Why Everyone Thinks Inflation Figures Are Wrong

Just 35 years after the Wright Brothers made their first flight in Kitty Hawk, the United States was already using fighter jets extensively in the war.

But after World War II, the US Air Force began to have problems with this new game-changing technology. The planes were now so fast and complex that the pilots were having trouble controlling them.

They were crashing everywhere for inexplicable reasons.

The military at first assumed it to be pilot error, but further investigation into the problems prompted them to look at the design of the planes themselves.

You see that the early cockpits for most of these aircraft were designed in the 1920s. Certainly, the dimensions of fighter pilots had changed since then, considering how many more were in the Air Force after the war.

So they began a study based on measurements from more than 4,000 pilots using 140 different dimensions of shape (arms, legs, arms, worms, etc.). He believed that building a better cockpit that took these measurements into account would help prevent so many accidents.

The lieutenant he employed to take these measurements was a young boy by the name of Gilbert Daniels. Daniels took data from more than 4,000 pilots studied and looked at the 10 most relevant measurements for the cockpit.

The idea was to come up with an average size of Air Force fighter pilot to help design a better aircraft. Yet when he compared each individual pilot to the “average” pilot by all measurements, Daniels made a startling discovery.

His fellow researchers assumed that most pilots would be within some range of the average, while many pilots would almost certainly hit all 10. But there were absolutely zero pilots who fit the bill when comparing the actual dimensions to the average.

Not a single fight pilot out of more than 4,000 was the average of all.

Some had long arms but short legs or vice versa. Others may have thick upper body but slender legs. Or maybe a thick neck a little short wrists.

in your book1 Based on these findings, Gilbert wrote:

The tendency to think from the point of view of the ‘average man’ is a pit in which many people make mistakes. It is almost impossible to find an average airman in this group, not because of any distinguishing feature, but because of the great variability of physical dimensions that are characteristic of all males.

Any change towards the “average” person was doomed to fail because the average person does not exist. His recommendation was to make the cockpit more adjustable for individuals, and not vice versa.

So the military eventually helped design aircraft that were person-friendly in many ways, including what we now take for granted – adjustable seats, straps that can be loosened or tightened, foot pedals that can be moved higher or lower. can go, etc.

Adjusting was the only way that made sense in a world in which averages do not apply to any individual.

