Why gas prices matter so much

I have a theory about fluctuating gas prices that I cannot verify but believe to be true.

When oil prices fall, gas prices also fall, but they do so at intervals and the decline is not as severe.

And when oil prices rise, gas prices rise immediately and the increase is proportional or greater.

It’s like a negative convexity or something.

It’s also possible that this is all on my mind because gas prices are only advertised on big signs everyone can clearly see driving down the road.

I was in plain English with Derek Thompson a few months ago and he gave a great theory about the relative importance of gas prices:

It’s weird when you think about it this way.

There is a psychology to gas prices that you don’t see with other goods or services.

The price of gas regularly comes up in negotiations. It is in the news all the time.

No one drives across town because bottled water is cheap at four cents per gallon, but it’s something that at least a small percentage of the population has no problem filling their tanks with.

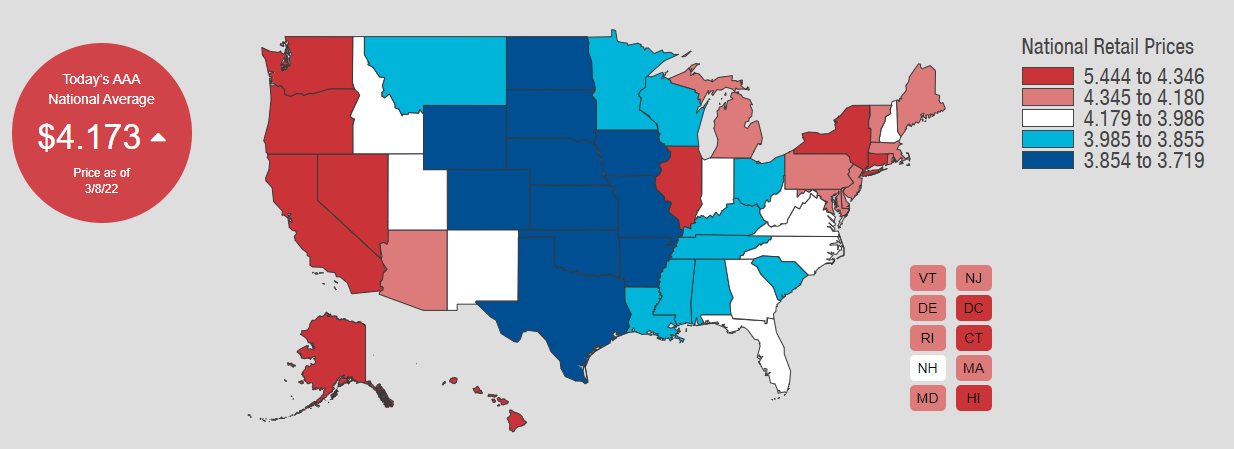

Average pump prices hit an all-time high yesterday according to AAA:

That’s more than 50 cents a gallon since late February alone. We have now embraced the previous high of $4.16 per gallon, which was reached when oil briefly peaked at $150 a barrel in the summer of 2008.1

So while there is a psychological component when it comes to these prices moving very quickly in real time, energy prices also have a large financial component when it comes to household budgets.

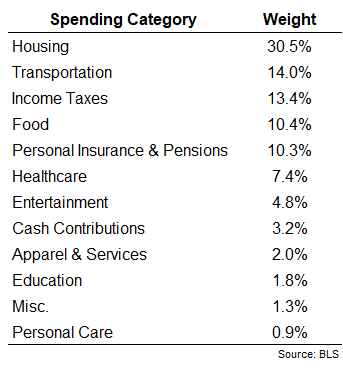

The Bureau of Labor Statistics publishes a report that looks at the consumption patterns of the household budget by breaking down spending into different categories.2

Housing and transportation are by far the biggest spending categories:

Gasoline itself doesn’t make up a big part of the household budget, accounting for about 2.2% of total spending. It is worth noting that these spending levels are from 2020 (the last time this survey was taken) but the numbers were less than 3% in 2019 and 2018 as well.

However, utilities account for about 20% of the total housing cost. This means that the combination of gas outlay and utilities is about 9% of the average household budget. With very high prices today, that number is certainly about 10% of the total and is increasing.

Experiencing higher prices at 10% spending is going to hurt the bottom line for many families.

