Why could this be years until we see a normal housing market?

Last week I received a letter in the mail.

Like you, I’m surprised this still exists as a practice, but desperate times call for desperate measures:

Now I think our house is just as beautiful, but I don’t think we’re the only ones who got a letter from this realtor. I’m sure there were many homes in many neighborhoods that got the same thing.

I showed this letter to my wife and jokingly said that we should ask for 20% premium over the present price. It’s a big round number but it’s essentially useless.

Why?

We have to live somewhere!

Even if we were able to get a much higher selling price it wouldn’t really help us all that much.

We already have a 3% mortgage rate closed. We have a fair share of equity in the house. And as our desperate realtor noted in his letter, it would be nearly impossible to find another home to buy right now.

The combination of rising home prices, low mortgage rates that have been put off by current homeowners and short supply make it unsuitable to sell your home and look for another one right now.

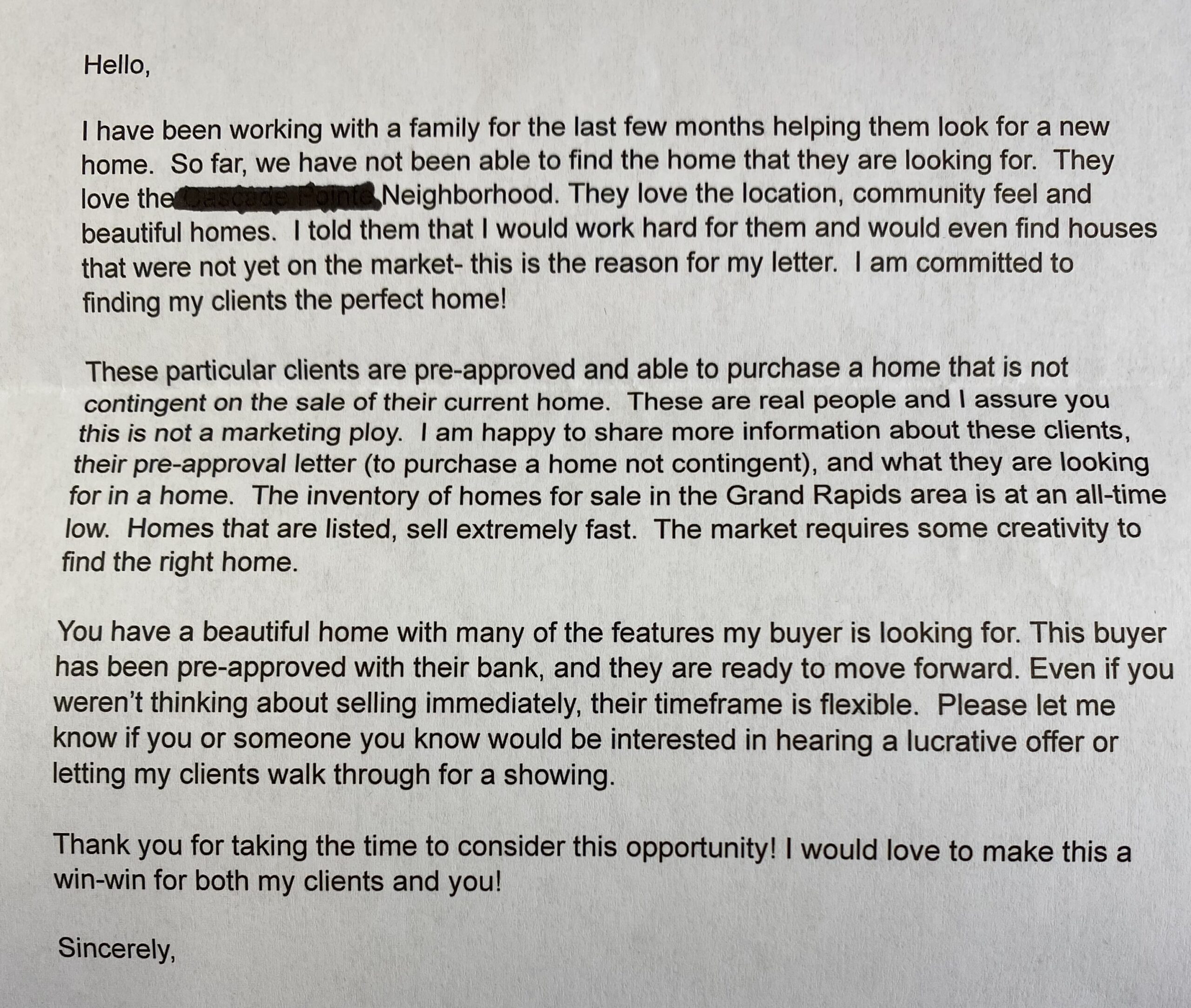

Mike Simonsen Altos Research has a chart that shows how to tell where the housing supply situation is right now:

That’s 271,913 homes for sale nationwide now!

