Why the 2020 housing market is going to make inequality worse

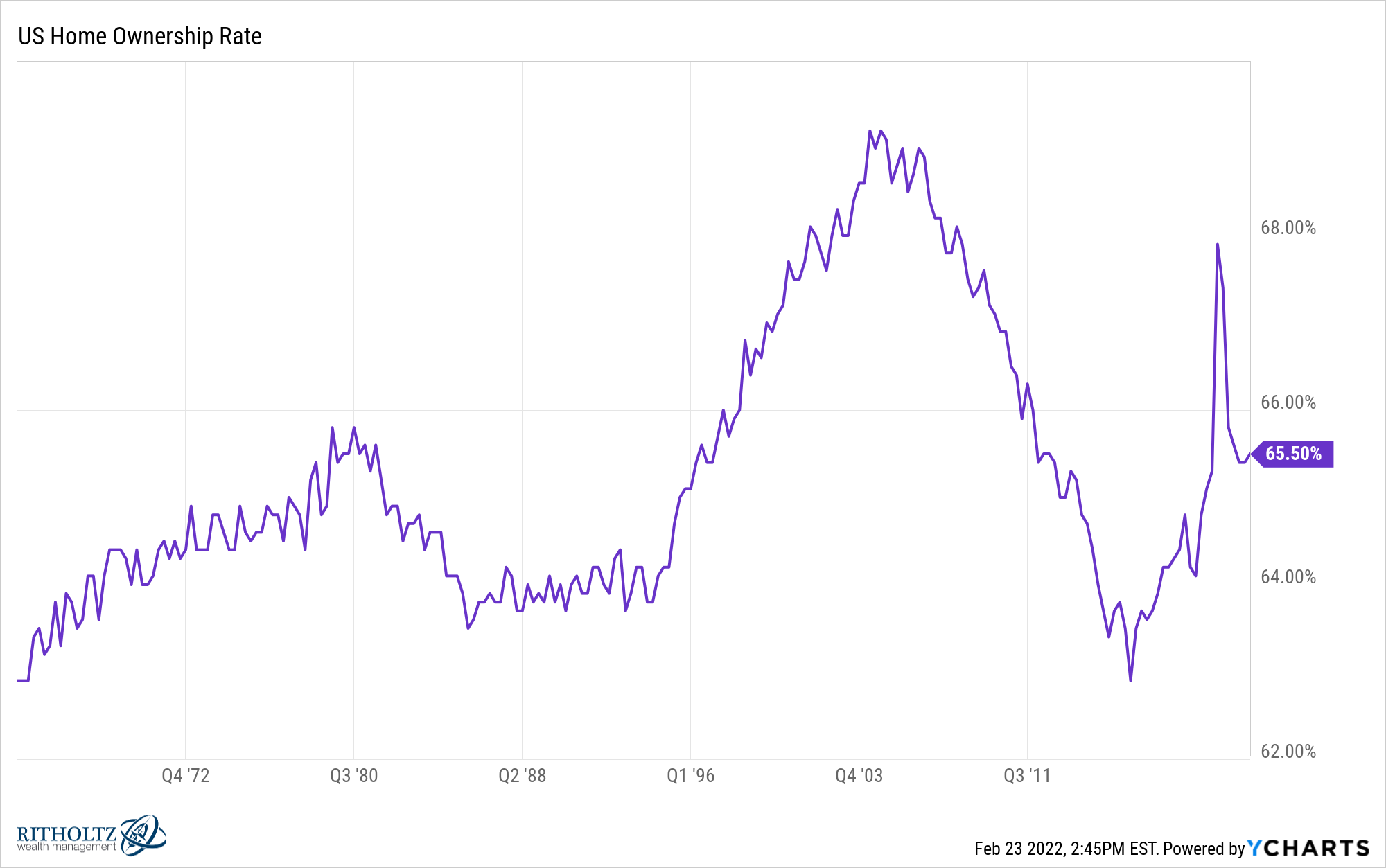

Roughly two-thirds of the country owns a home in the United States:

For those in this group who have had their own home for the past year or more, they are sitting on some pretty decent gains.

When you combine rising home prices with ultra-low mortgage rates1You could argue that homeowners have never been this better.

With housing prices rising by 20% over the past year a fixed rate mortgage has been the best inflation hedge you can ask for in the current environment.

