Half of Canadians overrun by rising cost of living

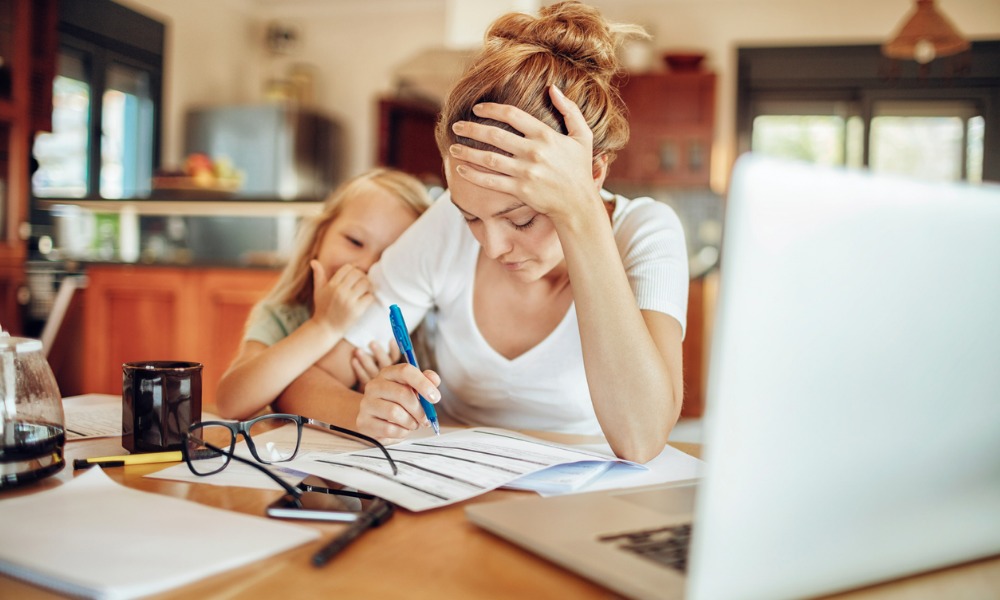

A growing household budget means that an emergency $1,000 bill will be beyond the capacity of nearly half of respondents, while 14% say they cannot manage any unexpected expenses.

Seven out of ten say they are stressed by financial matters these days and a third are worried about their debt levels. The Bank of Canada is likely to begin raising its interest rates this week, easing debt repayments, adding to domestic budget pressure.

The highest shares of people who say they are falling behind in the rise in cost of living are those with household incomes less than $25,000 and are in the $150K-199K band.

change behavior

To meet their needs, many Canadians surveyed reported that they have changed the way they manage their money.

Discretionary spending cuts (53%), major purchases (41%), extra trips in the car (31%) and vacations (29%) were all mentioned, while savings are cut by nearly a fifth of respondents.