how to prepare for recession

A reader asks:

What steps are you taking to prepare for the recession?

There seems to be a growing consensus among the smart people I follow right now:

- Inflation was already high and is only going to get worse because of the war. We can easily see 10% inflation print this year.

- The war is going to cause massive food shortages next year as a lot of agricultural commodities come from Ukraine and Russia.

- The supply shocks were already bad and are only getting worse. China’s handling of the Covid outbreak that is shutting down entire cities and supply chains is again in trouble.

- Therefore, a recession is now inevitable.

Last week I also hopped on this bandwagon by showing that recession is the only way we’ve seen high inflation decline in the past.

I believe the likelihood of a recession is higher now than it was a month ago.

However, when dealing with probabilities, you have to look at both sides of the argument. Nothing is 100% certain in the markets or the economy.

Let’s look at the other side of the argument to see if that could keep us out of a recession for a while.

There is a ton of stalled demand.

The Delta CEO said just two days were the busiest in the airline’s history in terms of sales. Travel expenses are booming right now.

I was at Disney last month. The parks were packed every day. My Disney insiders tell me that they think sometime in March may see the busiest week for their theme parks. And I know from experience – Disney is not cheap. Inflation is not holding back spending on parks.

Despite the increase in mortgage rates, the heat wave continues in the housing market. Logan Motashmi A new listing posted this photo of people standing in the street last weekend in California:

This is not bearish behavior at all.

To be honest, these are just tales. How about some data?

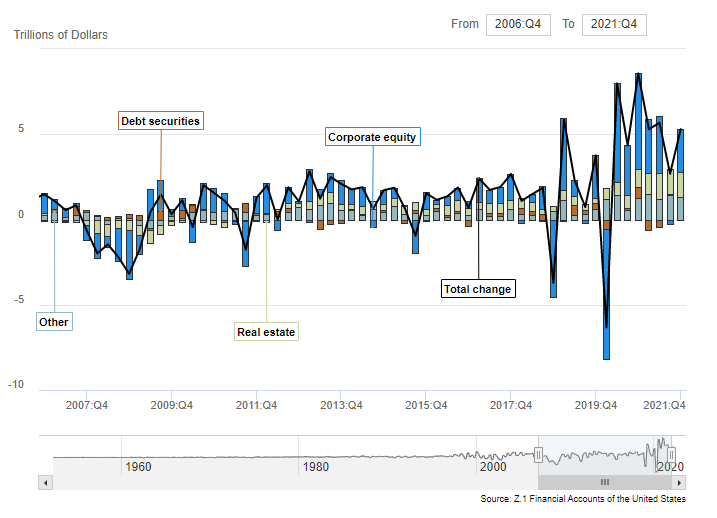

Each quarter, the Federal Reserve issues a report on household assets. Last year saw biggest ever increase in household net worth:

US household wealth increased by about $19 trillion in 2021. Real estate alone generated more than $5 trillion in profits.

Families have never been rich.

So on the one hand, rising prices may cause consumers to rein in their spending on certain products and services.

Inflation, on the other hand, has only been above the trend since last April. Consumers have been saving and repaying loans for two years. It is certainly possible that American households will complain about inflation but then go into debt and spend their savings for higher prices.

It can certainly expand the scope.

Both arguments have their merits.

So we could go into recession this year or next year or four years from now.

I honestly have no idea.

All I know is that we will have a slowdown at some point.

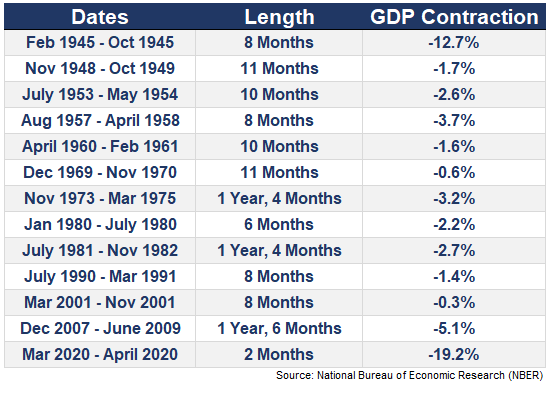

Since World War II, we have experienced 13 recessions in the United States:

This means there has been a recession once every 5.9 years on average over the past 80 years.

Now, the slowdown train does not run on schedule. Sometimes they occur in quick succession (such as in the 1950s or early 1980s) and sometimes they are few and far between (such as the 1990s or 2010s).

The way I see it is that you are not preparing for a recession but preparing for a recession. There is a difference.

Peter Lynch once said, “More money is lost by investors trying to prepare for a correction or hoping for a correction than it is lost in the correction itself.”

Same is the case with recession.

How do you prepare for one? The same way you prepare your finances for anything else.

Instead of changing your portfolio because you think a recession is coming, create an investment plan that is sustainable enough to withstand a wide range of environmental conditions (one of which includes economic contraction).

Give yourself a margin of safety with a high savings rate and an emergency fund, not because it will help you survive a recession, but because it will help you avoid any number of curveballs life inevitably entails. will throw at you.

Pay your bills on time and build a good credit score, not because it will help you during a recession, but because it will help you borrow money anytime.

Recession gives rise to thoughts of financial crisis and it is definitely something to be aware of as an investor.

But you can easily deal with your own personal slowdown that occurs outside of a contraction in GDP.

Maybe you lose your job. Your local economy may collapse. Maybe you get divorced. Maybe you will incur a big unexpected expense. Or you may simply make a poor investment decision that leaves you losing a bounty of money even when the market is right.

The point here is that you don’t prepare for a recession by trying to figure out the exact start and end dates of the next recession in GDP. Doing this on an ongoing basis is not only impossible, but it probably doesn’t help you that much either.

You should build into your financial plan the inevitability of recessions with the understanding that they are a natural extension of the capitalist system in which we operate, even if you do not know when they will occur.

We discussed this question on the latest version of Portfolio Hedge:

I also had Bill Artzeronian on the show to answer questions about the benefits of working with a tax advisor and the tax implications of selling a big loss in your portfolio.

Further reading:

Are we heading towards recession?