,

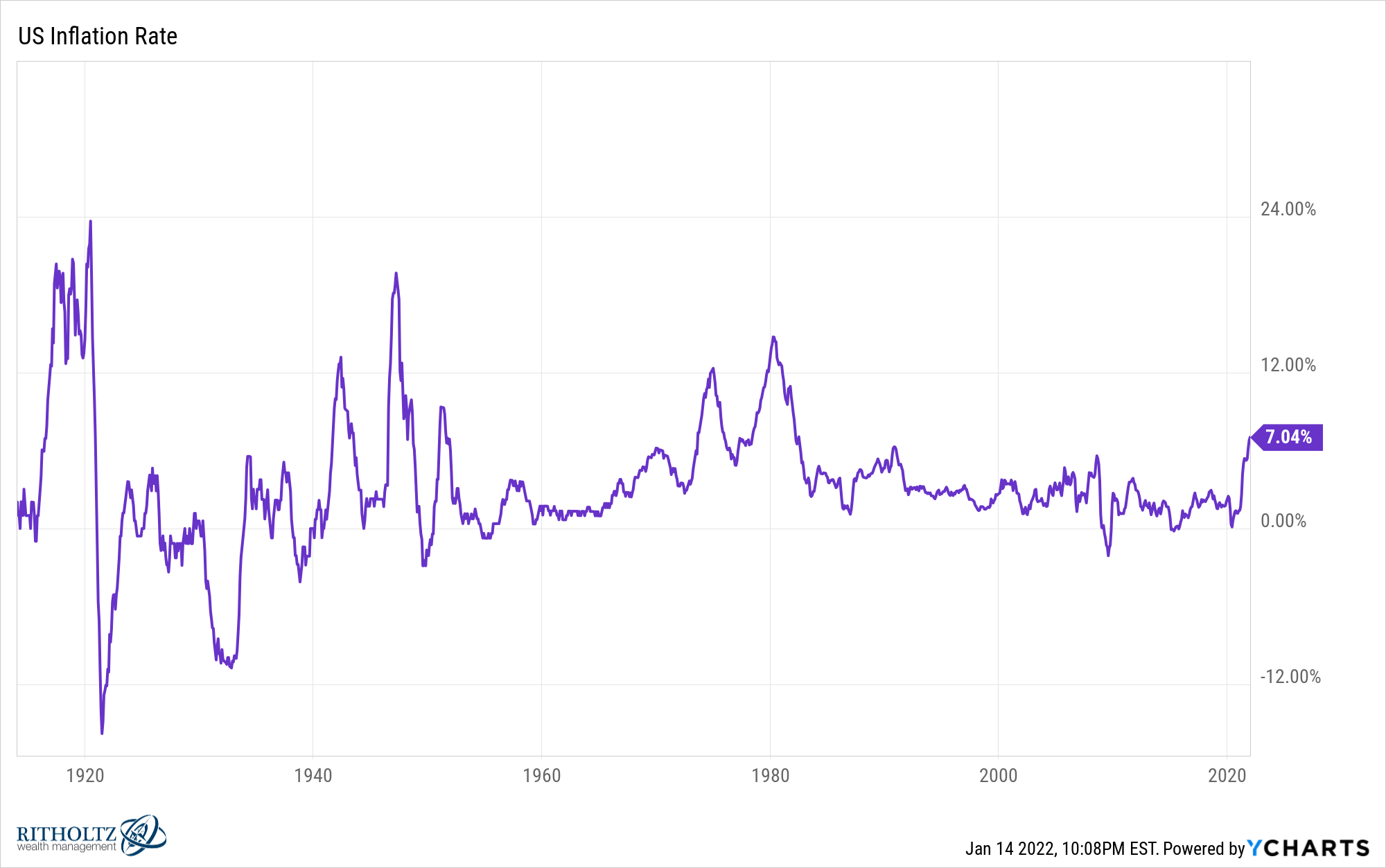

Last week US inflation hit a high of more than 7% in 40 years

We can now look under the hood to better understand the structure of the headline numbers each time we see economic data released for such an important gauge of the economy.

With inflation rising over the past year or two, more attention has been paid to individual components as to what is driving higher prices.

Some people claim that used cars are driving up the inflation rate. Others claim that the rate of inflation is decidedly low based on the calculation of rents equal to owners.

One thing is certain when it comes to the inflation rate – no one really believes that the average number makes sense.

But like the measurements of Air Force pilots, the average inflation rate is effectively useless for individual households.

No one really has an individual inflation rate that exactly matches the overall average.

And it is not only composition that cautions people with this number. Inflation is the most individual of economic indicators.