The big question is, how will high inflation and energy prices affect consumer spending patterns?

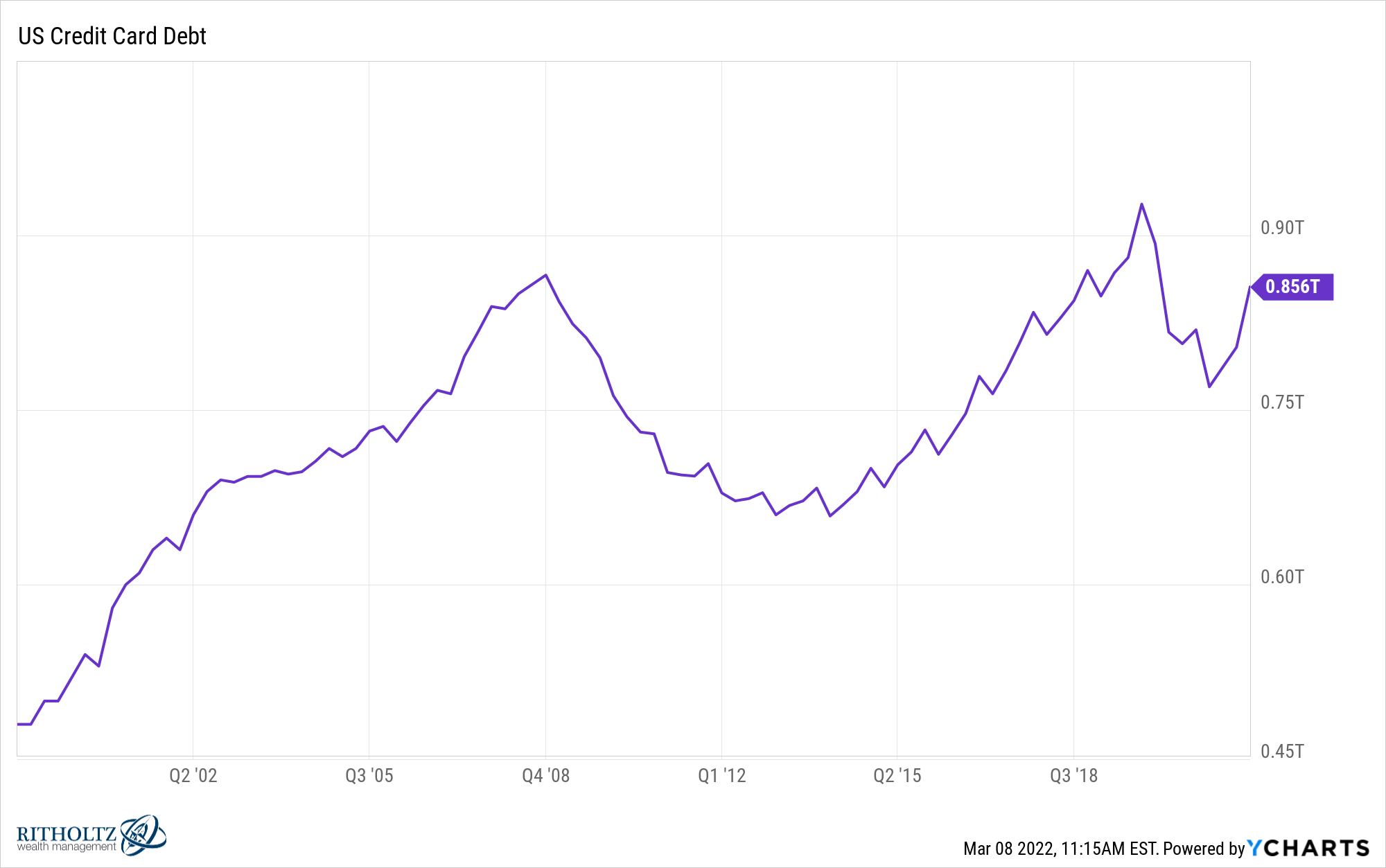

Consumers have spent the last two years cleaning up their balance sheets.

