This is normal

I have annual performance data on the S&P 500 going back to 1928.1

I also have historical decline data on US stocks going back to 1928.

are you thinking what I’m thinking?

Lets do it.

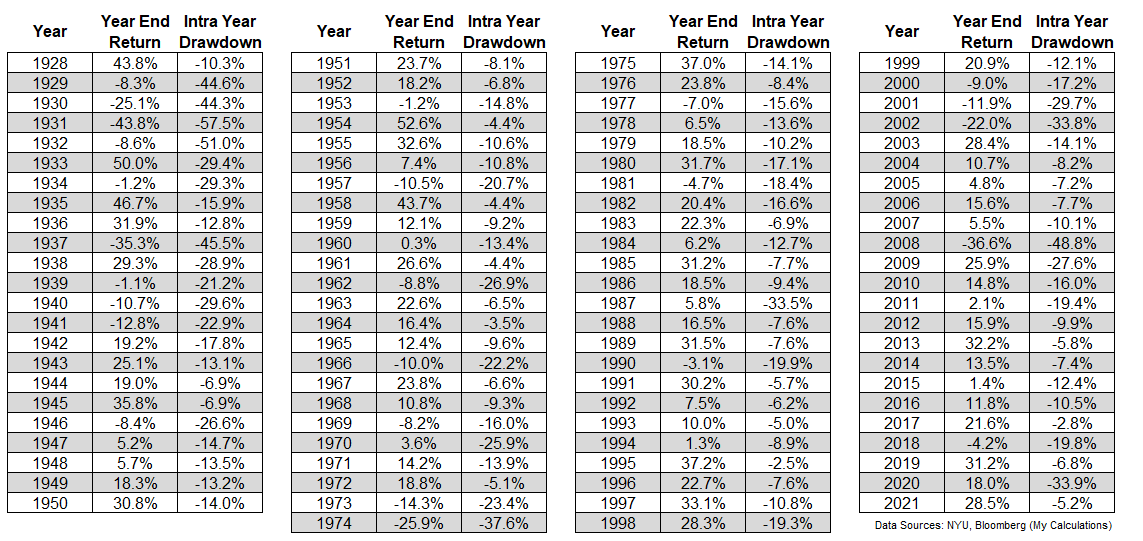

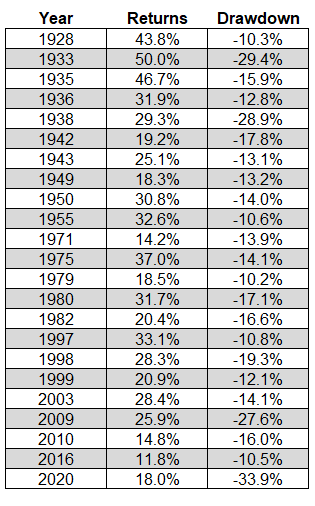

Here are the annual calendar year returns as well as intra-year peak-to-trough drawdowns for the US stock market:

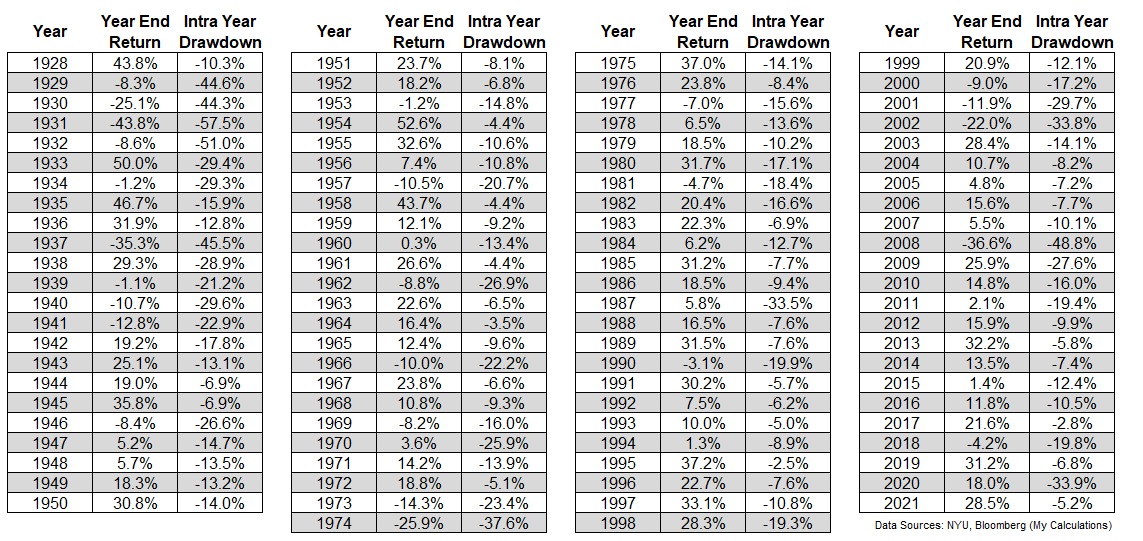

I know there are a lot of numbers here so this is for most visual learners:

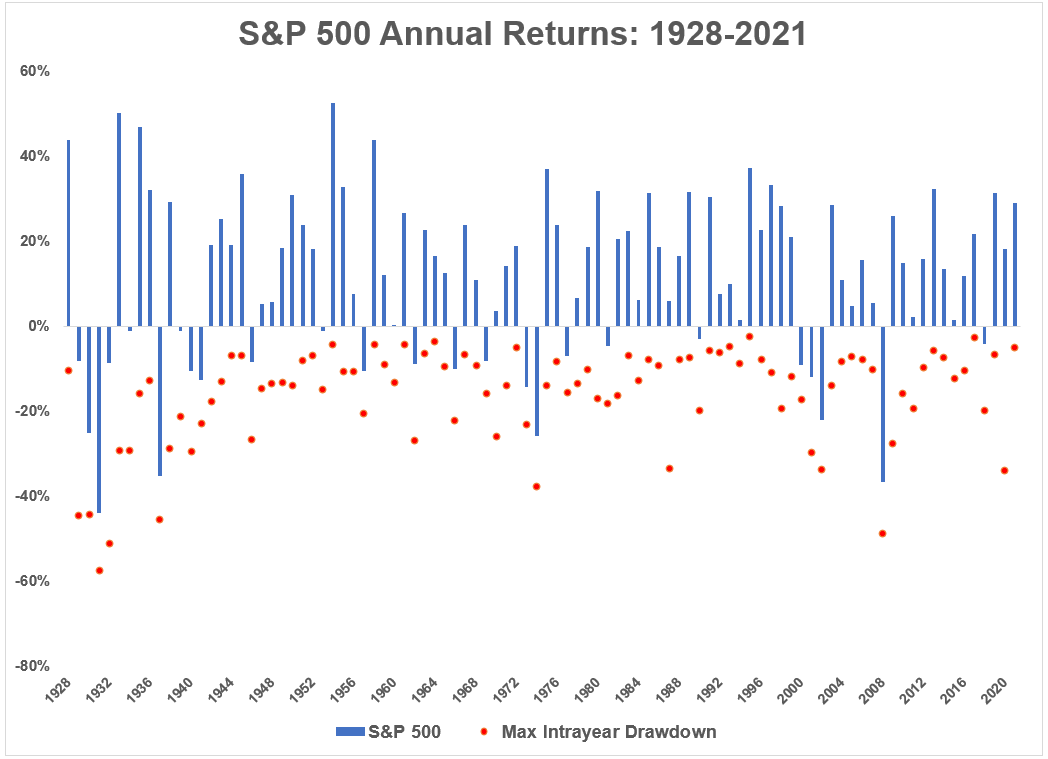

There’s a lot going on here so let’s look at some summary statistics on this data:

- The average decline over this 94-year period is -16.5%.

- In 59 of those 94 years, the deficit was more than 10%.

- In 24 of those 94 years, the deficit was more than 20%.

- In 10 of those 94 years, the deficit was more than 30%.

- In 6 of those 94 years, the deficit was more than 40%.

It is also true that the worst falls occurred in and around the Great Depression. Here’s a look at the annualized returns and the average intra-year drawdown by the decade:

Five of the 10 worst falls occurred between 1929 and 1937.2

Now here’s where things get interesting – we already know that the stock market is on average up 3 out of every 4 years. So despite all these downturns, the market ends the year with gains most of the time.

But even when there are huge losses throughout the year, the track record of the stock market is quite good.

We have already established that the market sees double-digit declines in two-thirds of all years. Yet when there has been an improvement of 10% or worse, 3 out of every 5 years have ended with a positive return.

And 2 out of every 5 years have improved by double digits, but still ended the year with a double digit profit:

The Corona accident in 2020 is an extreme example here. There was a 34% correction in February and March but the market still ended the year with a gain of 18%. The market was down about 28% at the beginning of 2009, but ended the year up 26%.

I’m not saying it’s definitely going to happen this year, but just showing what’s possible in the stock market, much less month-to-month (or day-to-day for that matter). is memory.

I know this correction sounds scary because we have inflation and the Fed and interest rates but there is something in every correction.

It can always be bad and if history is any guide it just can be. This is the nature of risk.

But it’s important to understand that this risk is nothing new.

Falling in the stock market is completely normal.

Further reading:

Some Things I Remind Myself During Market Corrections

1I know the S&P 500 wasn’t technically created until 1957. But researchers have data going back to the late 1920s. We work with the data we have.

2However it is interesting to note that 3 of the top 10 worst declines have happened in this century (2002, 2020 and 2008).