What happens when you buy a stock in a bear market?

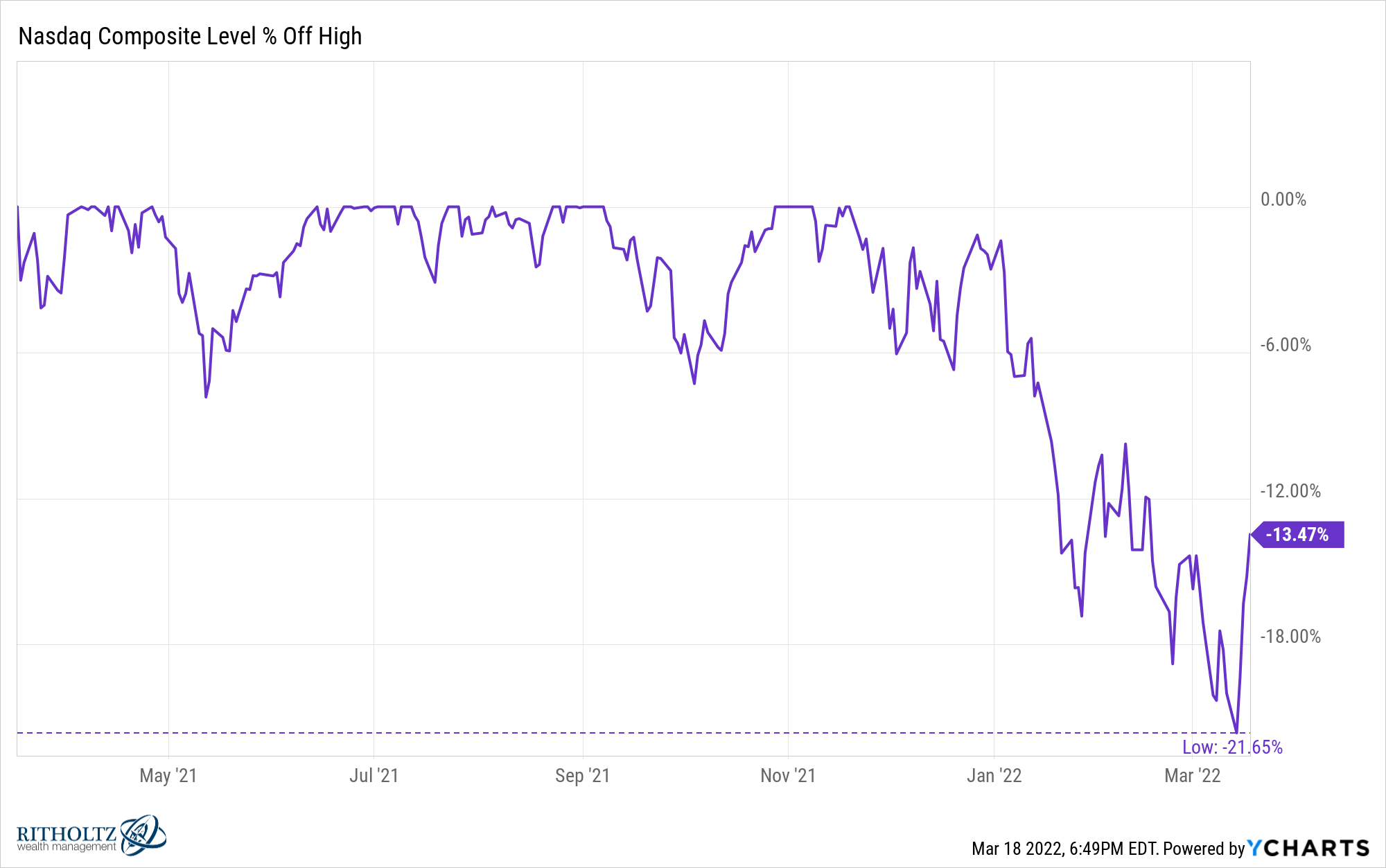

Last Monday, the Nasdaq Composite was in bear market territory, down nearly 22%:

A furious rally followed over the next four days, with the tech-heavy index up more than 10% from lows.

