What does the labor market mean for the stock market?

I know everyone hates inflation and I get why.

But it feels like those who are down on the economy because inflation is so high are missing out on the fact that the labor market is on fire.

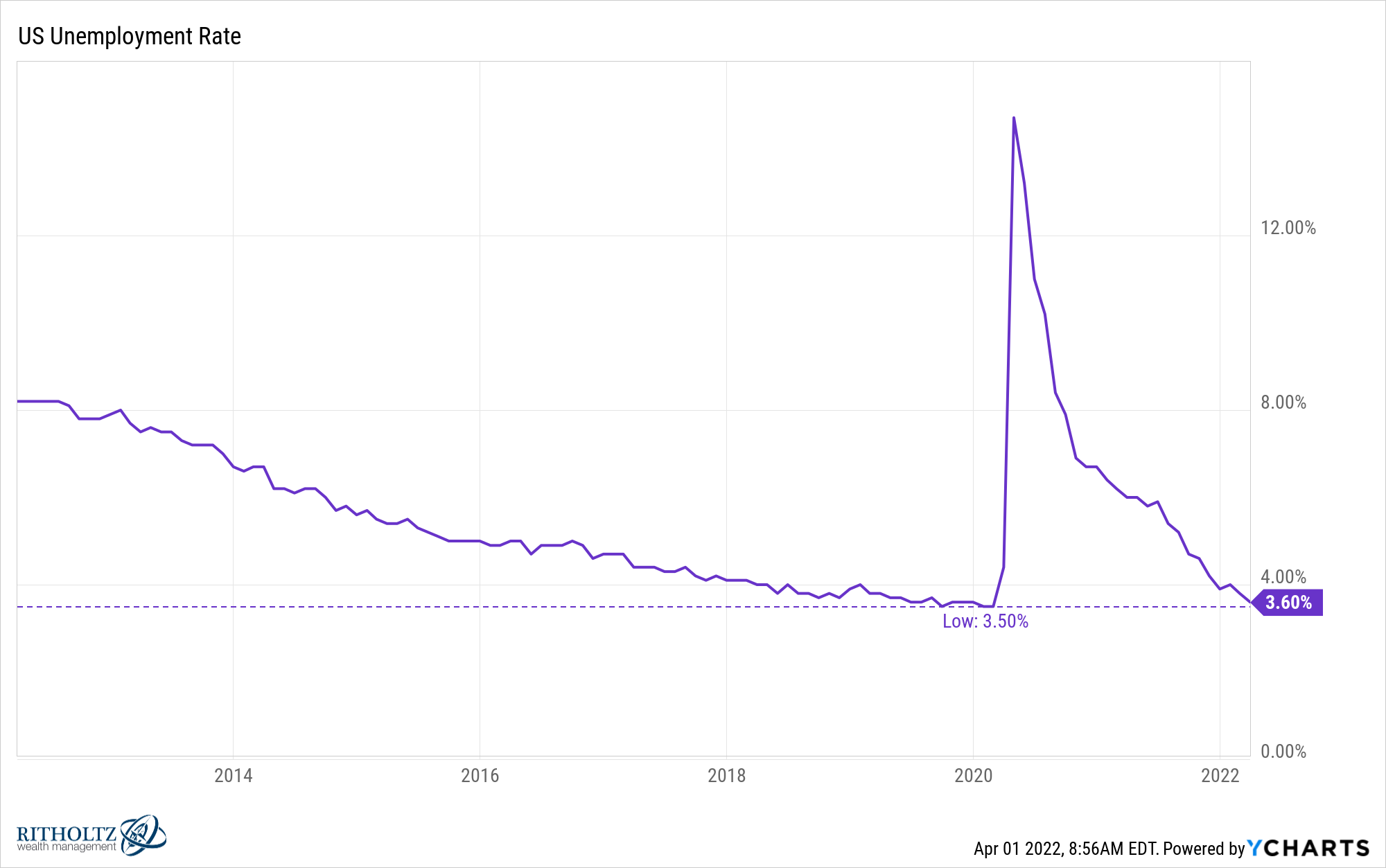

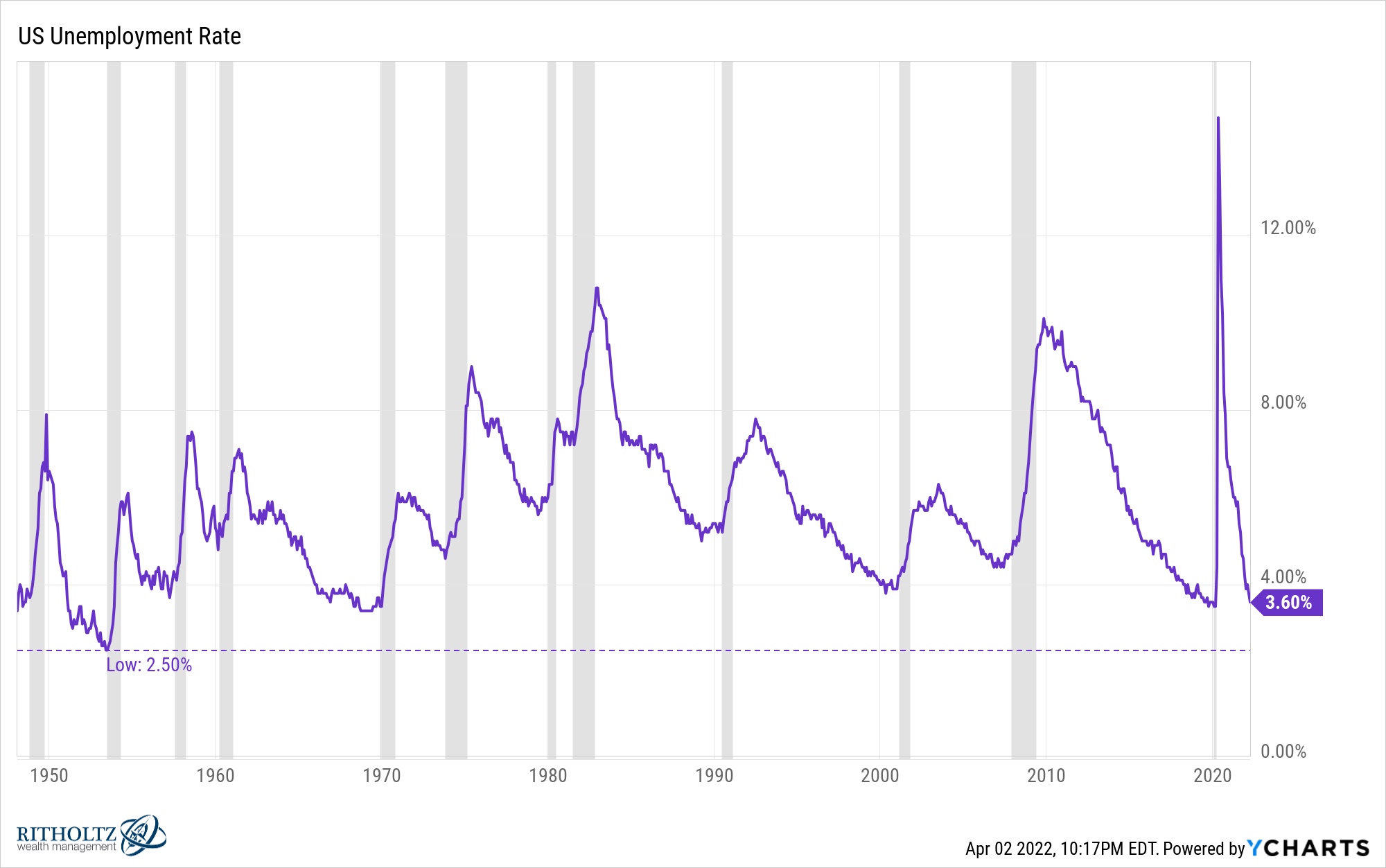

The unemployment rate has basically returned to pre-pandemic levels:

