3 biggest risks to the market right now

I’m looking at the glass-half-full side of things as it relates to the markets lately, so I should probably balance things out with some potential risk.

Black Swans were all the rage since 2008. Every year people now put out their own lists of highly unlikely events that can have a major impact on the markets.

Here are my top 3 for 2022:

1.

2.

3.

I’m sorry, but you’re probably not going to predict the next black swan. No one predicted that a pandemic would change lives as we know it in late 2019/early 2020.

What about some white swan risks?1

What are the risks that are out in the open that can have an impact on the markets but do not necessarily prove to be an outlier?

The biggest risks are often the ones we don’t see coming but small risks can still cause some short-term trouble.

You can always say war or any other crazy version or collapse of civilization as we know it, but I’m going to focus here on the risks related to the market.

1. Inflation. The bond market is still not concerned about inflation above 6%. Yes, the 10-year Treasury yield has risen slightly over the past week, but it is still hovering around 1.7%, which is nowhere near the current inflation rate.

There are a lot of factors at play here but it is possible that the bond market may not believe that high inflation is here to stay.

But what if it is?

The stock market is a great hedge against high inflation in the long run. It can be a good hedge in the short term but consistently high inflation is not great for stock returns.

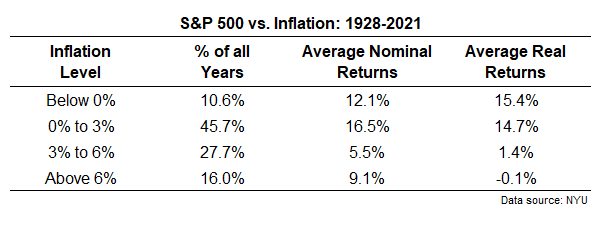

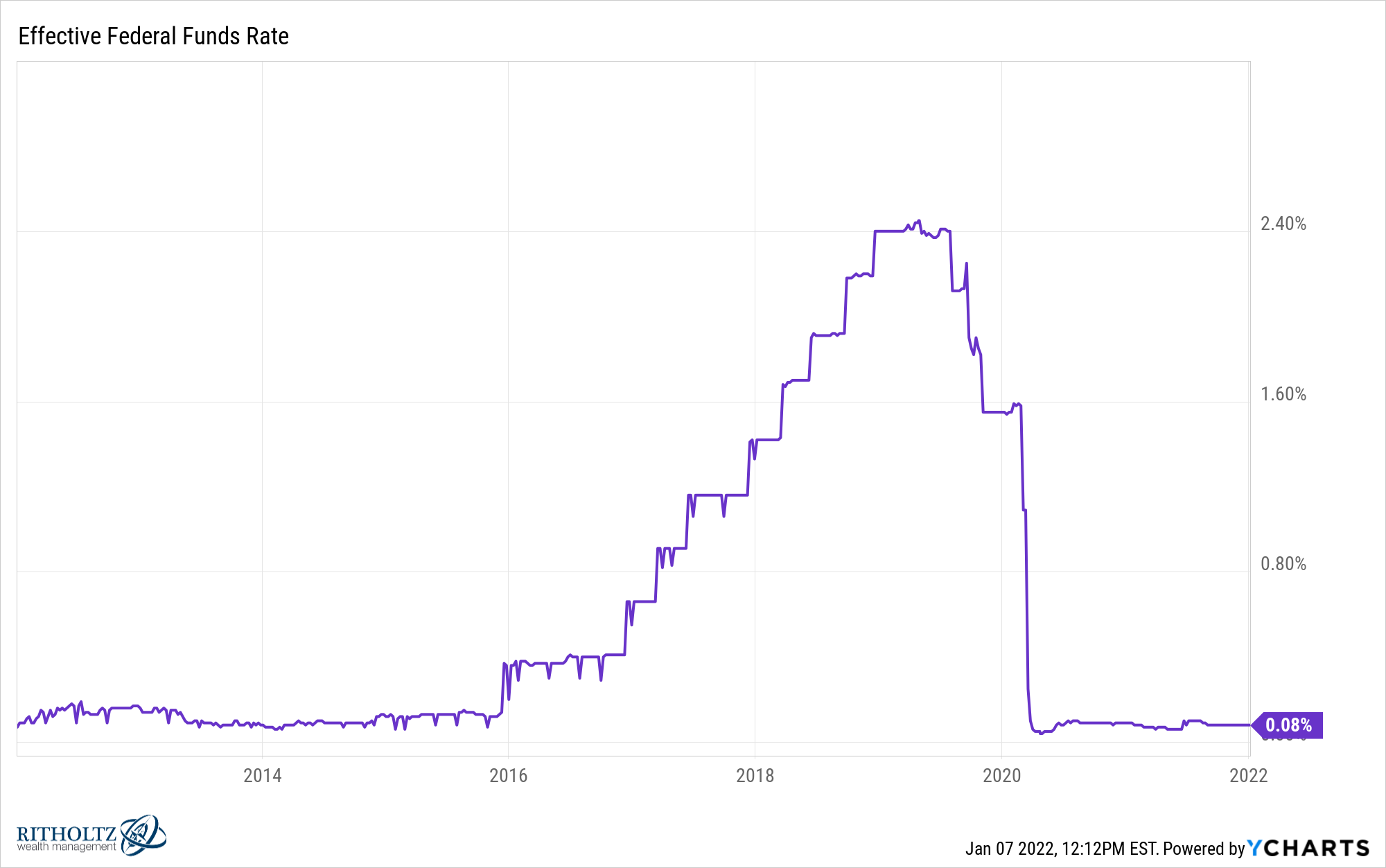

I looked at the calendar year returns of the S&P 500 going back to 1928 and compared them to various inflationary regimes:

You can see 0% to 3% is the sweet spot. Nominal returns are really great when inflation is running at 6% or more, but when you look at them on a real basis those returns are swallowed up by inflation.