Credit card debt is down (though rising again):

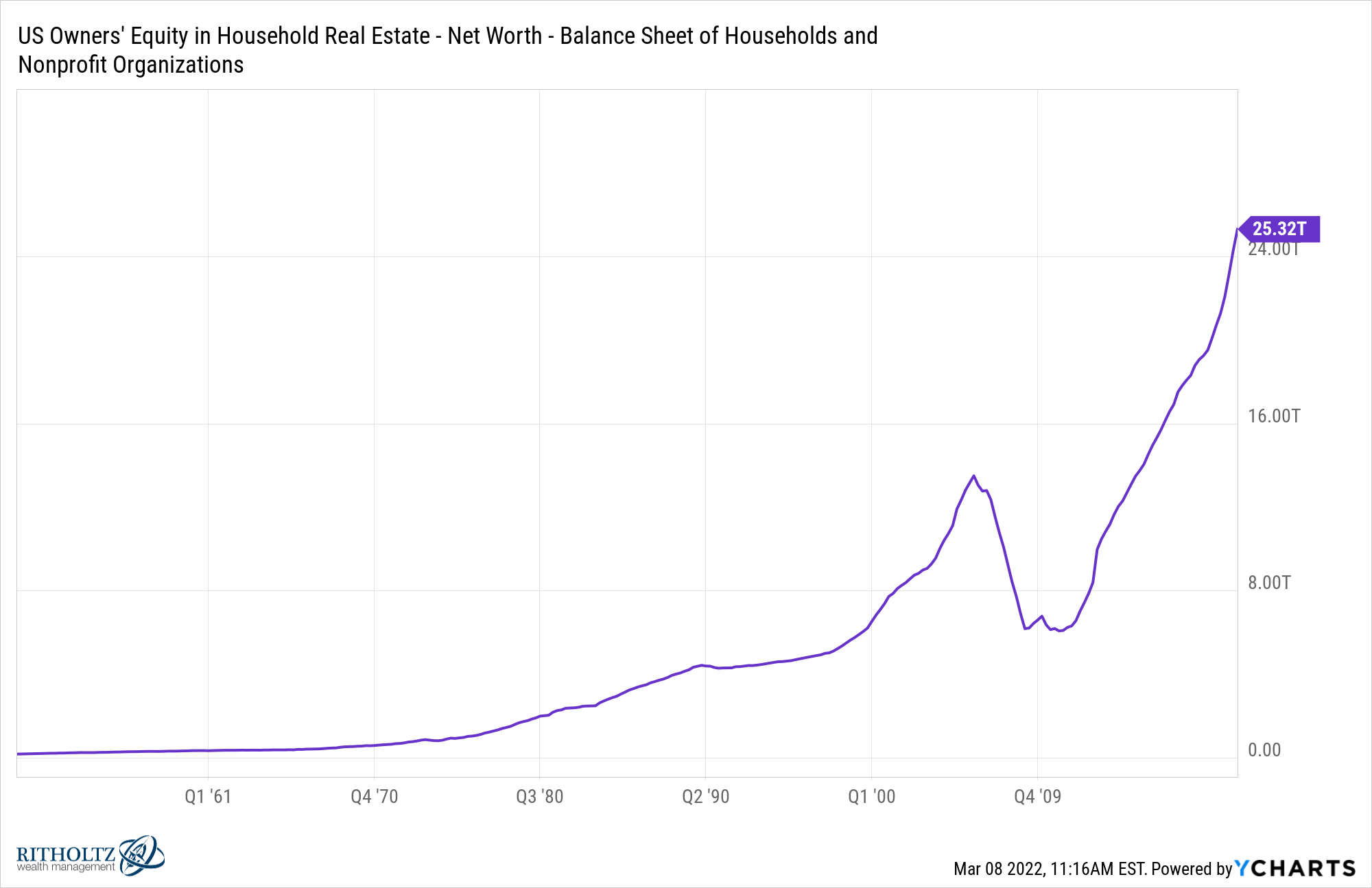

Housing prices and, therefore, home equity have increased by:

