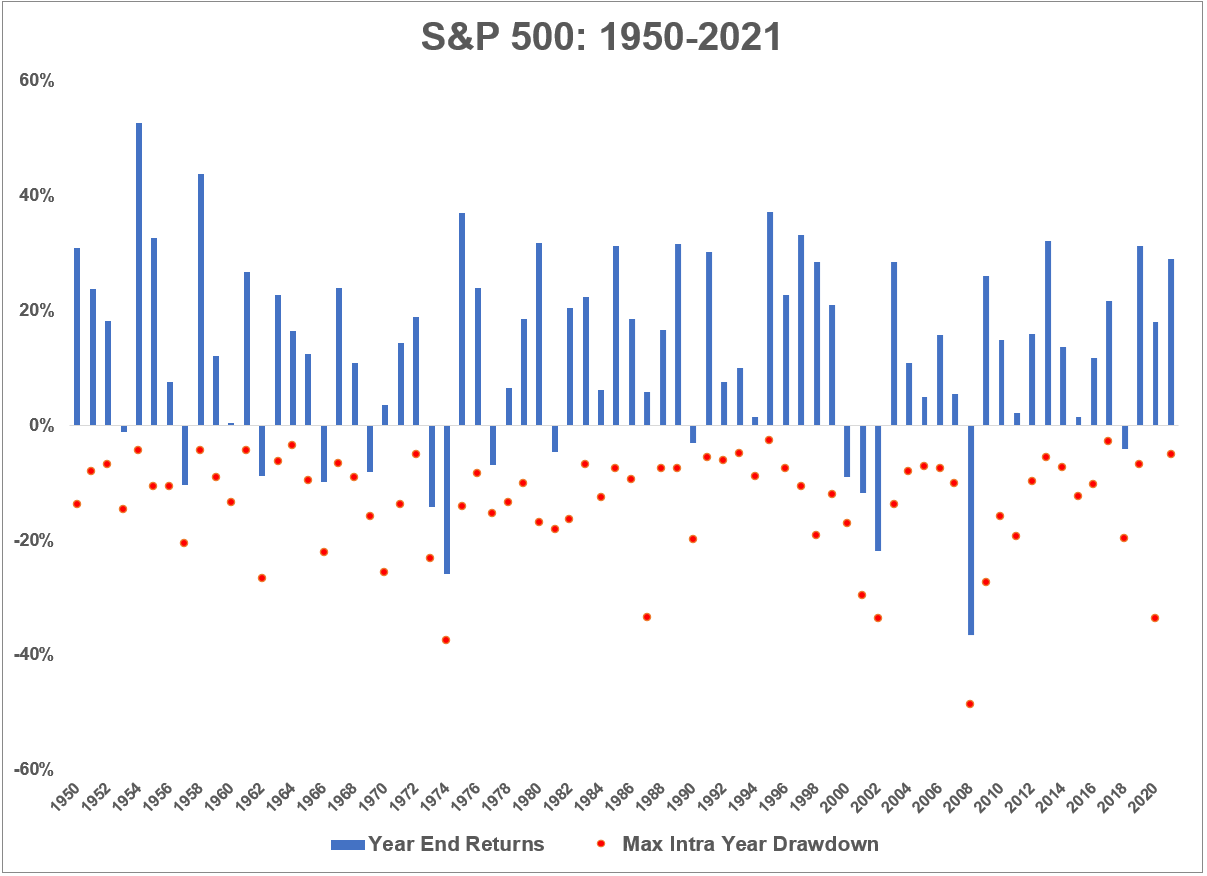

There is even more to the stock market than the S&P 500. In recent weeks, the Nasdaq 100, Russell 2000 and MSCI All World Ex-USA were down 20%, 21% and 16%, respectively:

And if you look under the hood, things are even worse, as if you’re a stockpicker.

While the Russell 3000 Index (a proxy for the entire US stock market) is down 11% or so from all-time highs, more than 60% of the companies that comprise the index are down at least 20% or more in the 52-week run. Huh. High. About 30% of stocks are down 40% or more from 52-week highs.

About a third of US stocks are down at least 20% this year alone.

I don’t know if this will translate into the technical definition of a bear market where the index is up 20% or worse. It is always possible, but I cannot predict the short term volatility of the stock market, especially during recessions.

Despite some made-up definitions, this feels Already like a bear market for many investors.

Here are some thoughts on bear markets:

Staring at the prices all day long won’t stop them from falling. With this they will not even go up. Paying more attention to the markets doesn’t give you much control over them.

My rule during a recession is that I never look at my portfolio. I can estimate how low it is based on my holdings and asset allocation, but looking at the values doesn’t make any sense to me.

Bear markets are confusing. The S&P 500 fell 3% on Monday. The Nasdaq 100 was down about 4%.

Then on Wednesday, the S&P 500 gained nearly 3%, while the Nasdaq 100 gained close to 4%.

It’s nothing like March 2020 when we saw string of -8%, +5%, -5%, -10%, +9%, -12%, +6% and -5% on consecutive days but it is in the form of a downtrend. What happens during

When things go crazy, investors panic in both directions because losing money makes people nervous.