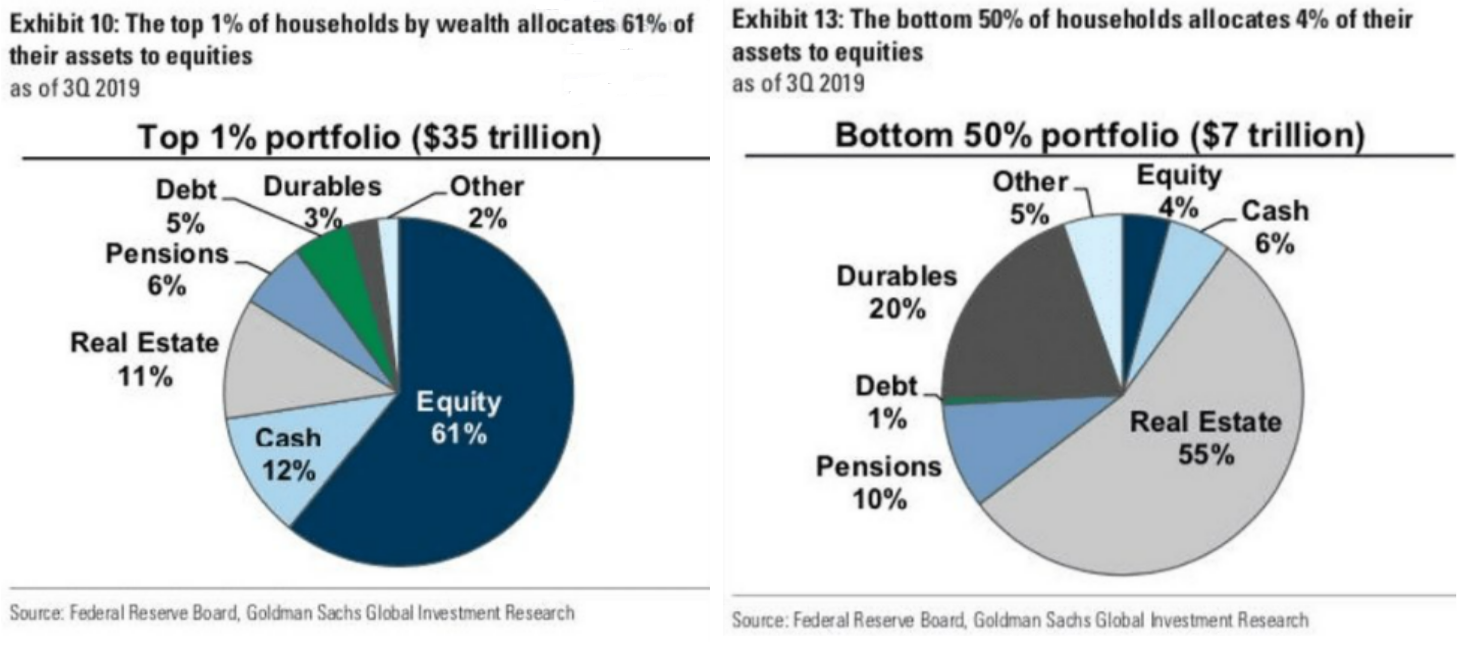

You can make the case that the current housing environment has benefited even the bottom 50% of households from the top 1% on a relative basis:

Obviously, the top 1% own most of the financial assets along with some real estate. But on a relative basis, the bottom 50% have the majority of their net worth tied up in their primary residence.

While this has been a wonderful environment for those who currently have a home, it’s probably going to be even worse for the bottom 50% of people who don’t own a home but want to someday do so. .

Here are some statistics from the recent Redfin update on the housing market:

- The median home selling price rose 15% year over year to $354,762. This was up 30% from the same time in 2020.

- The average asking price of newly listed homes rose 16% year over year to an all-time high of $381,000. This was up 26% from the same time in 2020.

- Monthly mortgage payments at the median asking price reached an all-time high of $1,997. This was 27% higher than a year ago when mortgage rates were 2.73%, and up 31% from the same period in 2020 when rates were 3.47%.

- Active listings (the number of homes listed for sale at any given time during the period) fell 27% year over year, Has hit an all-time low of 447,000. Listing was down 49% compared to the same period in 2020.

- 57% of homes under contract had an accepted offer within the first two weeks on the market, the highest level ever. This was up from 51% a year ago and 43% in 2020.

- 44% of homes under contract had an accepted offer within a week of coming on the market, the highest level ever. It was 38% during the same period a year ago and 29% in 2020.

- Homes that were sold were in the market for an average of 29 days, up from 38 days a year ago and 60 days in 2020.

- 41% of homes sold above list price, up from 33% a year ago and 19% in 2020.

In short – short supply, high monthly payments, bidding wars and rising prices. It’s not great if you’re in the market for a home and don’t currently have one.

This housing market will not last forever. There is no trend. We may not see housing prices rising at their current clip indefinitely in the future.

But it doesn’t look like the current unhealthy housing market is suddenly going to get better anytime soon. When it comes to residential real estate, it may take a few years for us to get back to anything normal.

The problem is rising mortgage rates and rising housing prices have led to the highest monthly payment ever made for the average mortgage payment.