We are in a housing market where we have record high demand and record low supply. If you want to know why prices are 20% higher than a year ago this is the simplest explanation.

But there is much more going on here.

Simonsen was recently on the Odd Lots podcast with Tracy Alaway and Joe Weisenthal, where he explained how many homeowners are doubling their real estate investments:

It’s like doubling. The homeowner goes to buy the next house, move up or move down. And because mortgages are so cheap, this is a really good time to have the first one as a rental unit. And so every year I go to buy the next one and I keep my first. And so this is a big event. And suddenly I’m a real estate investor. And at the same time, institutional money has been cheap. There is a lot of news coming in about big private equity funds buying homes, but it’s really the individuals who are driving most of it. So over the past decade we have taken 8 million homes out of the resale cycle and moved them to the investment rental portion of the pool. And that’s, you know, 9% of all single family homes.

I know everyone wants to complain about all BlackRock buying homes in this country, but 90% of residential rental units are owned by individuals in the United States.

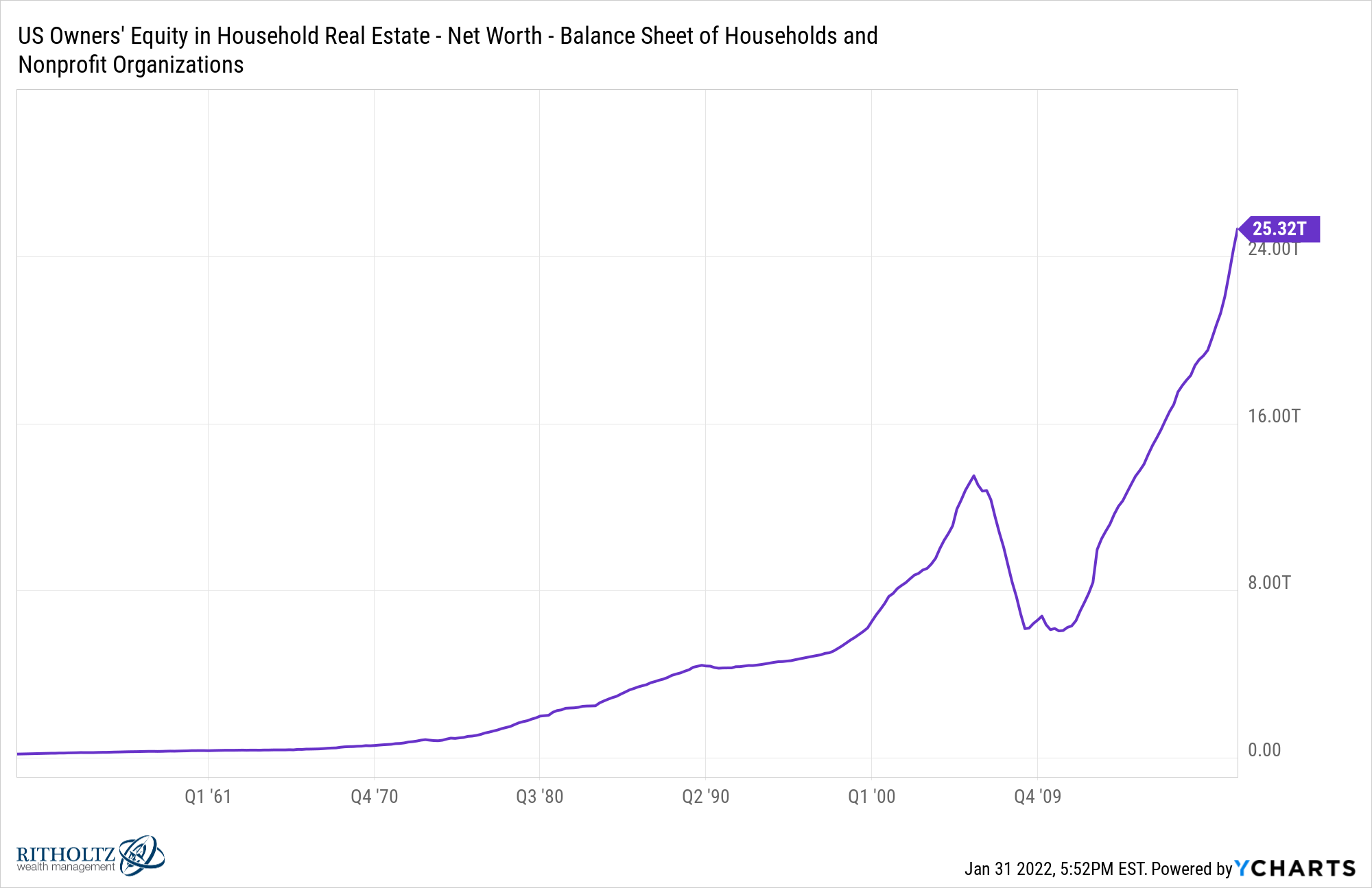

And that number is rising because of the abundance of home equity, the strength of consumer balance sheets, and prevailing low mortgage rates.