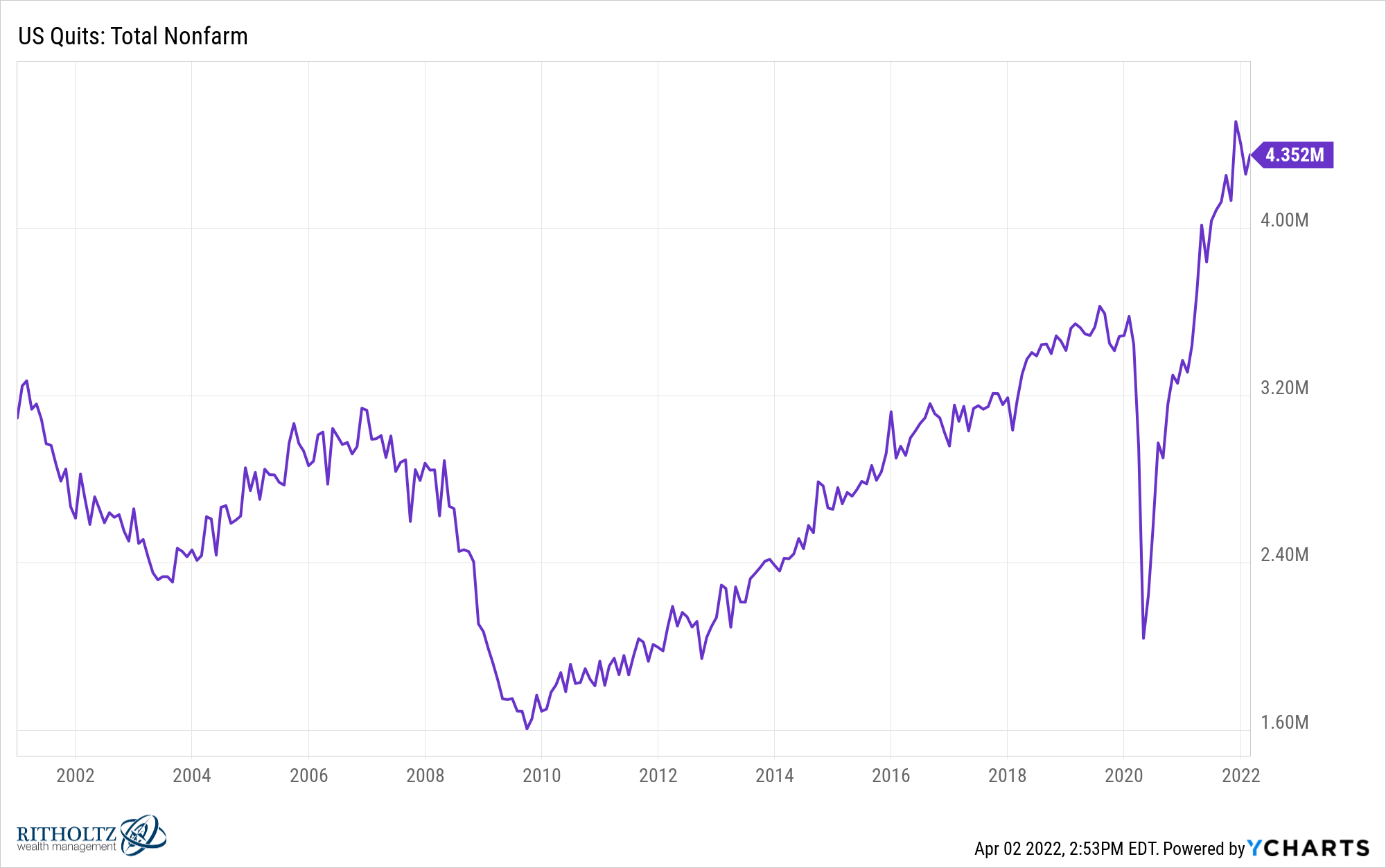

But Ben just because nobody wants to work anymore? Ever heard of The Great Resignation?

It is true that we have never seen so many people leaving their jobs before:

However, this is a good thing. This means that people are confident that they will get another job.

Great resignation requires hiring a PR agent. It should be rebranded as the Great Shuffle.