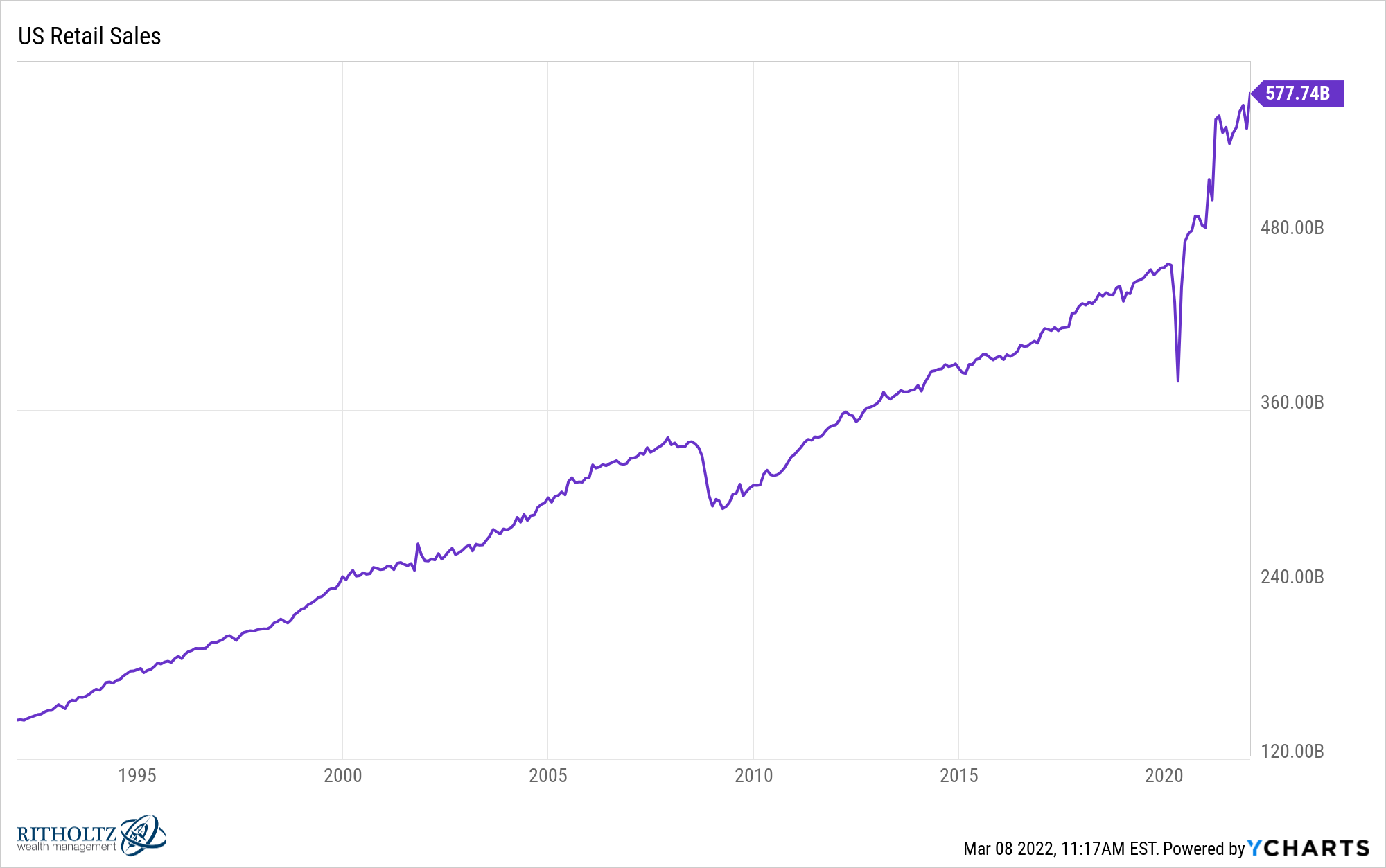

Bananas Going Retail:

