stock market is ruthless

When Russia invaded Ukraine on Wednesday night, stock markets around the world immediately sold out on futures markets.

US markets were down about 3% across the board. The S&P 500 opened the next morning down 2.5%. The Dow dropped 800 points. The Nasdaq 100 was also up more than 2%.

Thursday’s shares rallied furiously toward the end of the day, with the Dow ending in positive territory, the S&P 500 rising 1.5% and the Nasdaq 100 up more than 3%.

It seems strange to worry about the stock market in a time of war when people are dying, losing their homes and potentially the country they love.

The thing here is that the stock market is ruthless. It often encounters divine events when it almost doesn’t seem appropriate.

I wrote about the relationship between the war and the stock market a few years ago:

In the six months following the start of World War I in 1914, the Dow fell by more than 30%. Because the war had basically brought the business world to a halt and the market liquidity had all dried up, the decision was made to close the stock market that year. It lasted six months, the longest period on record. Compensating for lost time, the Dow rose more than 88% since its reopening in 1915, the highest annual return on record for the DJIA. In fact, from the beginning of the war in 1914 until the end of the war in 1918, the Dow was up more than 43% overall, or about 8.7% annually.

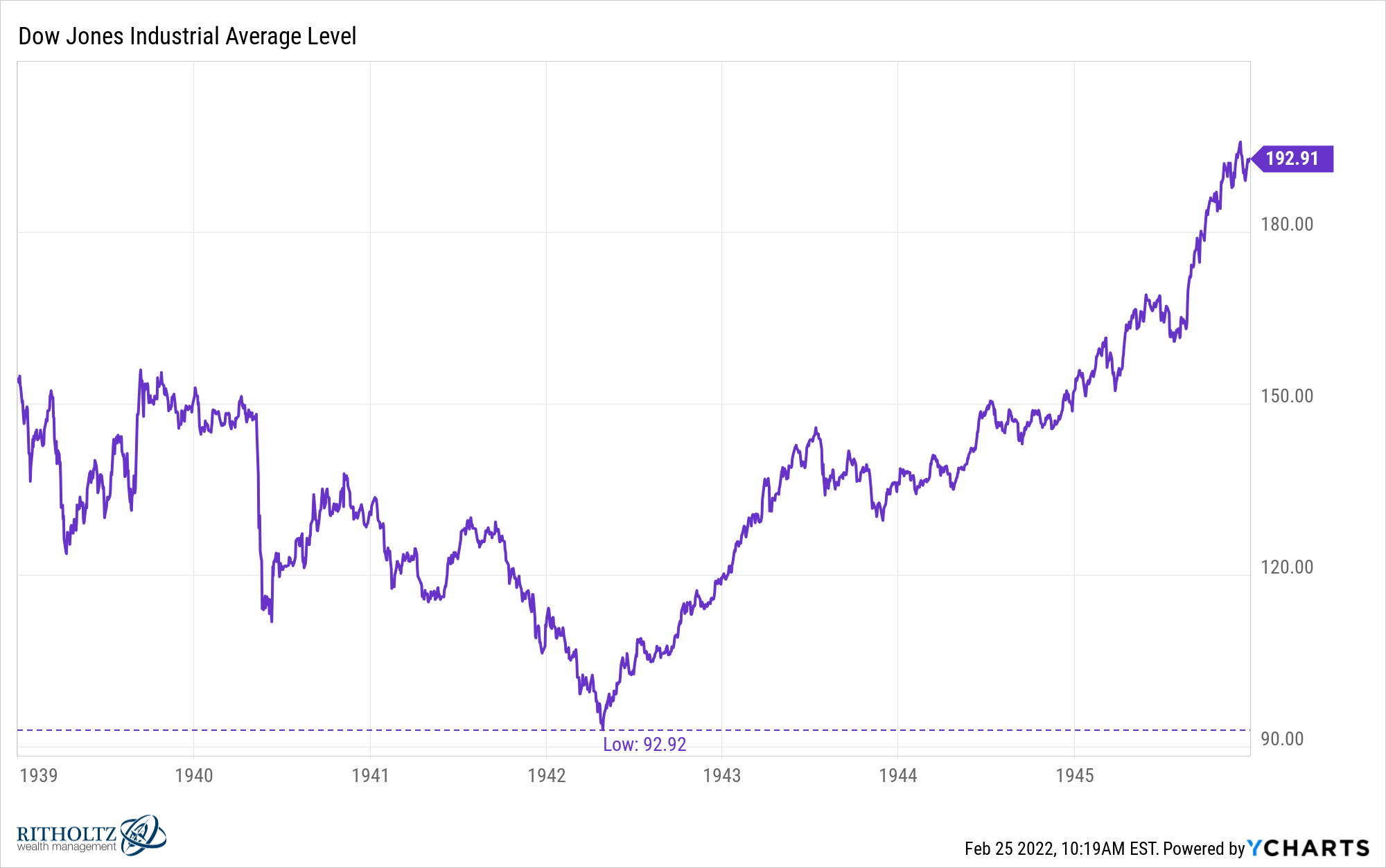

World War II had an equally counterintuitive market result. On September 1, 1939, Hitler started the war by invading Poland. When the market opened on September 5th, the Dow had gained about 10% that day. When the US naval base at Pearl Harbor was attacked in early December 1941, shares fell 2.9% the following Monday, but it took just over a month to recoup those losses. When Allied forces invaded France on D-Day on June 6, 1944, the stock market barely looked. The Dow rose more than 5% in the coming month.

From the beginning of WWII in 1939 to the end of 1945, the Dow grew by an overall 50%, amounting to more than 7% per year.

So, during the two worst wars in modern history, the US stock market rose by a combined 115%.

I have also written about geopolitical crises in the past:

American troops were sent to Vietnam in March of 1965. The Dow will outperform the remainder of that year by about 10 percent. By the time U.S. troops were pulled out of Vietnam in 1973, the stock market overall was about 43 percent, or just under 5 percent per year.

The world was on the verge of nuclear war due to the Cuban Missile Crisis in October 1962. The confrontation lasted 13 days from October 16, 1962 to October 28. The Dow remained surprisingly calm during that two-week period, losing only 1.2. The piercing would result in a gain of more than 10 percent to the Dow for the remainder of that year.

President John F. Kennedy was assassinated in Dallas a little more than a year later. A day later, the market opened with a gain of 4.5 percent. Stocks ended the following year, 1964, down more than 15 percent.

The stock dropped 13.3 percent in the three weeks following the Gulf War in the summer of 1990. From July to October of that year, the S&P 500 dropped 19.9 percent, but that also coincided with a recession.