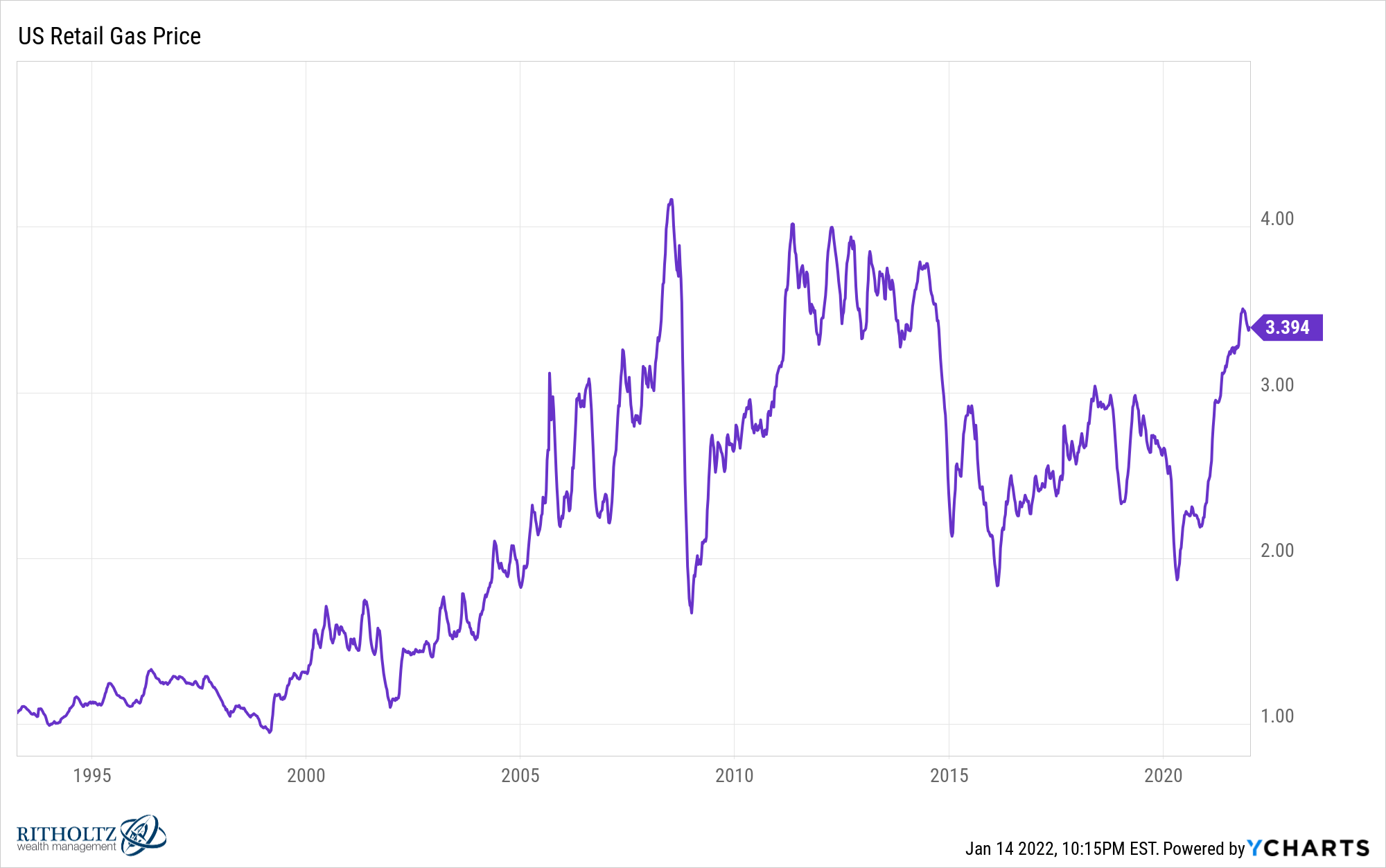

Take gas prices for example.

When I graduated college, I took a job in the eastern part of the state, while my then-girlfriend (now wife) moved to West Michigan to further her education. Almost every weekend one of us was on the road to the other side of the state and back.

The joys of a long distance relationship.

Since we were both giving a lot of mileage on our vehicles, so was the price of gas Very Important to our personal inflation rates.

I still remember when the price of gas rose above $2/gallon in 2005 for the first time in my life:

As someone out of school who wasn’t making a lot of money, it was painful for my bottom line.

At the same time, housing prices and mortgage rates were both soaring high. Had I been in the market for a house at the time, it would have been even more painful. Thankfully I was on rent and was not in a position to buy the house at that time, so it didn’t affect me.

Even though gas prices are still higher than they used to be, they still don’t really register with me today because I’m not driving hundreds of miles every other weekend.

My office is 5 minutes from my house so I don’t drive a ton of miles anymore.

When it comes to housing prices I’ve been in a very fortunate position when it comes to timing my purchase.

We bought our first home in late 2007 when prices were still crashing. When we bought our current home in 2017 it came at higher prices but things were still fair compared to today’s prices.

We have been able to refinance several times over the years as mortgage rates have come down. My first mortgage rate was 6.25% (or maybe 6.50%, I’m not 100% sure since I’m getting older). The pandemic allowed us to refinance under 3%.

My current home is probably worth 3 times as much as we paid for the first house, but the monthly payment (excluding taxes) isn’t really that high after accounting for the equity we built up in the first place And very low mortgage rates.

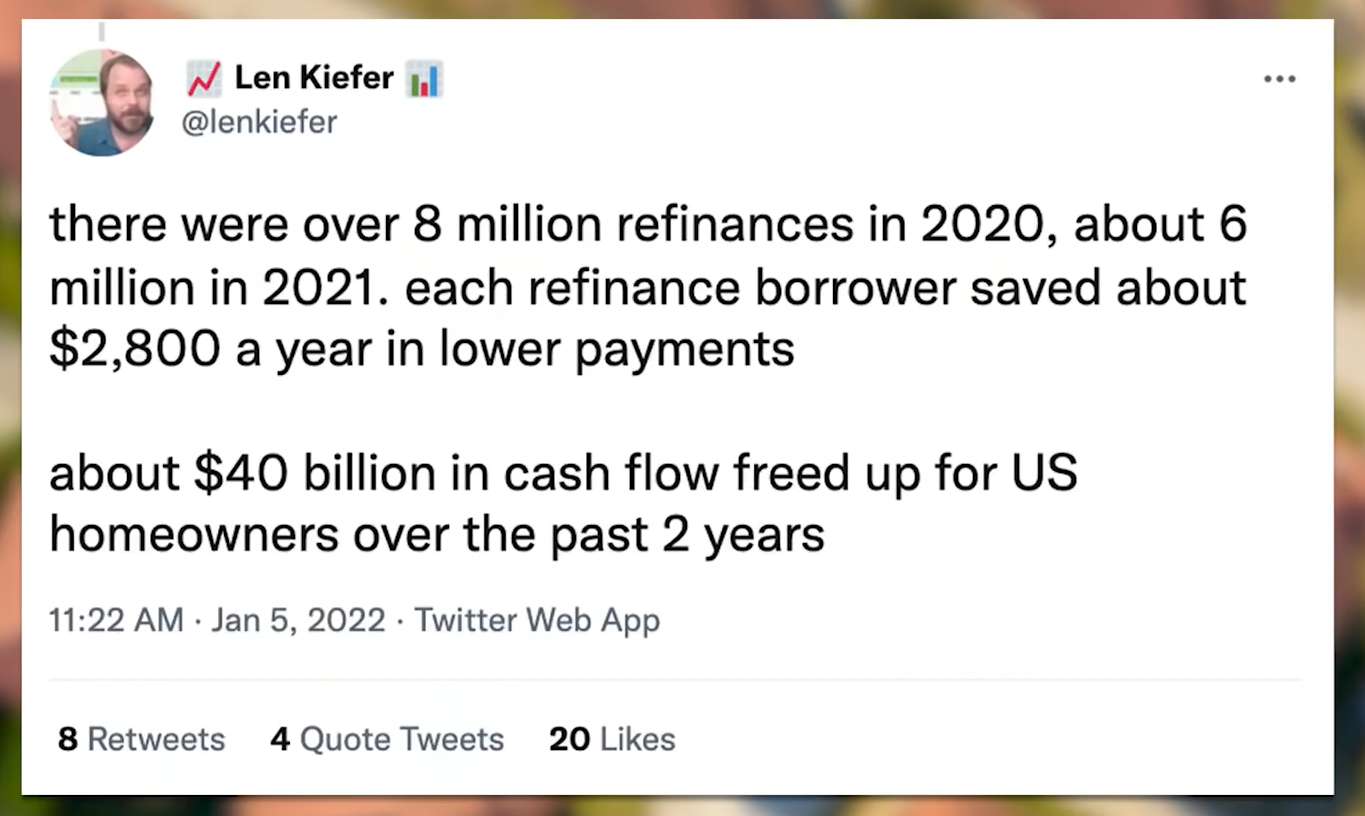

Len Kiefer, an economist at Freddie Mac, recently shared some statistics on how much refinancing has saved over the past two years:

This is amazing if you are a homeowner because you have been blessed with both low mortgage rates and housing prices that are up 20% or more over the past year.

And it’s not like refinancing is a one-time deal. You save that money every month for as long as you’re in the house and paying off the mortgage. It is like compound savings.

But what if you are someone who is in the market for your first home?

If you have been renting in the last 6-12 months and are re-extending your lease there is a good chance that your rent has gone up. And trying to buy with the number of homes for sale in short supply and very high prices means your monthly payments are going to be much higher than they were just a few years ago, even after accounting for lower rates.

Homeowners have experienced deflation through a combination of high housing prices and low rates, while those looking to buy or rent are experiencing uncomfortably high levels of inflation.

I feel for those who are being punished by the current environment through no fault of their own.

I know we would all like to believe that intelligence or hard work determines financial success or failure, but unfortunately, your personal inflation rate is often determined more by time and luck.

My wife and I did not buy a house in 2007 because we thought it was a good time to buy from an investment perspective. We bought because we were at that stage in our lives and housing prices were coming down at that time.

We got lucky (even though the housing market wasn’t down for a few years).

On the other hand, we made the not-so-poor decision to send our twins to pre-school this year, when teachers were hard to find due to labor shortages, which led to a 10% year-on-year increase in prices.

To quote Kirsten from Station Eleven, “It’s not your fault. That’s just what happened.”

I know it may sound ludicrous to complain that the government is manipulating official inflation figures, but the truth is that whatever the average inflation rate reported, it will be Always Most feel worthless at home.

When it comes to inflation, no one is average.

Your personal circumstances will determine your actual inflation rate more than anything else.

,

This week Michael and I joined Derek Thompson again to talk about inflation in his excellent podcast Plain English:

Further reading:

Reflections on Highest Inflation in 30 Years

1I’m also borrowing from end of average Here by Todd Rose which is great.