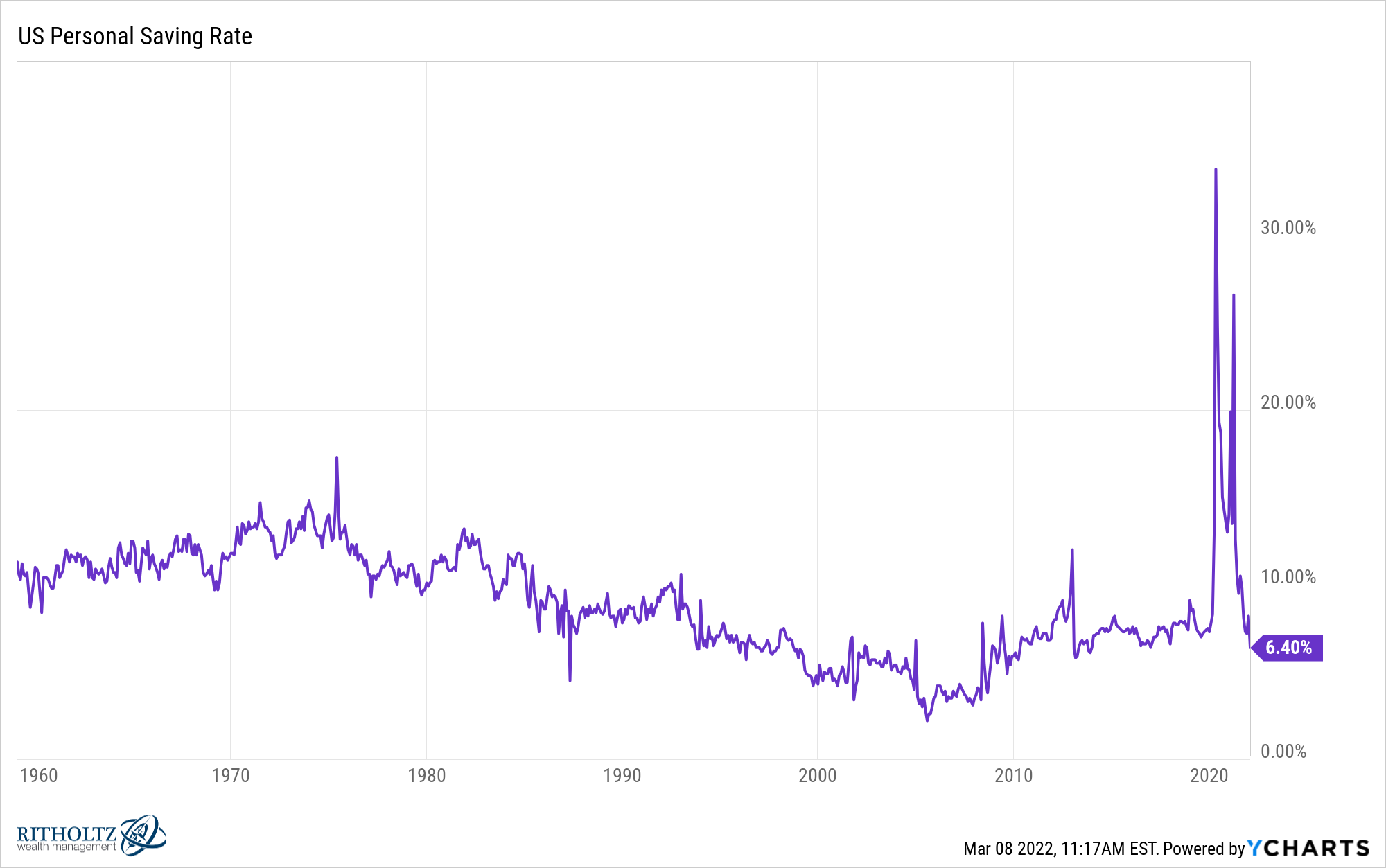

Personal savings rates have risen and are now back to pre-pandemic levels:

Dealing with inflation is no fun but you can make the case that households have been preparing for it for two years, whether they know it or not.

Consumers have two options when it comes to inflation:

(1) Slow down your spending for higher prices.

Sleep

(2) Spend your savings to spend or remain in debt.

I’m not sure how it plays out.

But one thing I know for sure is American Love to spend money I would be surprised if households reduce their spending in a meaningful way even with higher gas prices. The pandemic (fingers crossed) seems like it may be over. There is a very pressing demand.

I anticipate that we will see a lot more use of debt and home equity in the coming years to match higher prices.

Consumers will continue to consume.

Further reading:

Why Everyone Thinks Inflation Figures Are Wrong

1If we let this number inflation-adjusted the gas would be something like a high $5.50, but it does offer little solace to those feeling the pain at the pump.

2The caveat generally applies here – there is no such thing as an “average” family, just as there is no such thing as an average inflation rate. Expenses are circumstantial. But the relative importance of energy cost is the main measure here.