The September 11, 2001 attack on US soil saw the stock fall sharply, dropping nearly 15 percent less than two weeks after the tragedy. At that time the economy was already in the middle of a recession and stocks were still falling through the technology bubble, but within a few months the stock market had made back all its losses since September 11.

The US invaded Iraq in March 2003. The stock rose 2.3 percent the next day and ended the year with a gain of more than 30 percent from that point, though it followed the end of a brutal bear market.

World War II is one of the weirdest stock market reactions I’ve seen documented.

Barton Biggs wrote about the stock market’s path throughout the war in his book Wealth, War and Knowledge, He has this excerpt about the state of the world in 1942:

By 1942, a map of the world showed Germany in control of much of Europe with its fierce hegemony stretching from the North Sea to the very gates of Moscow and Leningrad. At the height of its expansion across Asia, Japan controlled ten percent of the world’s land mass and its most precious natural resources.

Since the start of the actual fighting in 1938, no army had been able to prevail against the Wehrmacht, the most highly trained, disciplined and well-equipped army in the world. By 1940, as John Lukacs explains in The Duel, Hitler’s forces had conquered all of Western Europe with little cost in men and equipment, Germany’s army spent a few miles of trenches and mud in World War I. did. The resistance of smaller European nations to this attack could be measured in days, and France, despite its large army and the supposedly impenetrable Maginot line, was humiliated by the German blitzkrieg. The British expeditionary force had barely escaped complete destruction at Dunkirk, and the Royal Navy suffered serious wounds at sea in North Africa and Norway. Britain was still firm in her island home, but she was slowly being put to death by U-boats, and her forces, however heroic, proved ineffective against German technique, discipline and courage. She was

Things were looking bleak to say the least.

Still see when the stock market went down:

Even though the war didn’t end until 1945, the stock market based in that dreadful, good year of 1942, when things looked so dire.

Biggs explains:

In fact, the bottom that US stocks made in the second quarter of 1942 was actually the end of the great secular bear market that began in 1929. That spring saw the birth of a new secular bull market that would last nearly 20 years and take American stocks to unimaginable new highs in an explosion of post-war prosperity. There will certainly be cyclical bear markets in between, but only the big, dumb, clumsy stock market has somehow understood that the long bear markets were over and a new era had begun.

The stock market often turns upside down. It is forward-looking but not always accurate. It’s sometimes smarter than everyone else, but others rely on the herd mentality.

I don’t know if the stock market came down this week or not. No one is smart enough to know these things in real-time.

Just know that trying to understand what’s going on with the stock market in a time of war can be confusing and counterproductive.

And if the stock market is your biggest concern right now, then consider yourself lucky.

Further reading:

The relationship between war and the stock market