Is Active Versus Passive Really Past?

Perhaps as a member of the last generation who grew up with rotary dial phones in the household, I still remember when there was a clear distinction between a phone and a computer. Phones were utilitarian devices, while computers were gateways to unlimited knowledge and entertainment. Nowadays that distinction has disappeared. For many consumers, phones arguably outweigh the need for a personal computer.

Similarly, developments in finance have removed the clear cut-and-dry distinction between active and passive investing. The current scenario suggests that such traditional, characteristics inherent by binary labels may not be sufficient to describe many of today’s investment approaches. A more nuanced framework takes the spirit of the active and passive definitions—versus betting against market prices. Embrace them—and examines how it applies to the underlying philosophy and implementation of an investment.

reduced distinction

Index investing emerged amid a growing body of evidence indicating that traditional proactive methods of attempting to select stocks and time markets were ineffective. Studies documenting underperformance by active fund managers supported the notion that market prices were largely justified and that any attempt to find more or less securities was tantamount to tossing a coin. Therefore, the advent of index funds represents a shift towards adapting to market prices – if you can’t beat them, join them!

Since early indexing did not spin its wheels in bottom-up company analysis or top-down economic trend forecasting, it became known as passive investing. However, it broadens the definition of “inactive”. A sailboat without its own propulsion must still be actively manipulated to keep wind in its sails. Indexed perpetual motion machines are not maintenance-free, but require periodic management through additions, deletions and safety reloads. Index creation rules are often designed to accommodate index-tracked mutual funds and exchange-traded funds, for example, by reducing index turnover, limiting the number of rebalancing events, and security weighting changes. By setting a threshold.

Further blurring the line between active and passive is the fact that some investors may use index funds to pursue an active investing approach. For example, the largest S&P 500 ETF had the highest average daily trading volume of US-listed securities at $31 billion in 2021, according to Bloomberg. It is appropriate to represent a portion of that trading activity as asset allocation changes driven by a market outlook, not accumulation of buy and hold positions.

A more evolved process for classifying investments applies separate active/passive labels to the structure/implementation of a strategy and its underlying philosophy. While some investment approaches still appear active or passive through and through this framework, many investing styles have a foothold in both camps.

Stock-picking and market-timing strategies would be described as universally active, and the 2×2 framework in Exhibit 1 shows how this label is earned. These approaches are rooted in an active philosophy that inherently mispriced securities or market segments can be identified. This philosophy is executed in a proactive structure that deviates from the market in an attempt to take advantage of opportunities for mis-pricing.

Broad market index funds, on the other hand, fit a passive definition along both dimensions. The ration d’etre of index funds is an acknowledgment of the pricing power of the market, a concession that attempts to outperform the markets are unlikely to succeed over the long term. Broad market index funds are structured true to the belief that, generally holding the entirety of a specified asset class or market segment, there are no deviations induced by expected-return targets.

The expansion of the ETF landscape has given rise to a segment of index ETFs that do not track broad market indices, instead offering more targeted exposure to investors who are looking to time the markets or on particular stocks. are concentrating. For example, you can find a social sentiment ETF that holds the top 75 large cap stocks based on investor enthusiasm measured through channels such as social media and news outlets. Another example is a millennial-themed consumer ETF that seeks to ride the coattails of companies benefiting from the consumption preferences of millennials.

These are two examples of index funds that differ from the traditional passive approach. They track indices, so are passive in structure. But the philosophical underpinnings of these niche ETFs would seem inconsistent with the acceptance of market prices. An investor who believes that stock prices reflect available information about companies will likely not see the appeal of an allocation of trendy stocks based on confidence in their growth potential. Our framework assigns these index ETFs an active/passive designation.

The last quadrant expresses an approach that begins with a firm belief in the power of the markets, a philosophy that has been dormant with the fundamental shift of the industry. It uses price information during the investment process with the aim of increasing the expected return daily, while seeking to add value above the market and benchmark. The implementation is therefore proactive – the construction rules of an index are not considered. Therefore, we land on the passive/active: an approach that seeks to outperform the markets without trying to outperform them.

A false dichotomy?

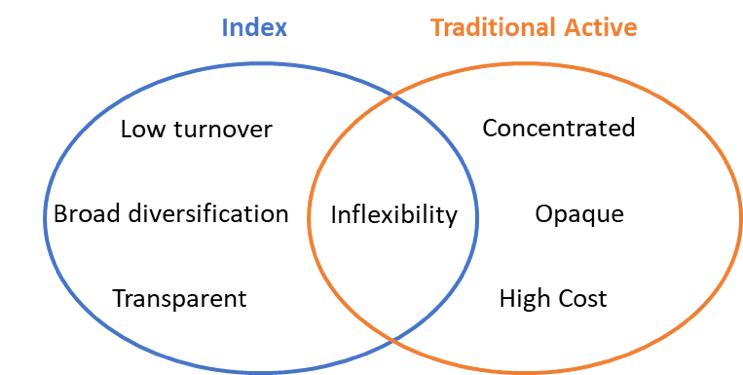

While active and passive sound like opposite ends of a spectrum, they often have one characteristic in common: inflexibility. For example, a proactive manager may act with urgency when trading at perceived false prices – after all, you may not be able to settle on information relevant to security prices that you believe are not yet included in the market. or move on to a different security for which you lack the same trust. Ironically, index fund managers also typically trade immediately—usually with little to no discretion on which securities to buy and when to buy them, as the index determines that decision.

Inflexibility imposes a number of potential costs on investors. An obvious one is sub-optimal trade execution. Beggars cannot be choosers, and an investment strategy that requires trading in a specific security at a specific time is not in a position to demand favorable buy and sell prices. Inflexibility can increase the cost of tradeoffs associated with short-term return drag, such as downward stock momentum, and increase the burden for taxable events whose treatment is dependent on the holding period.

The cost of inflexibility is more reason for investors to look at traditional labels like passive and active. Especially now that we can browse more details of the investment process from a phone or computer.

Wes Krill is Head of Investment Strategists at Dimensional Fund Advisors