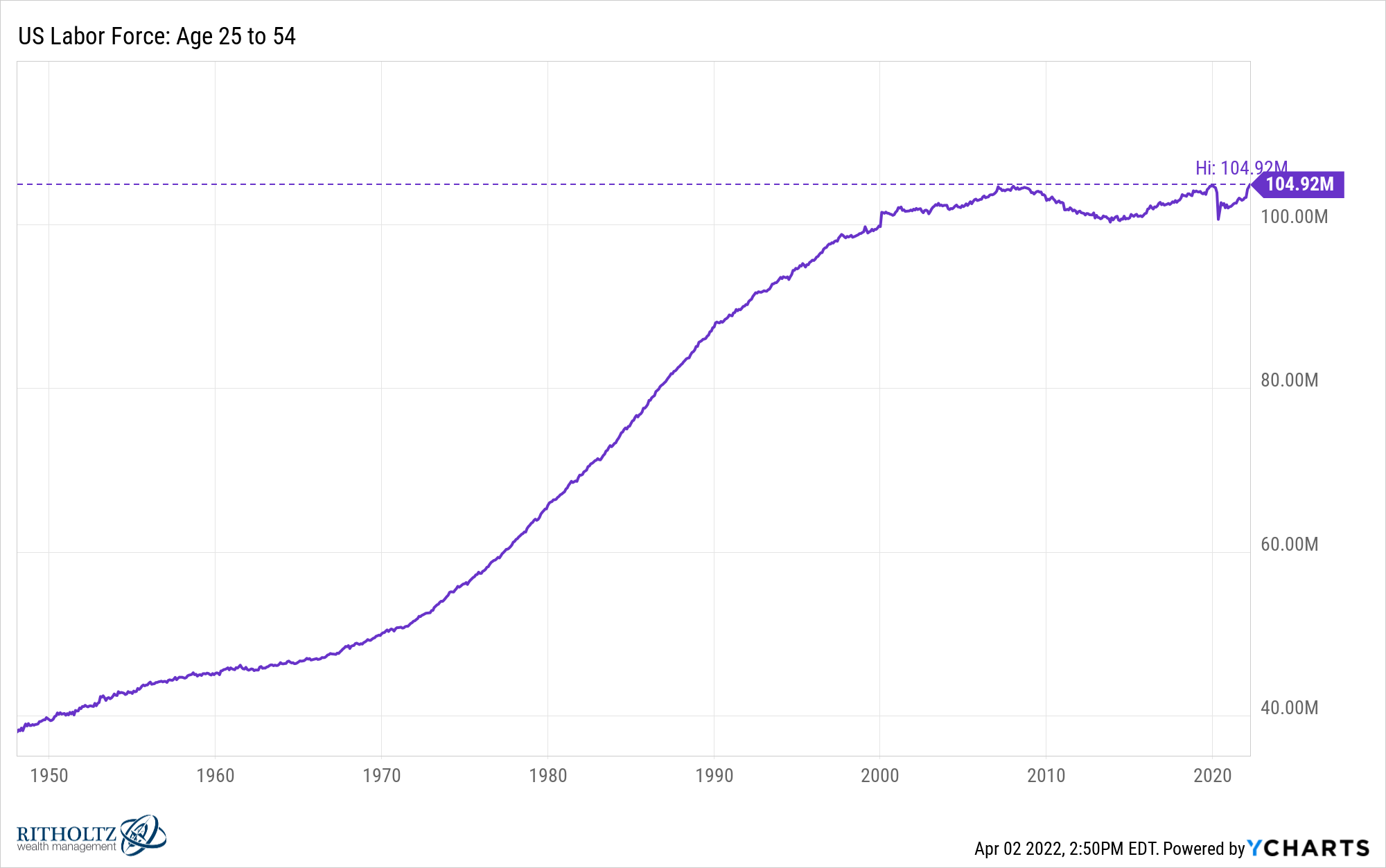

The number of prime-age workers (aged 25-54) hit a new all-time high, surpassing pre-pandemic levels:

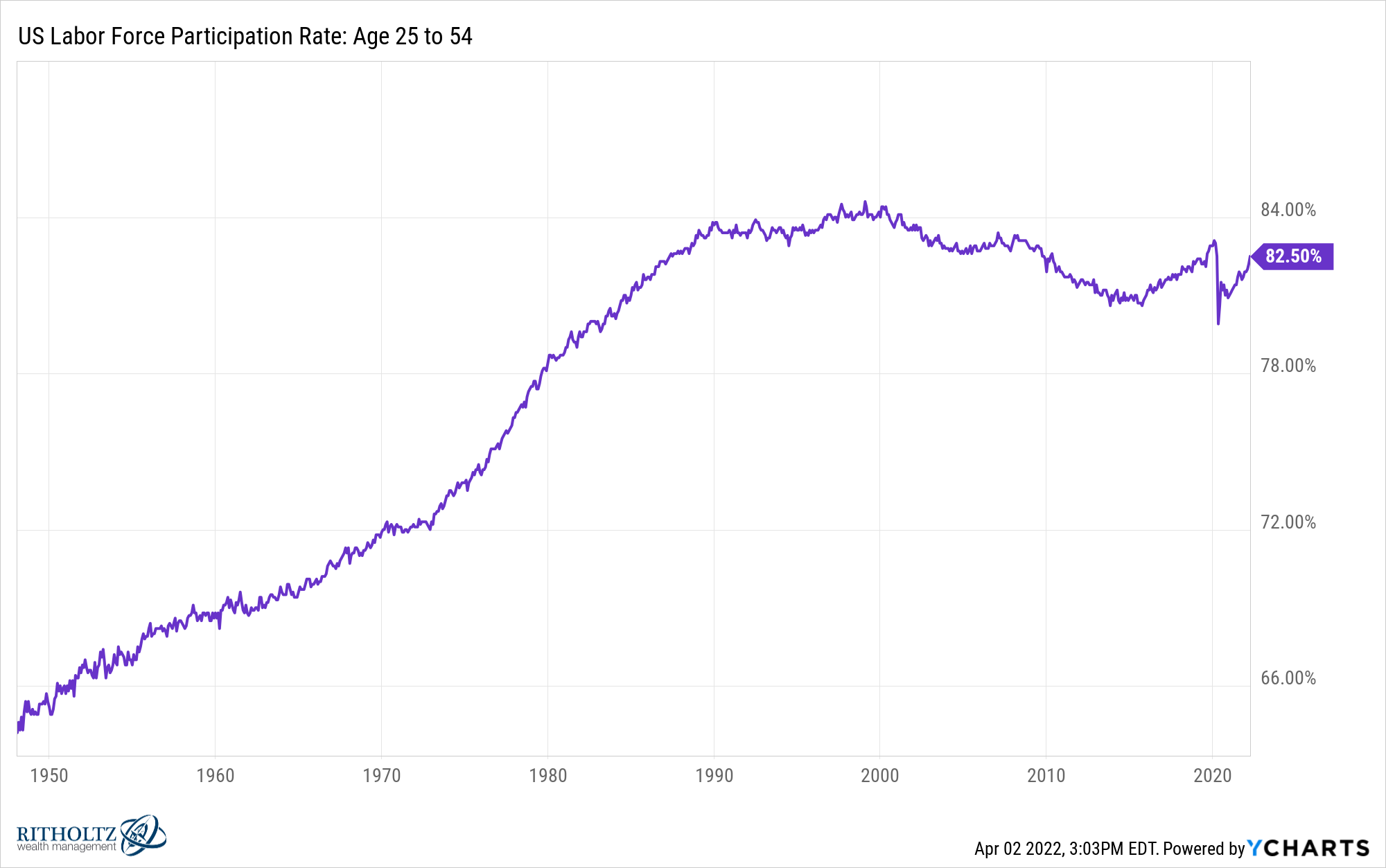

No, this is not a typo or a crime chart. You can see labor force participation among this group1 Closing even at pre-pandemic levels:

I know it’s against the prevailing narrative right now, but most people want or want to work.

