Successful Strategies to (Not) Time the Stock Market

Timing the stock market is an attractive idea for many investors. However, even seasoned investment professionals find it nearly impossible to predict the daily market volatility, immediate sector rotation and ever-changing investor sentiments. The assumption that you can absolutely sell at the top of the market and buy at the bottom is naive and often leads to wrong decisions.

The 24-hour news cycle is constantly bombarding us. The speed and scale of information can easily make the stock market jump between excitement, FOMO and irrational euphoria from frustration, apathy and fear.

In this context, market volatility can be disturbing and depressing. However, for long-term investors, it is foolish to try to time the market’s up and down. Constantly trying to figure out when to go in and when to exit can back fire. There is overwhelming evidence that most investors underestimate their long-term returns in an attempt to time the market. Market timers are more likely to chase the market up and down and become cautious, buying high and selling low.

The hidden cost of timing the stock market

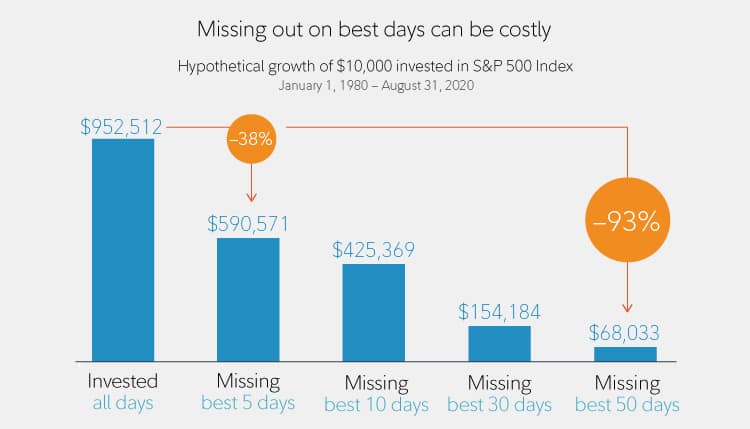

There is a hidden cost to market timing. According to Fidelity, missing just 5 of the best trading days of the past 40 years can reduce your total return by 38%. Missing the best 10 days will cut your returns in half.

For more discussion on how to manage your portfolio in times of extreme market volatility, check out my article.Understanding tail risk,

