RIAs predict failure of private equity ownership

Private equity firms have become active players in recent years in M&A deals involving independent registered investment advisors. Owners of the advisory firm see private equity investing as a validation of the RIA business model, but some RIAs, a Dynasty Financial Partners speaking on a media call, predict that it will end in failure.

“It’s great that PE is involved with our business as a kind of validation,” said Phil Fiore, CEO of Procyon Partners. “But I think the thesis is wrong because they are paying extremely high evaluations with the idea that if they aggregate a group of these, and then start building some common themes within them—HR, Maybe reporting, maybe some other things — to fix the P&L synergistically, they can get the right results from an EBITDA standpoint. Independent businesses don’t really do that. They left it to be independent.”

Fiore said his firm, which has about 32 employees and less than $6 billion in client assets, gets calls all the time from private equity firms interested in buying Procyon. But his firm has not taken any outside money.

Brian D., managing director of Interchange Capital Partners. Baum said it is understandable why private equity firms would go after RIA.

“They want a stable customer base; They want a recurring revenue stream; And they want the people who have always been doing this to continue to do so and not force them to change us to run the business. We hit all that,” he said.

But Baum said they would “fail miserably”. He expects the same thing to be happening to wirehouses with private equity firms in this business.

“At the end of the day, we all have decades-old customer relationships,” he said. “That’s, I think, what’s interesting to private equity firms, but it can also go against them because we can leave the private equity firms, and the clients will come along with the advisor.

“If it’s happening to UBS, Merrill Lynch or Morgan Stanley today, then ultimately if any of these succeed in the future, it’s going to happen to them,” he said.

Jason Fertitta, CEO and partner at Americana Partners, said private equity firms believe that RIAs are benefiting from a generational change in wealth, and that RIA firms have access to the same technology they had on Wall Street. .

“It’s like a confluence of events where I think private equity has recognized that Wall Street is not going to dominate this space forever, and independent firms can really compete with Wall Street,” he said. said.

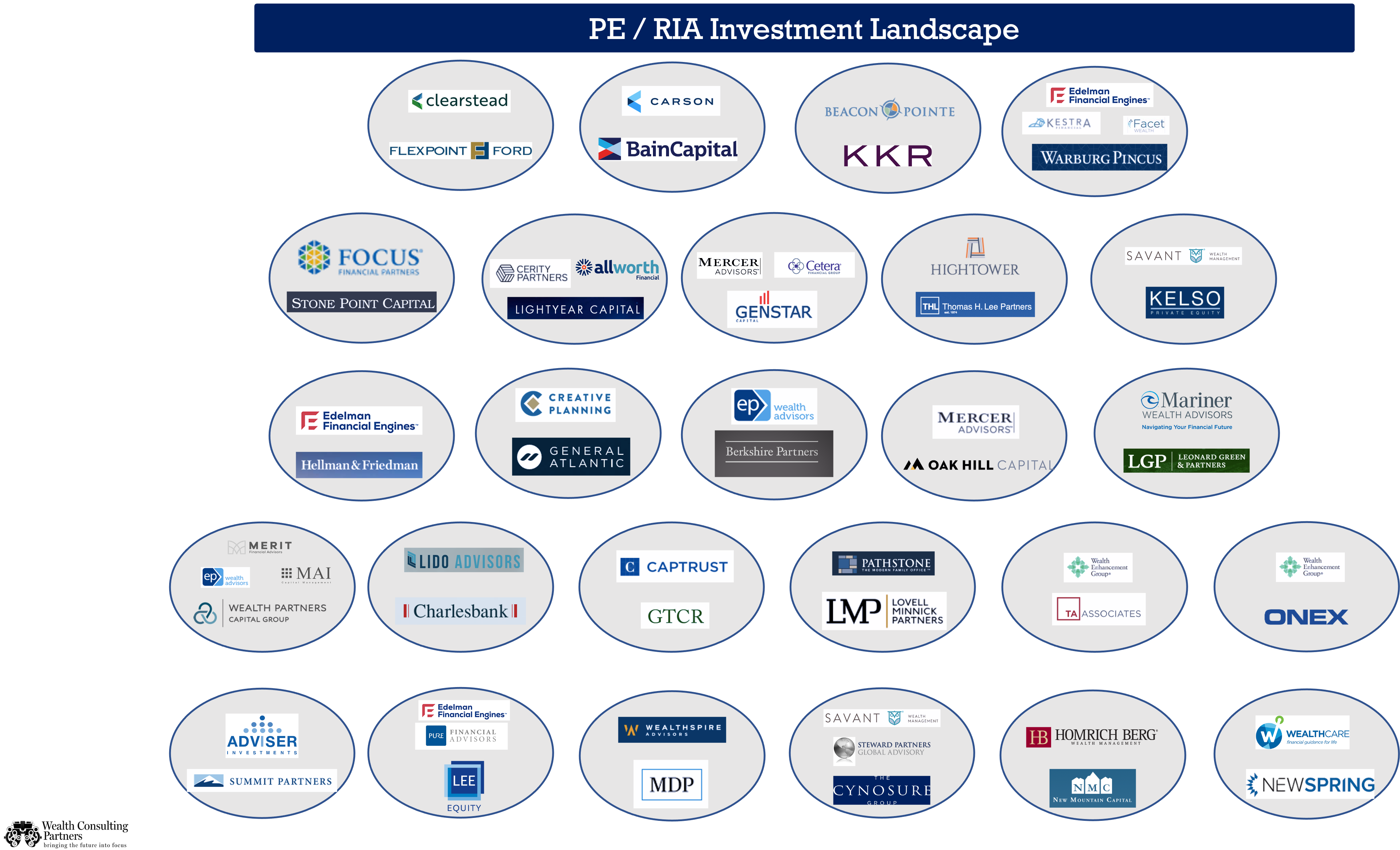

Private equity firms continue to be active investors in the RIA sector. We are investing 29 private equity firms in this space, which is double what we saw a year ago, said Gavin Spitzner, president of Wealth Consulting Partners.

But a recent study released by the University of Oregon links private equity ownership to advisory misconduct; It found that private equity-backed RIAs increased the percentage of misconduct of their advisors by 147% and that the average number of misconduct incidents following a change of ownership increased by 2000%. Those results were mostly driven by regulatory conduct and customer disputes, the study said.