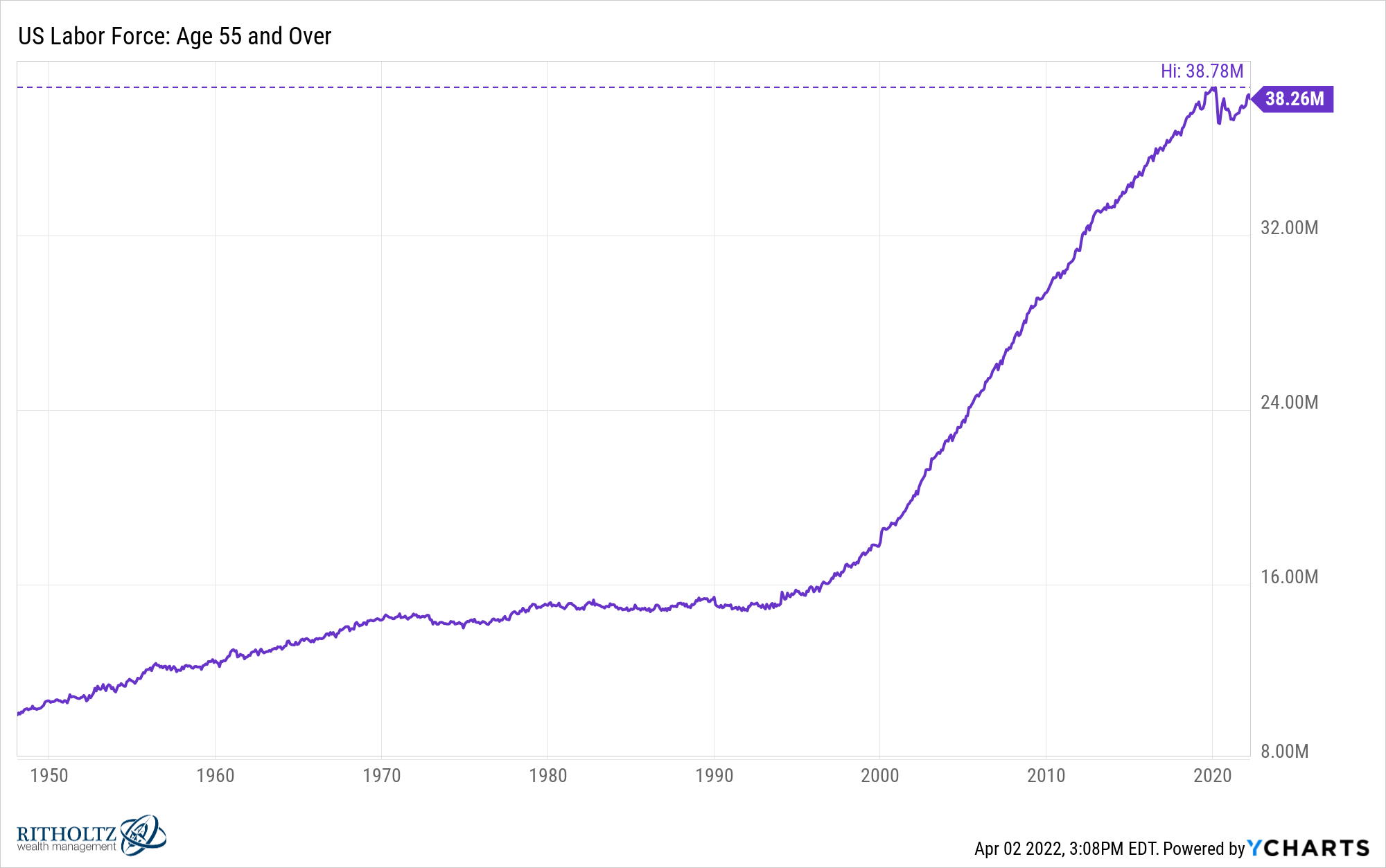

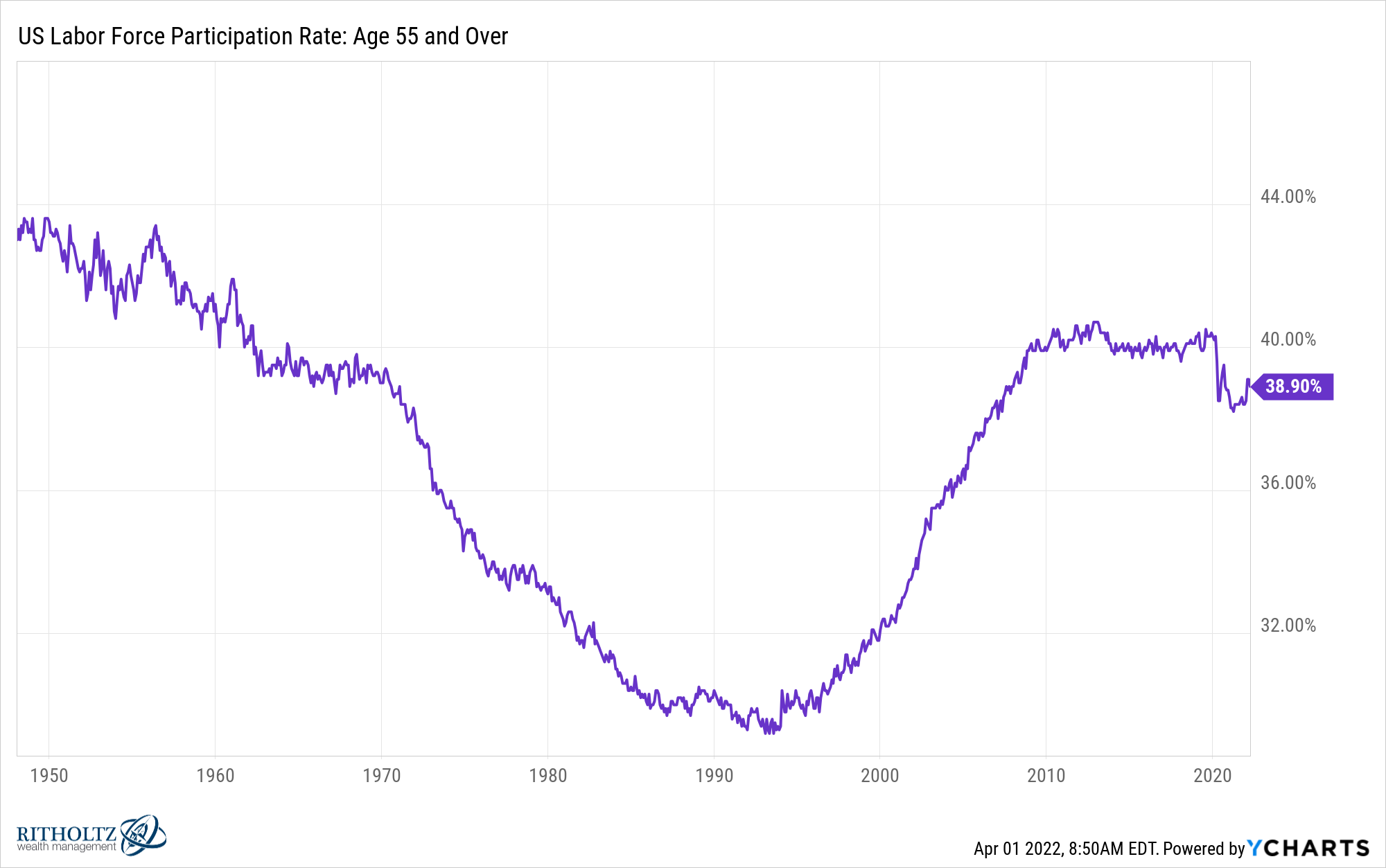

Well what about all those older people who retired early?