That could be the bottom. But it could be a vicious bear market rally. we will see.

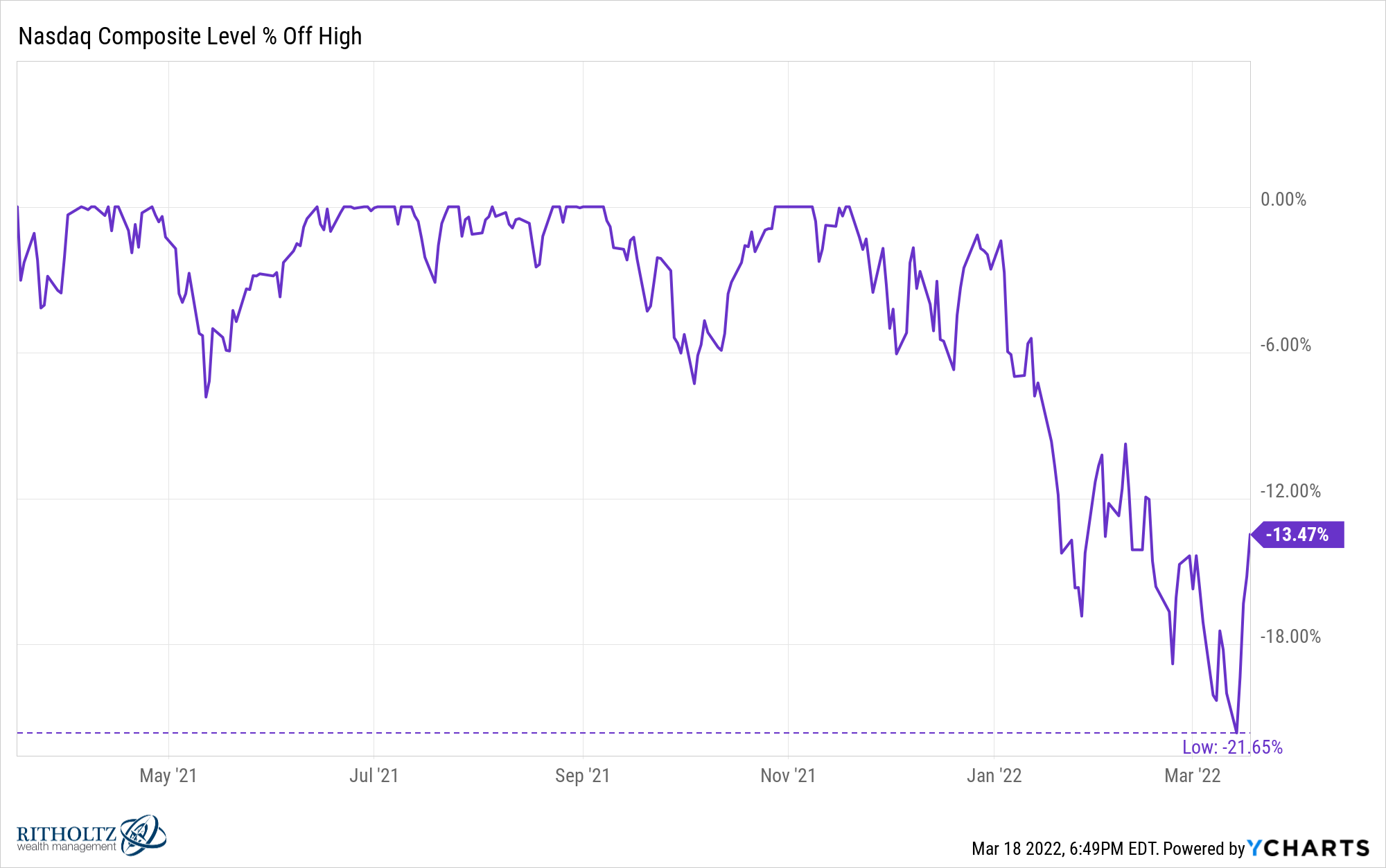

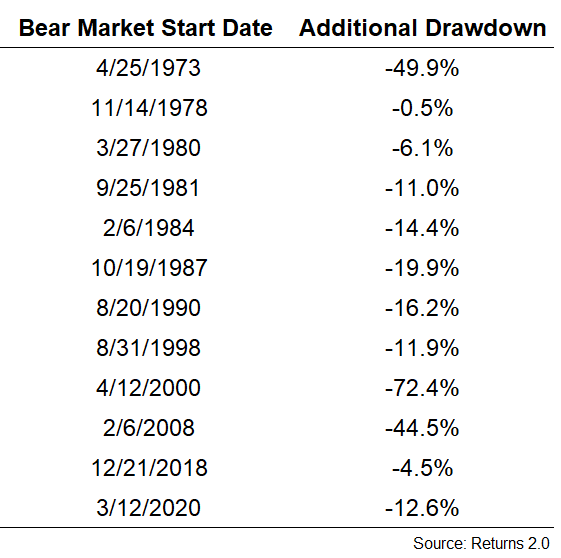

I think there have been 12 bear markets1 Going back to the 1970s before the current recession on the Nasdaq:

The average loss on this table is -37.6%.

You can see some nasty crashes on this list along with a few more run-of-the-mill bear markets.

The problem with Down Market is that you never know which ones will turn into complete vaporization and which will just be a flesh wound.

This of course also applies to the current situation.

So what if you had bought the Nasdaq in the past every time it entered a bear market without any foresight to know if it was going to get worse?

Let’s say you bought the Nasdaq every time it fell 20%. What will be your return?

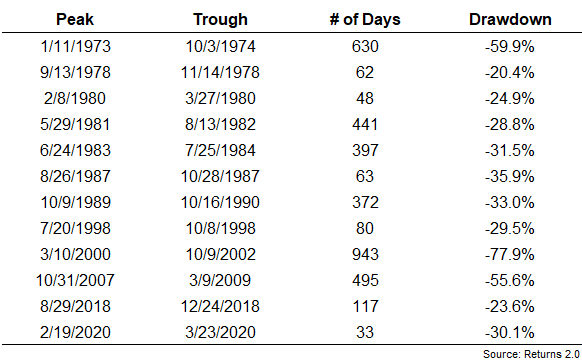

Here’s a look at further one-, three-, five- and ten-year returns if you had bought the Nasdaq right after it plunged into bear market territory.2,

Averages are good enough, especially when you consider the fact that many of these bear markets have gone far deeper than 20% losses. this is what happened after Initial 20% Flush:

Although the returns were good in most cases, they were still accidents that lasted much longer than most investors could stomach.

Returns were negative even after another three years after the 1973–1974 bears. And you’ll still be down a third on your investment ten years after the dot-com explosion. And after that it had already dropped 20%!

Some thoughts on this data:

Buying when a stock is in a bear market is generally a good strategy. Newsflash – Buying stocks when they are on sale becomes a winning strategy in the long run.

Even if you incur some further losses, buying stocks after they’ve already fallen 20% has historically yielded good returns.

I know every improvement looks like it’s going to be the end of the world, but most of the time it’s not the end of the world.

Nothing works all the time. Most of the time when you buy stocks when they are very low, your forward return is good. However, sometimes investors need to be reminded that risk can mean years of terrible returns in stocks.