This will make it even more difficult for the bottom 50% to participate in the housing market.

The subprime mortgage crisis was terrifying for many who overstretched themselves and took on too much debt or too many homes.

But there were many people who bought a home in the housing bubble of the 2000s who didn’t lose their home who are in much better financial condition because they were able to access a mortgage and buy a home.

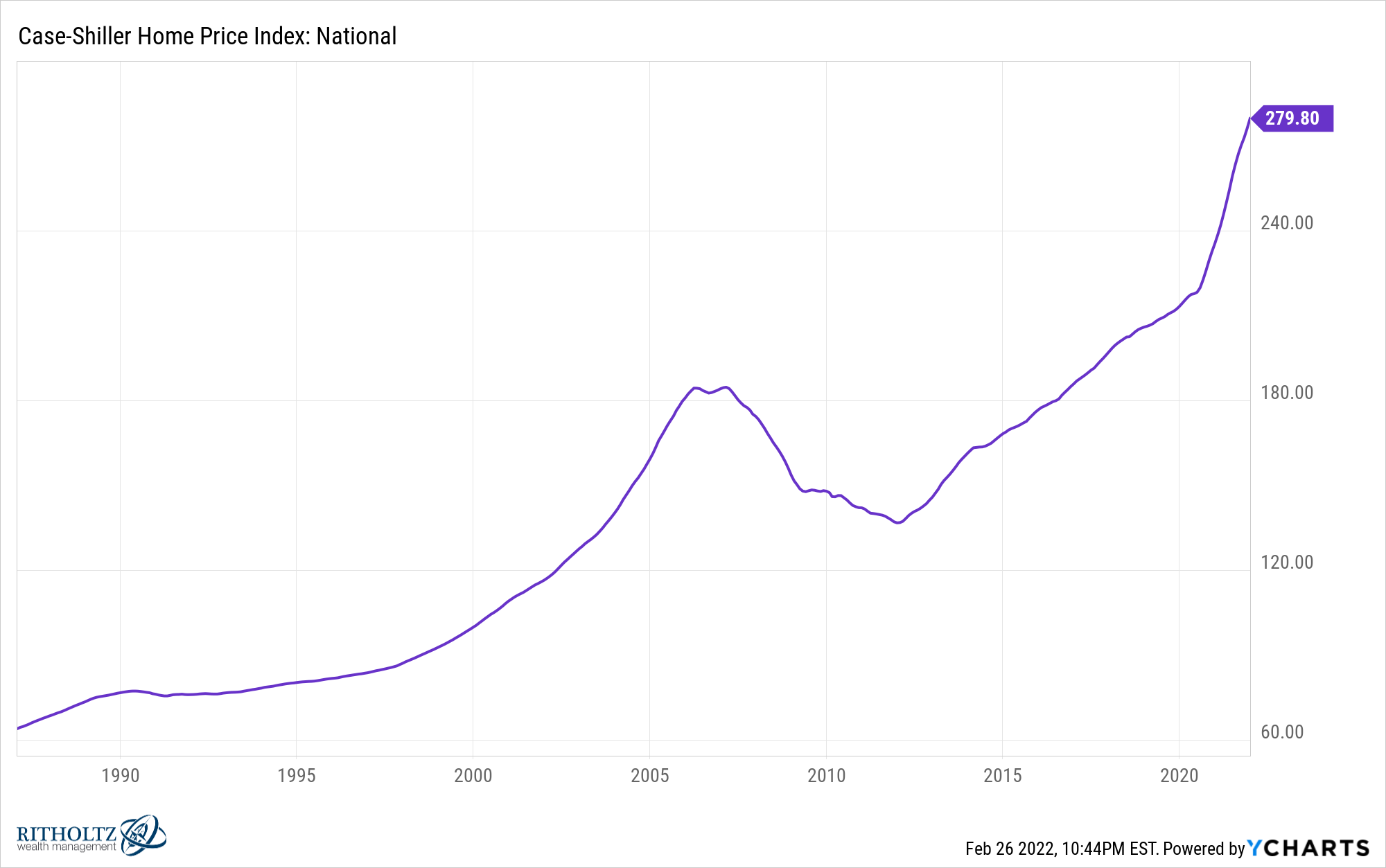

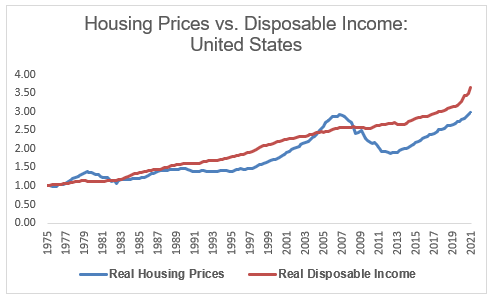

Housing prices are much higher than at the height of the housing bubble:

Lending standards were very loose at that time, but certainly benefited the bottom 50%.