It is true that millions of people retired prematurely, but for those 55 and over the labor force is back to almost 2019 levels as well:

The labor force participation rate for those 55 and older still hasn’t recovered, but it’s rising again and not far off:

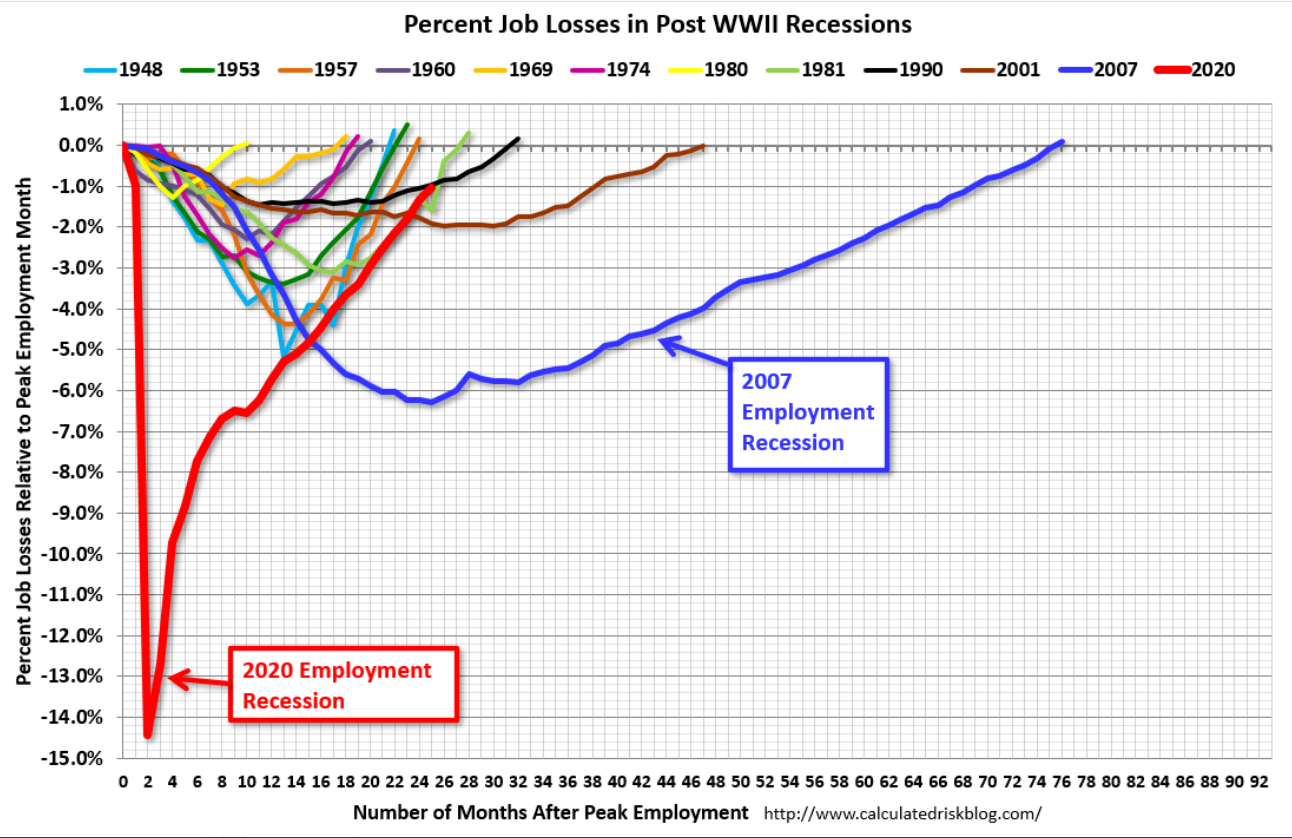

this chart Bill McBride Here’s something else showing the current job recovery compared to the previous WWII recession:

We have added 17 lakh new jobs in the first 3 months of the year alone.

