5 smart 401k steps to take in 2021 to boost your retirement savings

5 smart 401k steps to take in 2021 to boost your retirement savings, Do you have a 401k? These five 401k tricks will help you grow your retirement savings and ensure that you take full advantage of your 401k benefits.

After a very challenging 2020, 2021 allows you to take another look at your 401k, re-evaluate your financial priorities and re-evaluate your retirement strategy, let’s make sure your 401k works for you.

withdrawal calculator

What is a 401k Plan?

A 401k plan is a workplace retirement plan that allows employees to build and grow their retirement savings. It is one of the most convenient and effective ways to save for retirement as both employees and employers can make retirement contributions. You can make automatic deductions directly into your 401k account through your company’s payroll as an employee. You can choose the exact percentage of your salary that will go towards your retirement savings. In 2021, most 401k’s will offer you multiple investment options in stocks, fixed-income mutual funds, and ETFs. In addition, most employers offer a 401k match up to a certain percentage. In most cases, you need to participate in a plan to get the match.

1. Maximize Your 401k Contribution in 2021

The smart way to boost your retirement savings is to max out your 401k contribution each year.

Did you know that in 2021 you can contribute up to $19,500 As for your 401k plan? If you are 50 or older, you are eligible for an additional catch-up contribution of 6,500 in 2021. Traditional 401k contributions are tax-deductible and will reduce your overall tax bill in the current tax year.

Many employers offer a 401k match, which is free money for you. The only way to achieve this is by participating in the scheme. If you can’t max out your dollar contribution, try subtracting the highest possible percentage so you can capture the entire match from your employer. For example, if your company offers a 4% match on every dollar, at a minimum, you must contribute 4% to receive the full match.

How to reach $1 million in your 401k by age 65?

Do You Want to Withdraw $1 Million in Your 401k Until You Withdraw? The secret recipe is to start early. For example, if you’re 25 today, you only need to set aside $387 a month for 40 years, assuming a 7% annual return. If you’re 35, the savings rate jumps to $820 per month. If you started late, you need to save about $3,000 a month in your 50s to get a million dollars by age 65.

401k Contribution by Age

| Age | , | Monthly Contribution |

annually Contribution |

Life span Contribution |

||

| 25 | $387 | $4,644 | $190,404 | |||

| 30 | $560 | $6,720 | 241,920 | |||

| 35 | $820 | $9,840 | $305,040 | |||

| 40 | $1,220 | $14,640 | $380,640 | |||

| 45 | $1,860 | $22,320 | $468,720 | |||

| 50 | $3,000 | $36,000 | $576,000 | |||

| 55 | $5,300 | $63,600 | $699,600 |

2. Review Your Investment Options

When was the last time you reviewed the investment options inside your 401k plan? When was the last time you made any changes in your fund selection? With automatic contributions and investments, it’s easy to get things done on autopilot. But remember, this is your retirement savings. Now is the best time to hold onto your 401k investments.

Look at the performance of your funds over the past 1, 3, 5 and 10 years and ensure that the fund’s returns are close to or above their benchmark. Review fund fees. Check if new funds have been added to the lineup recently.

What is a Target Date Fund?

A target-date fund is an age-based retirement fund that automatically adjusts your stock and bond investment allocation as you approach retirement. Younger investors tend to have a higher allocation to equities that are considered high-risk assets. In comparison, investors approaching retirement get a bigger share in safer investments like bonds. By design, plan participants must choose a target-date fund, set it, and forget it until they retire. As you approach your retirement age, the fund will automatically change asset allocation.

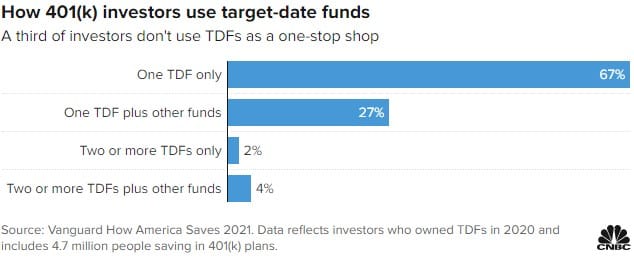

However, in a recent study, Vanguard concluded that about 33% percent of 401k plan participants misuse their target-date funds. A third of the people who have TDF link them with another fund.

So if you own one or more target-date funds or combine them with other equity and bond funds, you need to take another look at your investment options.

3. Change your asset allocation

Asset allocation tells you how your investments are spread among stocks, bonds, money market and other asset classes. Stocks are generally risky but offer good earning potential. Bonds are considered a safe investment but provide a limited annual return.

Your ideal asset allocation depends on your age, investment horizon, risk tolerance and specific individual circumstances.

Generally, young scheme participants have a long investment horizon and can face volatility in the portfolio to get higher returns in future. If you are one of these, investors can choose to have a higher allocation of shares in your 401k.

However, if you are approaching retirement, you will have a much shorter investment horizon and may have less tolerance for investment losses. In this case, you should consider adding more bonds and cash to your asset allocation.

4. Consider Contributing to a Roth 401k in 2021

Are you worried that you will pay more taxes in the future? Roth 401k allows you to make pretax contributions and avoid taxes on your future earnings. All Roth contributions are now made after paying all federal and state income taxes. The advantage of this is that all of your potential earnings will be tax-free. If you keep your money until retirement or age 59, you’ll collect your benefits tax-free. If you are a young professional or believe that your tax rate will increase in the future, a Roth 401k is an excellent alternative to your traditional tax-deferred 401k savings.

5. Rollover the old 401k plan

Do you have an old 401k plan with your former employer? How often do you get a chance to review your balance? Unfortunately, many old 401k plans have been forgotten and ignored for many years.

It’s a smart move to transfer the old 401k to a rollover IRA.

Rollovers are your opportunity to gain complete control over your retirement savings. In addition, you’ll expand your investment options from a limited number of mutual funds to stocks, ETFs, and a whole universe of fund managers. Most importantly, you can manage your account according to your retirement goals.

- Tax Brackets for 2022 – January 12, 2022

- 401k Contribution Limit 2022 – January 8, 2022

- Roth IRA Contribution Limit 2022 – January 8, 2022

- Choosing Between RSUs and Stock Options in Your Job Offering – November 2, 2021

- Getting After Tax Alpha and Higher on Your Investments – June 11, 2021

- 5 reasons to leave your robo-advisor and work with a real person – May 1, 2021

- Step by Step Guide to Planning Initial Stock Option Exercises – January 29, 2021

- Effective Roth Conversion Strategies for Tax-Free Growth – June 23, 2020

- 5 smart 401k moves to make in 2021 – August 4, 2021

- tax saving ideas for 2021 – September 16, 2021

View All Posts