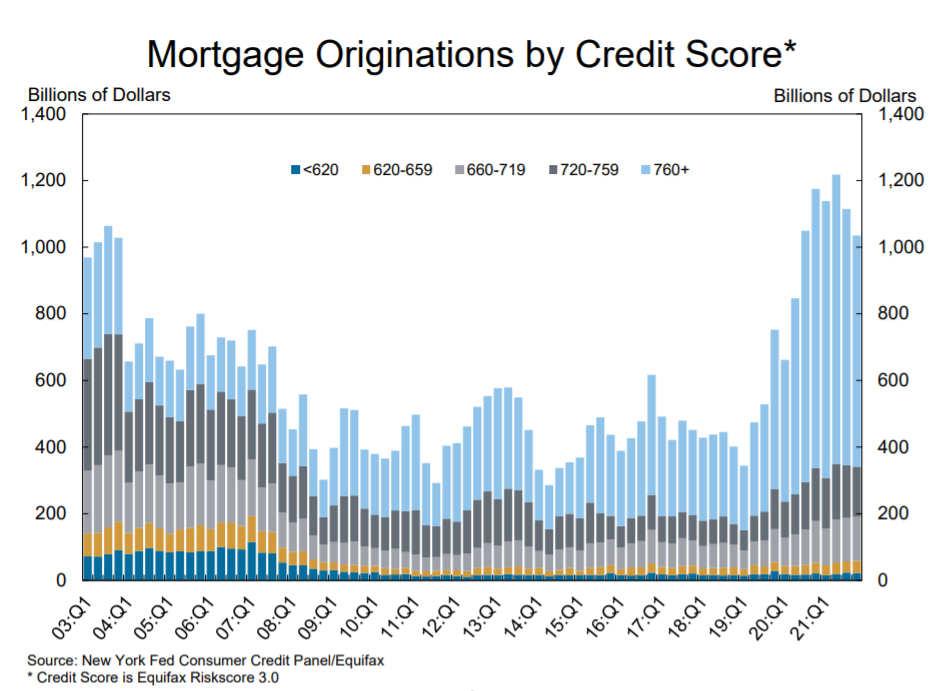

See how things have changed since the 2008 financial crisis and all the banking regulations it created:

From 2004 to 2006, about one-quarter of mortgage originations occurred on average for people with credit scores of 659 or lower.

Only 6% of mortgage originations from 2019 to 2021 occurred for households with a credit score of 659 or lower.

Obviously, these numbers make for a healthier financial system and help banks issue mortgages. These numbers help explain why I don’t think we’re in a housing bubble right now, even with prices rising rapidly.

But it is also true that it is going to be much more difficult for people with less means to buy a home now because housing prices are very high and credit standards are tighter.

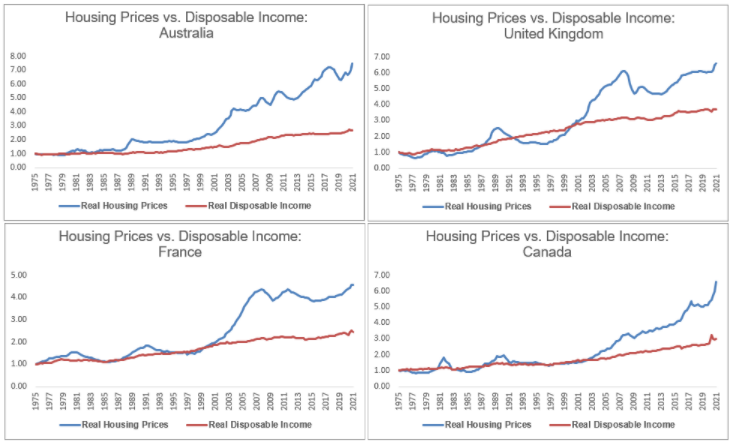

And you can make the case (like I did here) that the housing market in the United States still has room to go crazy compared to other developed countries than ever before:

I don’t know for certain that housing prices in the United States will continue to rise.

The future is as unpredictable as ever.

But the set-up is only for a sustained increase in prices based on demographics and housing supply.

If this happens and most hostages continue to go to those who have more means, the gap between the rich and the handicapped will continue to widen.

Michael and I discuss why it’s one of the craziest real estate markets ever on this week’s Animal Spirits video:

Subscribe to Compound so you never miss an episode.

Further reading:

Why US Housing Prices Aren’t As Crazy As You Think

Now here’s what I’ve been reading lately:

1Mortgage rates are eventually rising (by more than 4%) but anyone who has a free home for more than 12 months has the opportunity to either refinance or lock in a lower rate at the time of purchase.