Last year was actually one of the best years on record, with inflation so high. Only real returns were higher when inflation was 6% or more, which was in 1975.

Stocks may continue to perform well with rising prices, but corporations can only go through with high prices for so long. Eventually, above-average inflation becomes a headwind for the stock market.

2. Fed. We made two double-digit improvements in the US stock market in 2018:

We were basically in bear market territory on Christmas Eve that year. At that time no one knew why the market was falling. There was no good reason.

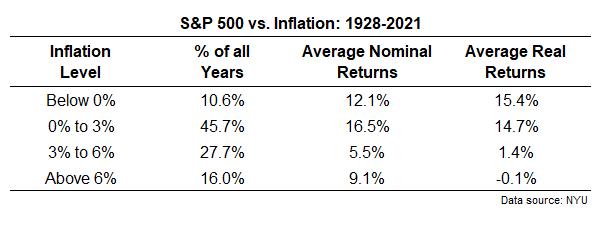

After the fact that most people agreed it was the Fed hiking rates:

The Fed raised rates to more than 2%, then abruptly changed course after a sell-off in the market. Mortgage rates also went up around 5% at the time, so it was a nice bit of a tightening cycle.

I don’t know what the line is in the sand for these things now, but it’s possible that too much tightening from the Fed could derail the stock market again.

And last time around they didn’t have inflation or high economic growth, so it’s hard to see them reversing sharply if markets don’t like higher rates.

History doesn’t always rhyme, repeat or retweet, but it’s not out of the question for the stock market if the Fed goes on a rate hike spree.

3. The stock went up too much. Why did the stock market crash in 1987? These are all technical reasons regarding market structure and portfolio insurance, but what most people don’t realize is that stocks were up about 40% in the first 8 months of the year before the Black Monday crash.

And after that from 1982-1986 the market was already up about 150%.

Sometimes the reason stocks fall is because they rise too much in a short period of time and investors look for an excuse to lock in some profit.

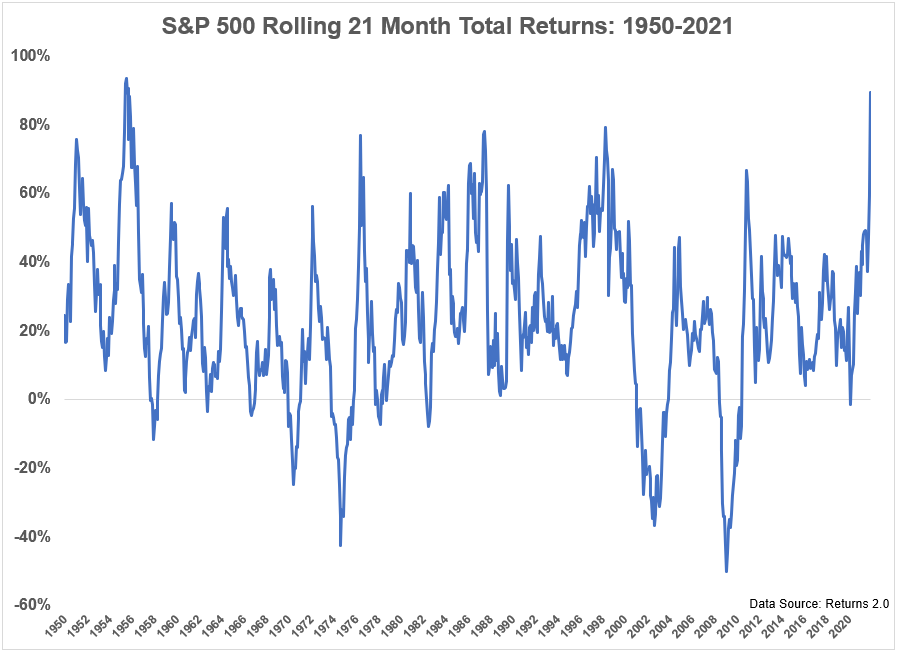

From April 2020 to the end of 2021, the S&P 500 was up 90%. This is a huge return over a period of 21 months. Just look at where it ranks for 21-month total returns since 1950:

It was higher only in the bull market of the 1950s.

Guess what happened after almost two years of this boom?

There was an 11% improvement in one month in the fall of 1955. Then the shares fell 15% in the summer of 1956. Less than a year later, the only bear market of the 1950s began as stocks fell by about 21%.

Returns were still excellent throughout that decade but the trees did not skyrocket and the improvement was a natural extension of the larger profit.

I’d be surprised if we of which If we do, improve 10-20% in the next 18 months.

Michael and I talked about how pullbacks are needed even in the best of times on this week’s Animal Spirits occasion:

Subscribe to Compound so you never miss an episode.

Further reading:

Is this the biggest bull market in history?

Now here’s what I’ve been reading lately:

1yes i made it. just go with it.