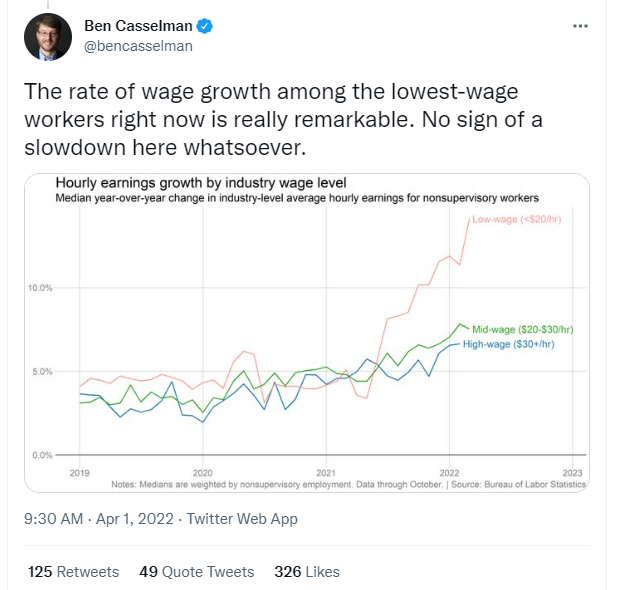

That’s great Ben but what about wages?

fair point. There are many workers who are seeing their wages rising but not as fast as the inflation rate. It’s not great.

Surprisingly, those in the lowest paid group are seeing the highest pay increases. just look at this chart Ben Castleman,

Talman Smith in the New York Times wrote an article this week about Nebraska, the state with the lowest unemployment rate in the country:

The unemployment rate in Nebraska stood at 2.1 percent in February, the lowest in the country with Utah and the lowest on record for any state. Unemployment is less than 1 percent in many countries. Even taking into account adults who have left the workforce, the share of the employed population in Nebraska aged 16 and older is about 68 percent, the highest figure in the nation.

This story about a bartender who’s changing jobs because he keeps getting better offers sums it all up about who has the upper hand right now:

This included Nikki Polk, a bartender in the evening shift, a spontaneous lady with pink hair. “I’m in hot demand, baby,” she said with a smile, referring to the “desperate” employers. “I’ve worked like six times in the last six months because I keep getting better offers that I can’t turn down.”

This all sounds like an amazing development, beyond inflation and for employers giving employees a hard time. The workers eventually have some negotiating power.

The only other potential downside I see here is that there probably isn’t much room for improvement from here on out. It’s like we’re rolling the tube to try to get a little toothpaste off that list before moving on to a new tube.

The lowest unemployment rate ever recorded in modern economic times was 2.5% in the early 1950s:

You can also see from this chart that a low unemployment rate usually follows a recession. Not all recessions start with low unemployment rates, but when you consider that recession comes from excesses in the economy.

I have looked at the relationship between the unemployment rate and the stock market in the past. The average forward return is high when the unemployment rate is high and low when the unemployment rate is low.

This also makes sense because unemployment tends to be higher during recessions, which are also the case when the worst bear markets occur.

Buying when the stock market is going down is a good long term strategy.

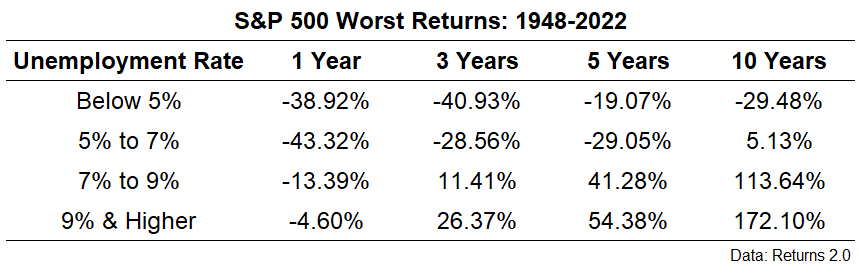

Let’s look at it in another way. Going back to 1948, I looked at the worst results of the S&P 5002 From different unemployment rate categories:

Again this is the worst case so it is not a base case but you can see a clear relationship in the data here.

The likelihood of bad outcomes in the stock market is high when the unemployment rate is low. It is actually safer to invest when the unemployment rate is high.

I am not saying that this means a recession is imminent.

It is easy to predict a recession except for the timing, magnitude and length part.

With the labor market so strong, it is possible that this reform could continue for a few more years. Do not know?

And even if we go into recession in the coming months or years, there’s no way to tell how the stock market will react.

I have to say that sometimes the market and the economy are conflicting.

Good and bad times don’t last forever.

Further reading:

how to prepare for recession

1The growth in this chart since the 1950s is also insane.

2These are total returns including dividends, using monthly returns.