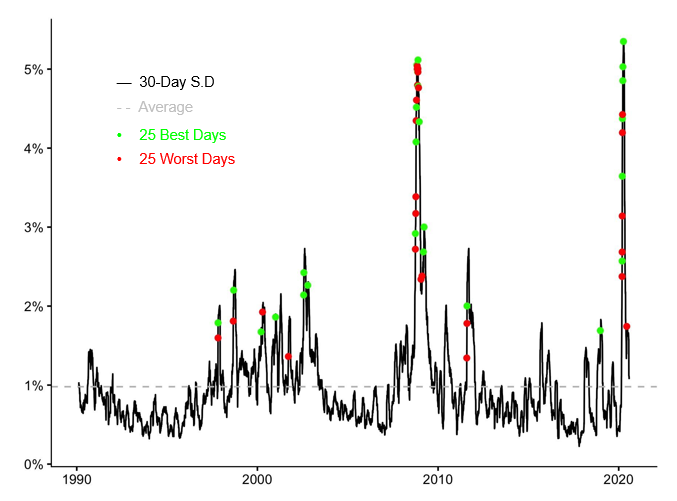

You can see the biggest loss And The biggest gains occur during the exit rush when volatility increases:

When markets fall volatility clusters that keep people on their toes.

People who are using this as an opportunity to scare you will never bring you back. There is a difference between people who are excited about bear markets because it is a good opportunity to buy at lower prices and those who are excited about bear markets because they want to see the world burn.

Perma-Bear will happily tell you why things are getting worse day by day. They will use intimidation tactics and make arguments that seem wise.

But they will never bring you back to the market after trying to scare you away from them.

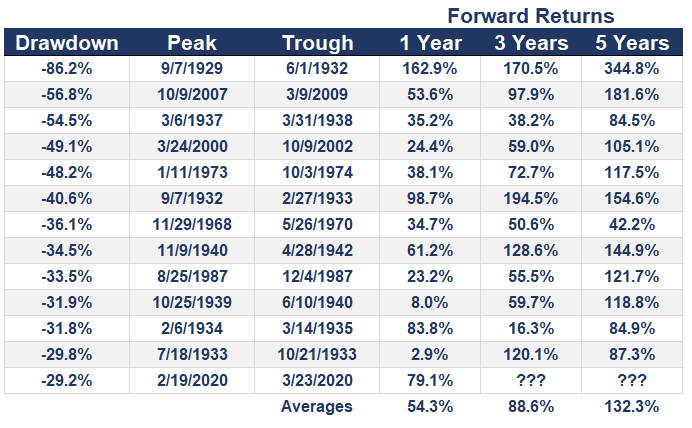

Bear markets are creating buying opportunities. I’ve seen returns from under bear markets before:

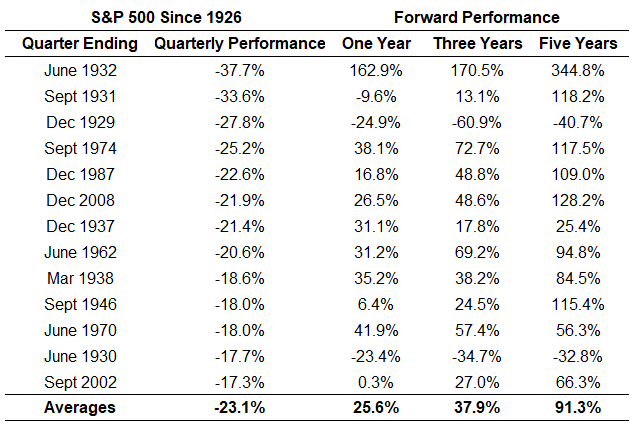

I’ve seen what happens after a really bad quarter for stocks:

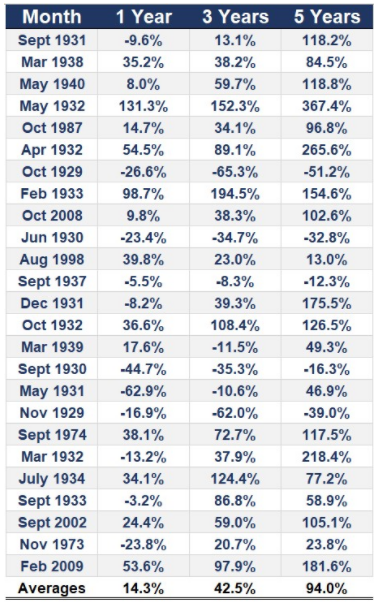

And I’ve seen what happens after a bad stock month:

When stocks are down, they give pretty solid returns in the long run.

Of course, the current losses are nowhere near these historical examples. And the future doesn’t have to look like the past.

But buying when stocks are on sale becomes a good strategy in the long run.

History provides context, not a crystal ball. When it comes to markets I love to look at historical data. It helps to provide context, shows investors a range of possible outcomes and helps to understand what is possible in the markets.

But you cannot predict the future from the past. There is no use of the words ‘Never’ or ‘Always’ when it comes to the market because things that have never happened before happen all the time. And things that work all the time eventually stop working.

It’s been a while since we made an extended fix. The markets are moving faster than ever these days. If you look at every correction since the Great Financial Crisis, all the recoveries have been V-shaped in relatively short order:

The Corona Crash saw the market drop 34%, but the fastest doubling from the bottom of a bear market we’ve had in modern history.

We haven’t had an extended bear market since the 2007-2009 debacle, which saw the S&P 500 fall by more than 50% and took almost six years to hit new all-time highs again.

Volatility tests the strength of your emotions and gut. The extended slump tests your patience and resilience.

I’m not sure how long this decline will last. I could end up having another V-shaped recovery.

But ultimately we’re going to run into something that lasts longer than most investors expect.

Michael and I discussed the pros and cons of bear markets on this week’s Animal Spirits video:

Subscribe to Compound so you never miss an episode.

Further reading:

Returns from the Bottom of Bear Markets

Now here’s what I’ve been reading lately: