Diversification is not undefeated, but it never ends

There are different levels of losses in the markets right now:

- If you own value stocks, it’s not too bad (2-3%)

- If you own an S&P 500 index fund, that’s a slight improvement (down 6-7%).

- If you own the Nasdaq 100, that’s an improvement (11-12%)

- If you have small caps, it’s a bear market (down 20% from last week)

- If you own Facebook, it’s the crash of 1987 (26% down in a single day this week)

- If You Own Crypto, It’s A Crash (down 40-60%)

- If you have some hyper-growth stocks, it is a depression (50-80%) down

If you’ve invested in a specific group listed here, you’re either not doing so bad or you’re losing your shirt.

But what if your investment is spread across all or many of these properties?

Yes, you are experiencing some pain in some parts of your portfolio, but there are other things that are slowing down.

And the areas where the markets are hitting the market right now were properties that were booming in previous years. And while those assets were booming, some of the assets that are doing well now were performing poorly.

Markets don’t always work like this but you get the idea.

That’s why diversification is both wonderful and difficult depending on what’s going on with the individual pieces of your portfolio.

Let’s take Facebook as an example.

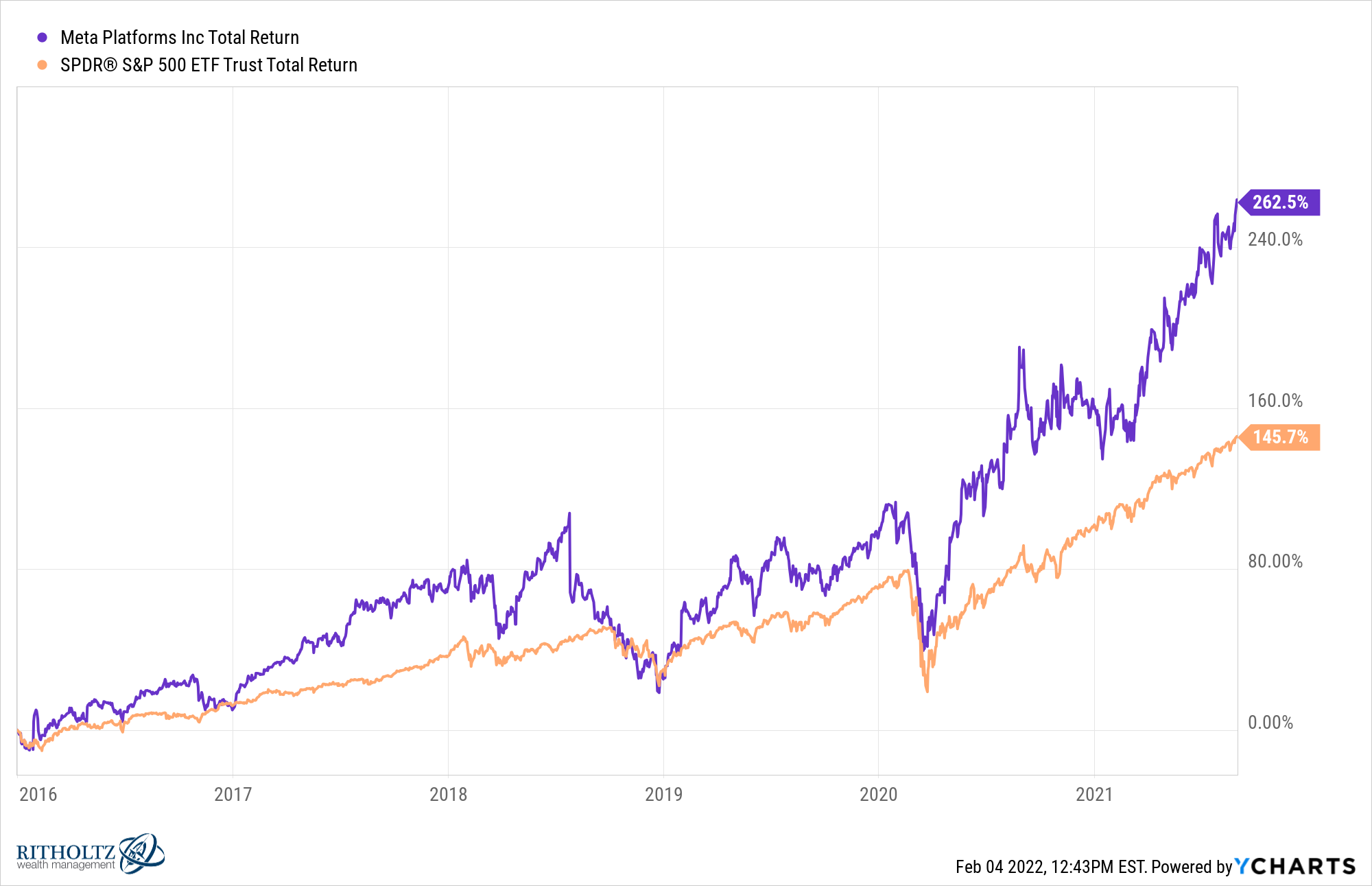

From 2016 to the end of this past summer, the company was outperforming the market by a wide margin:

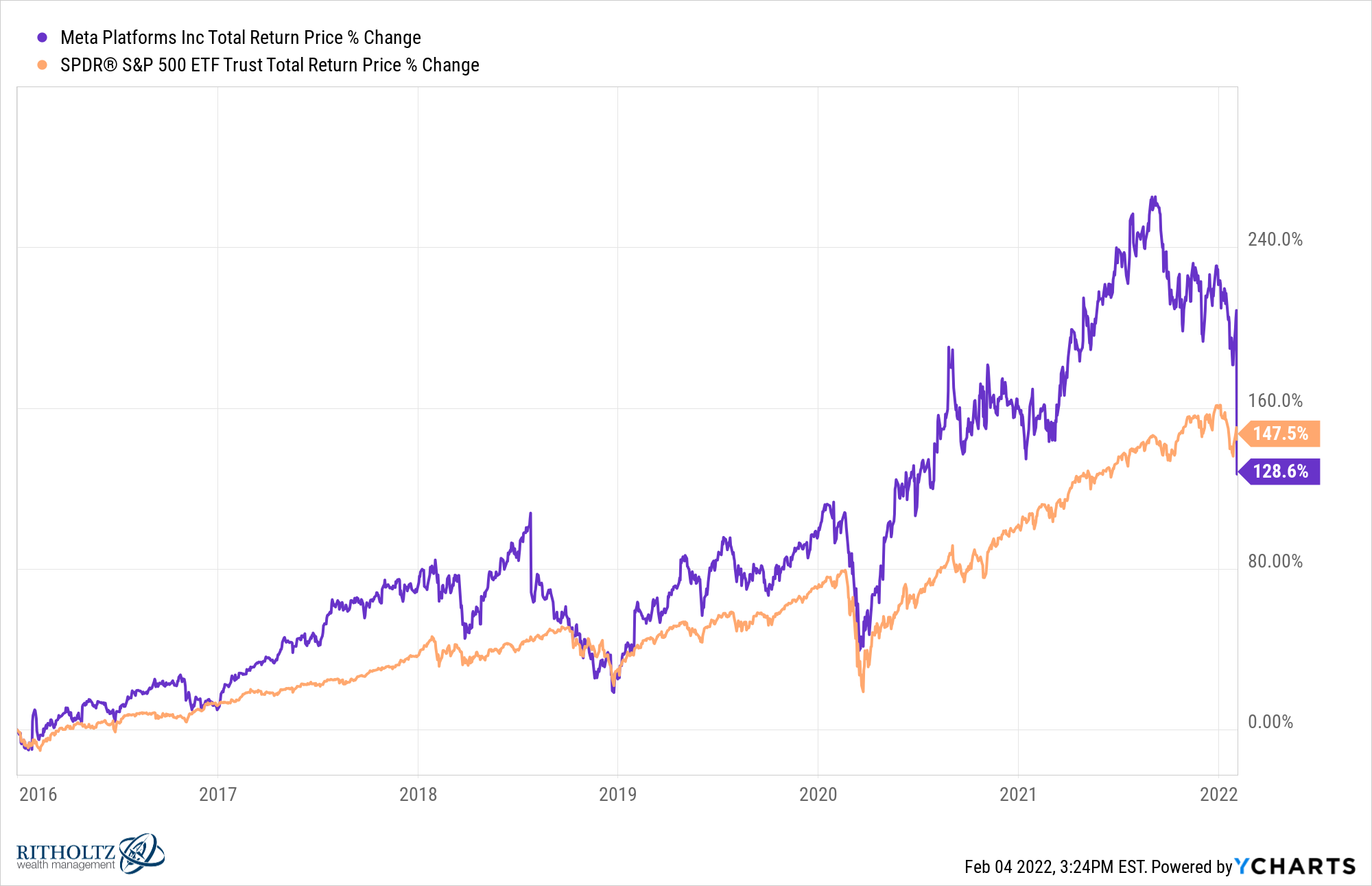

Now let’s take a look at the updated performance stats during this week:

All that improved performance is now gone after a few bad months and one bad day.1

Facebook’s 1987 moment saw the biggest dollar loss ever for a single stock, losing $230 billion in market cap on Thursday. Before this crash, Mark Zuckerberg’s company was the 5th largest stock in the S&P 500.

Yet on the day when the 5th largest stock in the market was down 26%, the stock market as a whole was down only 2.5%.

Now a 2.5% down day isn’t great but it’s certainly not the end of the world.

And as luck would have it, Amazon followed a one-day crash like Facebook’s 1987 receiving Over $200 billion in market cap, one of the biggest one-day gains in history.

By diversifying you avoid having a single point of failure in your portfolio.

Another way to look at it is to examine the current losses in certain underlying stocks in the US stock market.

The overall US stock market (Russell 3000 Index) is down about 7% from all-time highs. This is still a minor improvement area.

But there are plenty of stocks within that universe that are being crushed:

- 60% of stocks are currently down 20% or more from all-time highs

- 30% of stocks are currently down 40% or more from all-time highs

- 15% of stocks are currently down 60% or more from all-time highs

The returns from stocks that have not fallen drastically, are more than offset by large losses,

Of course, being diversified means you’re never going to invest exclusively in the best-performing names.

You don’t win games by blow-out margins while practicing diversification. And sometimes you can even give up for a while. The examples I am using here are ephemeral in nature.

Diversification isn’t undefeated, but it’s never been blown away.

Michael and I discuss the difficulty and much more involved in stock-picking on this week’s Animal Spirits video:

Subscribe to Compound so you never miss an episode.

Further reading:

Why isn’t the stock market down any more?

Now here’s what I’ve been reading lately:

1I’m cherry-picking the time frame here. If you go back to their IPO the stock is still outperforming but I am trying to make a point here.