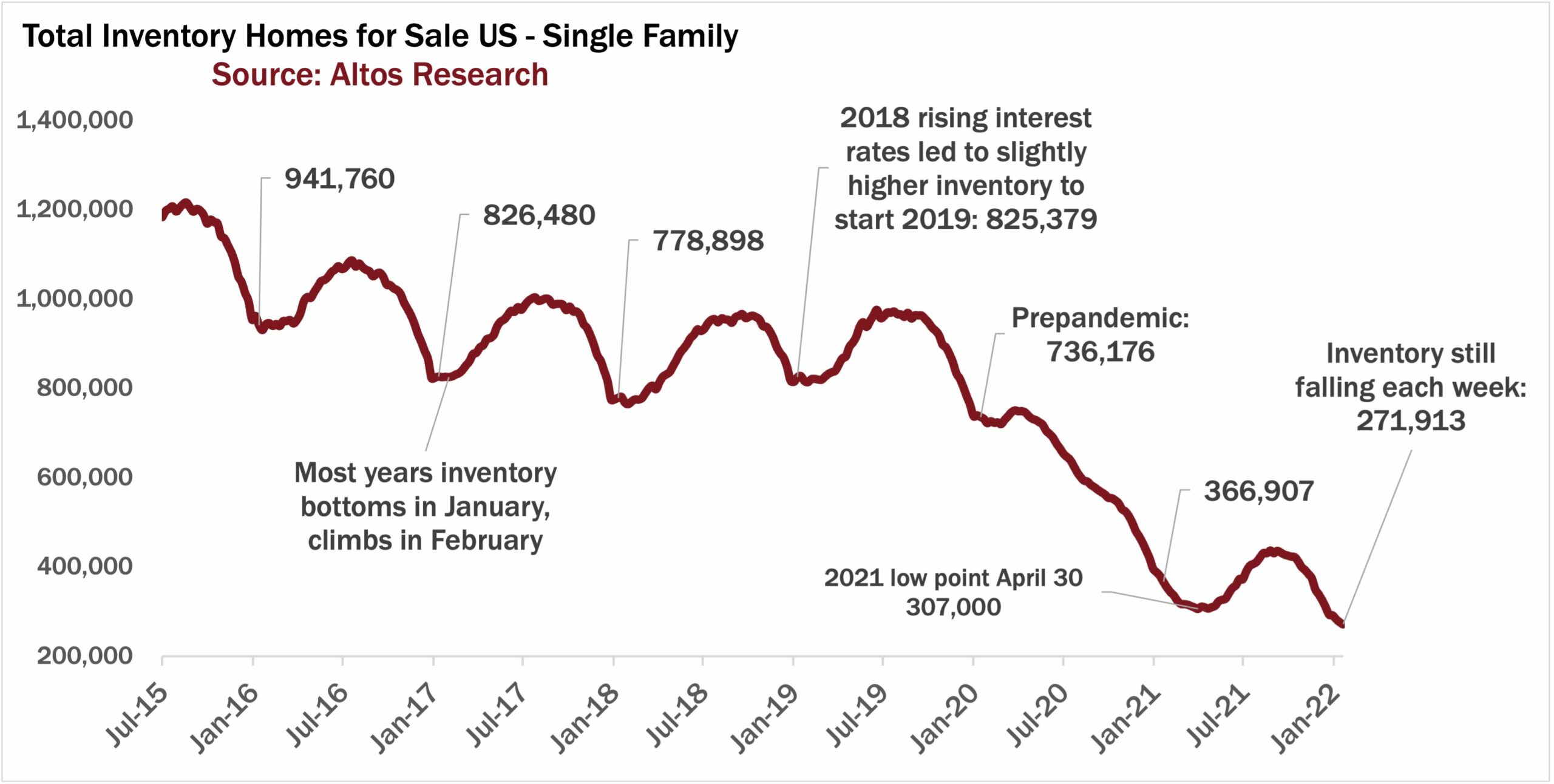

Low mortgage rates make monthly payments as affordable as ever:

Home equity has skyrocketed due to rising housing prices:

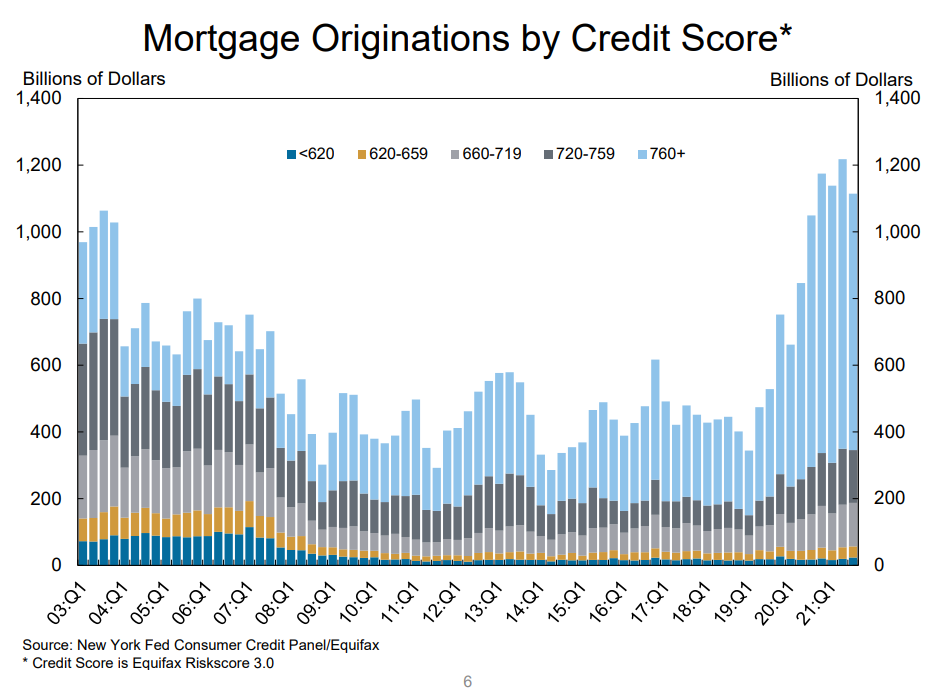

Plus, check out the creditworthiness of home buyers these days:

Home buyers today have excellent credit scores. Not so in the subprime boom of the early-to-middle aughts, when most buyers came from people with low credit scores.

Just imagine that your house has been around for 5 years or more. By now you have definitely refinanced at least 2-3 times and chances are that your lending rate is 3% or less. You are also sitting on some decent equity through a combination of principal payouts and rising prices.

It certainly doesn’t seem like housing prices are going to rise any time soon and rents are on the rise too, so it’s understandable that people would still prefer to hold onto their original property after buying something new. are.

They can simply charge enough rent to cover the mortgage, insurance and taxes and still get ahead by slowly paying off a cheaper mortgage and seeing the value of their home increase.