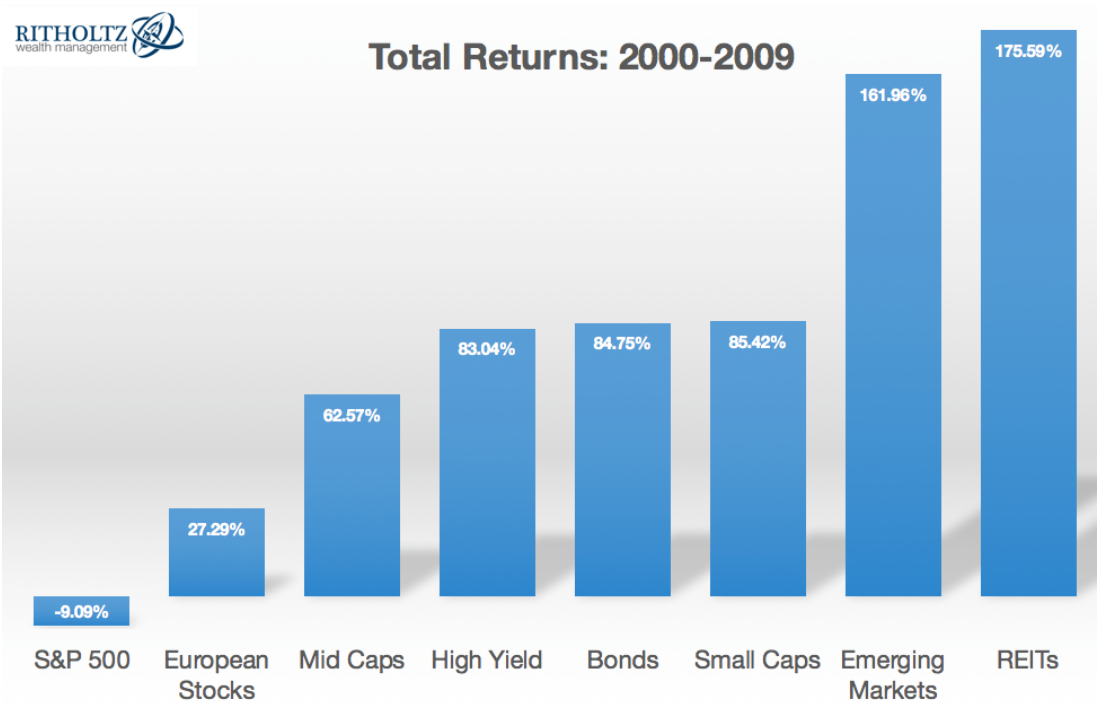

From 2000 to 2009, the S&P 500 overall was down 9.1% even after accounting for dividends. It was a lost decade for the biggest companies on the US stock market.

During the same decade, the Nasdaq was down more than 41%. It’s an entire decade where investors got wiped out.

It is perhaps notable, this terrible, terrible, not good, very bad decade from 1980–1999 was preceded by total returns of 3,688% (19.9% per annum) and 2,583% (17.9 per cent per annum), respectively, for the Nasdaq. and S&P.

It’s hard to know when this will happen, but exceptional performance in the stock market often results in terrible returns.

So the risk goes.

If there was no risk involved in buying the stock, there would be no reward.

Maybe it’s like the end of the dot-com bubble but maybe not. I know a lot of people who feel that the tech stock boom in the 2010s was akin to the blow-off tops of the 1990s, minus the big losses that started at the turn of the century.

It is definitely possible. The Nasdaq was up more than 1,000% (20.7% per year) from 2009 to 2021.

It’s a pretty good run.

Maybe the 2020s will see another protracted bear market that will lead to a lost decade.

The last time we lost a decade, it’s worth looking at the returns of other asset classes:

The Nasdaq may have another lost decade. Maybe the S&P 500 will too. Somewhere in the world there might be a stock market that went nowhere for decades like in Japan from the late 1980s.

It’s not the answer most investors are looking for, but we don’t know when long-term risk is going to appear in certain areas of the stock market.

The only answer I have for preparing for these types of risks is diversification.

Further reading:

A Brief History of Dead Cat Bounce

1You can quibble with my bear market numbers here. The bear market of 1973–1974 and the bursting of the dot-com bubble in 2000 were followed by several rallies and additional declines. In fact, the Nasdaq didn’t hit the 2000 high again until 2015. Sometimes with these definitions we’re dividing the hair.

2Technically these are returns from the end of the month following the start of the bear market. To use the total return I am using monthly data. Sometimes it makes it better and sometimes it makes it worse. close enough.