fast trade

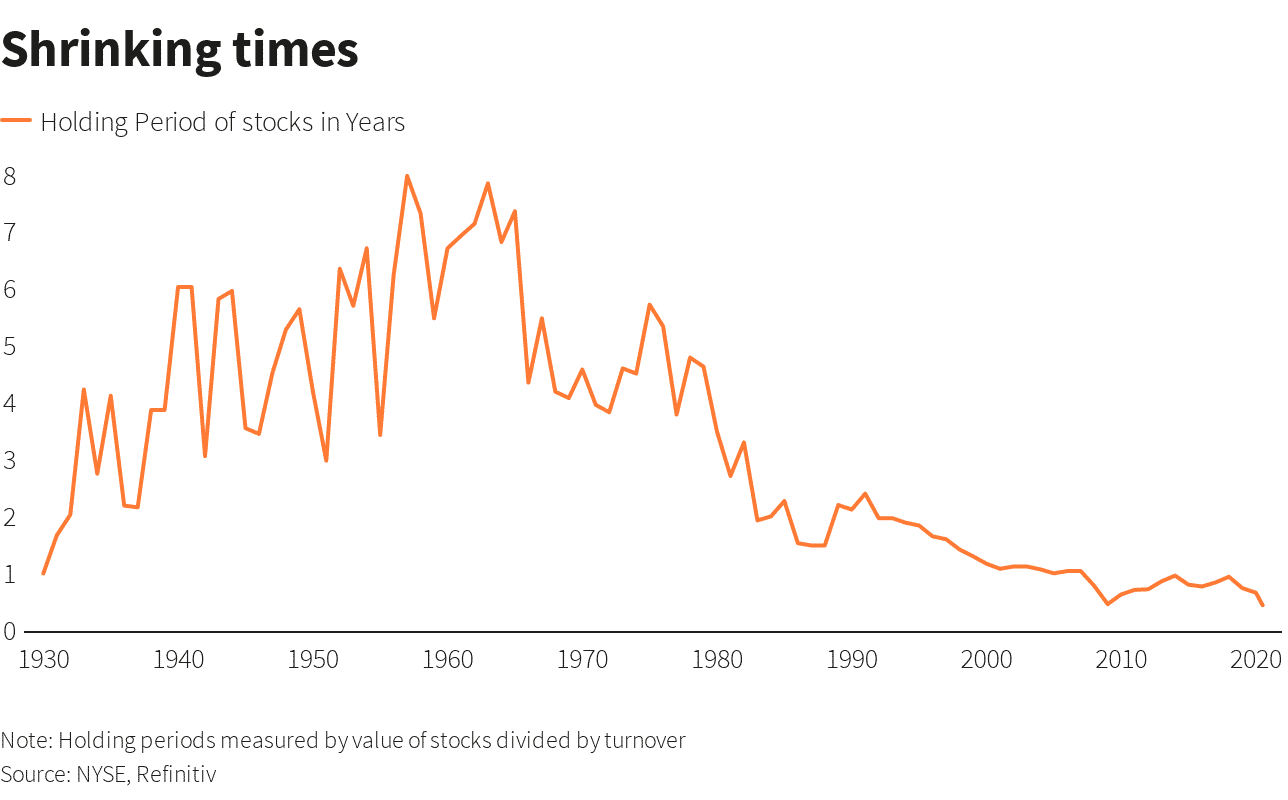

Today’s stock market is dominated by algorithmic trading platforms and swing traders with extremely short investment horizons. Most computerized trading strategies hold their shares for a few seconds, not even minutes. Many of these strategies are run by large hedge funds. They trade based on market signals, momentum and various inputs built within their models. They can process information in nanoseconds and do business faster. The average long-term investor cannot and should not attempt to outsmart these computer models on a daily basis.

Reuters calculated that the average holding period for US stocks as of June 2020 was 5-1/2 months, versus 8-1/2 months at the end of 2019. For example, in 1999, the average holding period was 14 months. In the 1960s and 1970s, investors held their shares for 6 to 8 years.

Market timing strategy gives investors a sense of control and empowerment, It doesn’t mean that they are making the right decision.

So, if market volatility gives you a tough time, here are some strategies that can help you through volatile times.

dollar cost averaging

DCA is the proven approach to always be able to time the market. With DCA, you make continuous periodic investments in the stock market. And you continue to make these investments whether the market is up or down. The best example of a DCA is your 401k plan. Your payroll contribution is automatically invested every two weeks.

Diversity

Diversification is the only free lunch in investing. Diversification allows you to invest in a wide range of asset classes with low correlation between them. The biggest benefits are reducing the riskiness of your investment portfolio, reducing volatility and achieving better risk-adjusted returns. A well-diversified portfolio will allow your investments to grow at different stages of the economic cycle as the performance of assets moves in different directions.

Balanced

Rebalancing is the process of trimming your winners and reinvesting them in other asset classes that have not performed successfully. Naturally, one might ask, why should I sell my winners? The quick answer is diversification. You don’t want your portfolio to be too heavy in any specific stock, mutual fund, or ETF. By limiting your risk, you will allow yourself to realize profits and buy other securities with a different risk profile.

buy and keep

For most people, buy and hold is probably the best long-term strategy. As you saw earlier, there is a huge hidden cost of missing the best trading days over a given period of time. So being patient and resilient to noise and negative news will ultimately increase your wealth. You have to be in it to win it.

tax-loss harvesting

If you hold stocks in your portfolio, tax-loss harvesting allows you to take advantage of falling prices and reduce your taxes. This strategy works by selling your losers at a loss and using the proceeds to buy a similar security with a similar risk-reward profile. At the time of this article, you can use capital losses to offset any capital gains from the sale of profitable investments. In addition, you can use up to $3,000 of residual capital loss to offset your regular income. The unutilized amount of capital loss can be carried forward to the next calendar year and thereafter until it is fully utilised.

maintain a cash reserve

I advise all my clients to maintain an emergency fund sufficient to cover expenses for at least 6 months. An emergency fund is especially important if you depend on your investment portfolio for income. The money in your emergency fund will help you tide over any unforeseen market volatility and fall in your portfolio balance. A great example of this would be the rapid recovery in the market at the start of the coronavirus outbreak in March 2020. If you need to sell stocks from your portfolio, you will be in trouble. But if you had enough cash to survive the crisis, you would be in an ideal position to enjoy the return in the next market.

Focus on your long term goals

My best advice to my clients who are nervous about the stock market is to focus on what they can control. Define your long-term goals and make a plan to achieve them. The volatility in the stock market can be a setback but it can also be a big opportunity for you. Whatever happens in the stock market, follow your plan. Step back from the noise and focus on strengthening your financial life.

- Tax Brackets for 2022 – January 12, 2022

- 401k Contribution Limit 2022 – January 8, 2022

- Roth IRA Contribution Limit 2022 – January 8, 2022

- Choosing Between RSUs and Stock Options in Your Job Offering – November 2, 2021

- Getting After Tax Alpha and Higher on Your Investments – June 11, 2021

- 5 reasons to leave your robo-advisor and work with a real person – May 1, 2021

- Step by Step Guide to Planning Initial Stock Option Exercises – January 29, 2021

- Effective Roth Conversion Strategies for Tax-Free Growth – June 23, 2020

- 5 smart 401k moves to make in 2021 – August 4, 2021

- tax saving ideas for 2021 – September 16, 2021

View All Posts