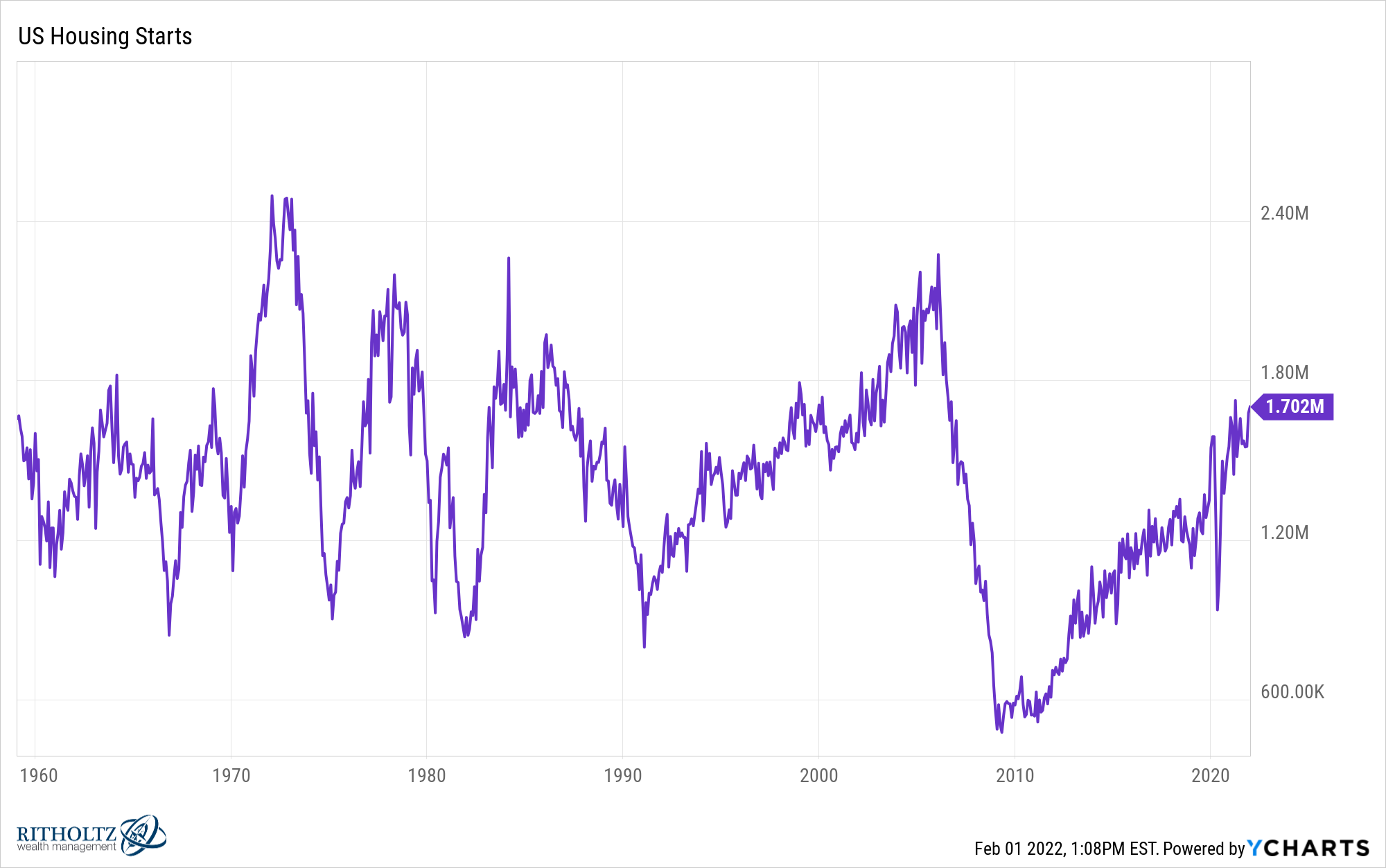

If I had to guess, until we see anything close to a “normal” housing market, this is going to be the year. We didn’t build enough homes after the last housing crash to meet the demand that has reached millennia from the years of their domestic formation.

Things are finally progressing, but we have years and years of underbuilding to build on. And it’s not like supply chain problems, government regulations and Covid are making it easier to build homes any faster.

Meanwhile, if mortgage rates get high enough, rising rates can slow things down a bit. With rising housing prices and higher lending rates, at least it will not be as attractive for people to hold onto their old homes and rent them out.

However, rising rates will also keep a lid on the housing supply as many people have put off the lower rates. Why sell to buy a home at a higher price with a higher cost of borrowing?

Obviously, people will still decide to sell people for a new job or family or a change of scenery or for some other reason.

But until we see some sort of balance between supply and demand in the housing market, it is going to take a long time.

Further reading:

Will Higher Mortgage Rates Derail the Housing Market?