How much do you need for down payment?

A reader asks:

I’m a 33 year old filmmaker in LA and have my own company, so no steady salary, but it’s safe to assume that I’ll be making anywhere from $40,000 to $150,000 (impossible to predict). I currently have $125,000 (70% inventory, 30% cash). Personal finances are in good shape (no kids, no debt). I’m currently renting and I have a roommate and it sucks. I aim to get a house in the Valley by mid 2023, preferably early. Most homes are around $650,000 – $850,000. I have two questions:

Do I need to put myself in a bigger cash position because I want to spend money soon-ish? What is a good ratio?

Should I wait until I have a substantial down payment or find the right place? Is it better to save for a nice big down payment as my annual income varies?

While going through this process most people have the impression that you need at least 20% discount while buying a home.

There are some benefits to having a 20% down payment.

There is less debt to take out. It gives you an equity cushion if the housing goes into the toilet for a while. And it saves you from paying private mortgage insurance (PMI) which can run you something like $75-$150/month depending on the size of your mortgage.

I get why many homeowners would want to reduce that 20% before buying.

But it is not a condition.

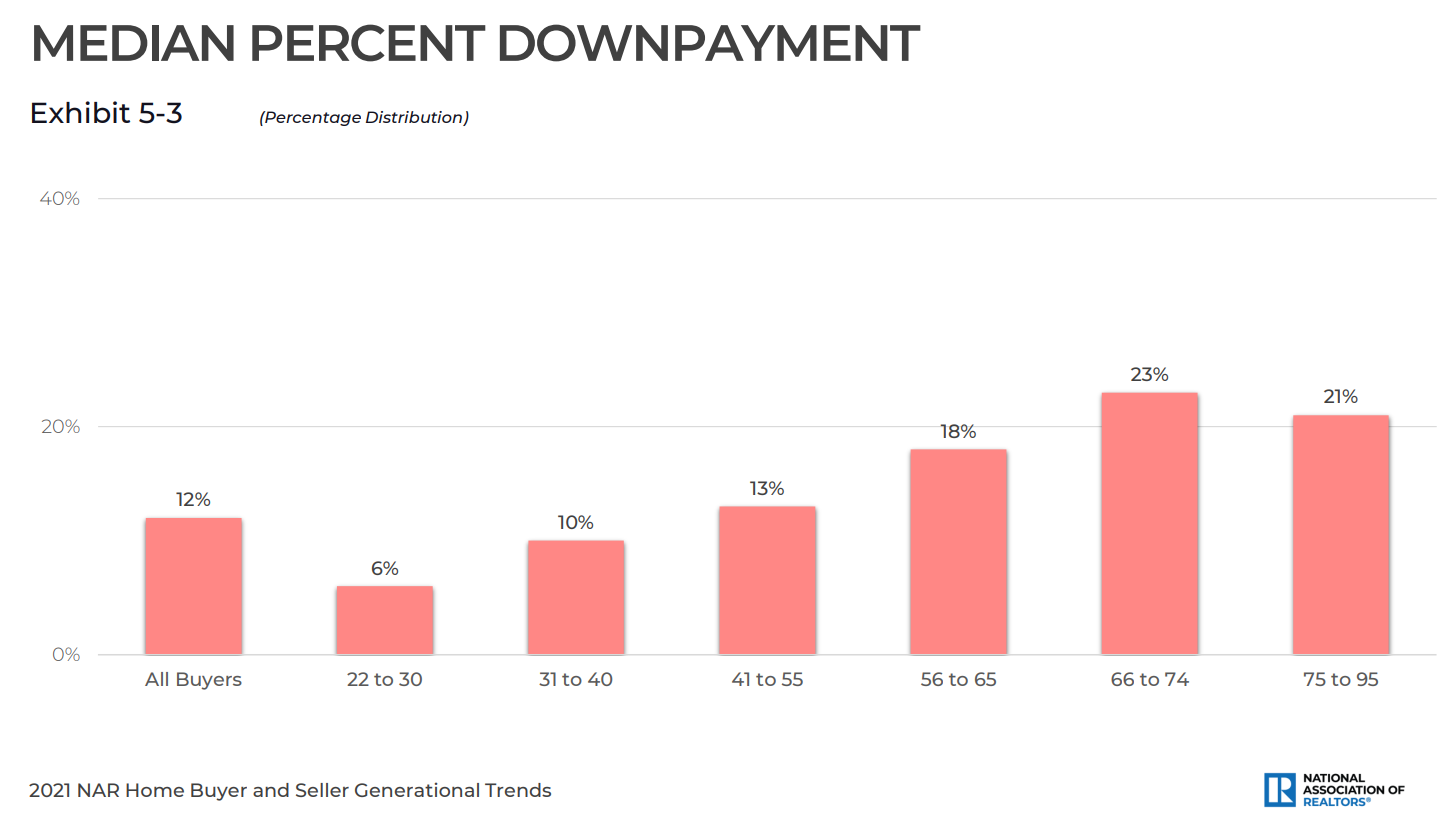

According to a research report from the National Association of Realtors, this is what the average down payment number looks like overall and across different age groups:

The average down payment is 12% but you can see that it is much lower for people in their 20s (6%) and 30s (10%).

This makes sense when you consider that older people have more financial assets or equity in their existing homes, which is a larger down payment.

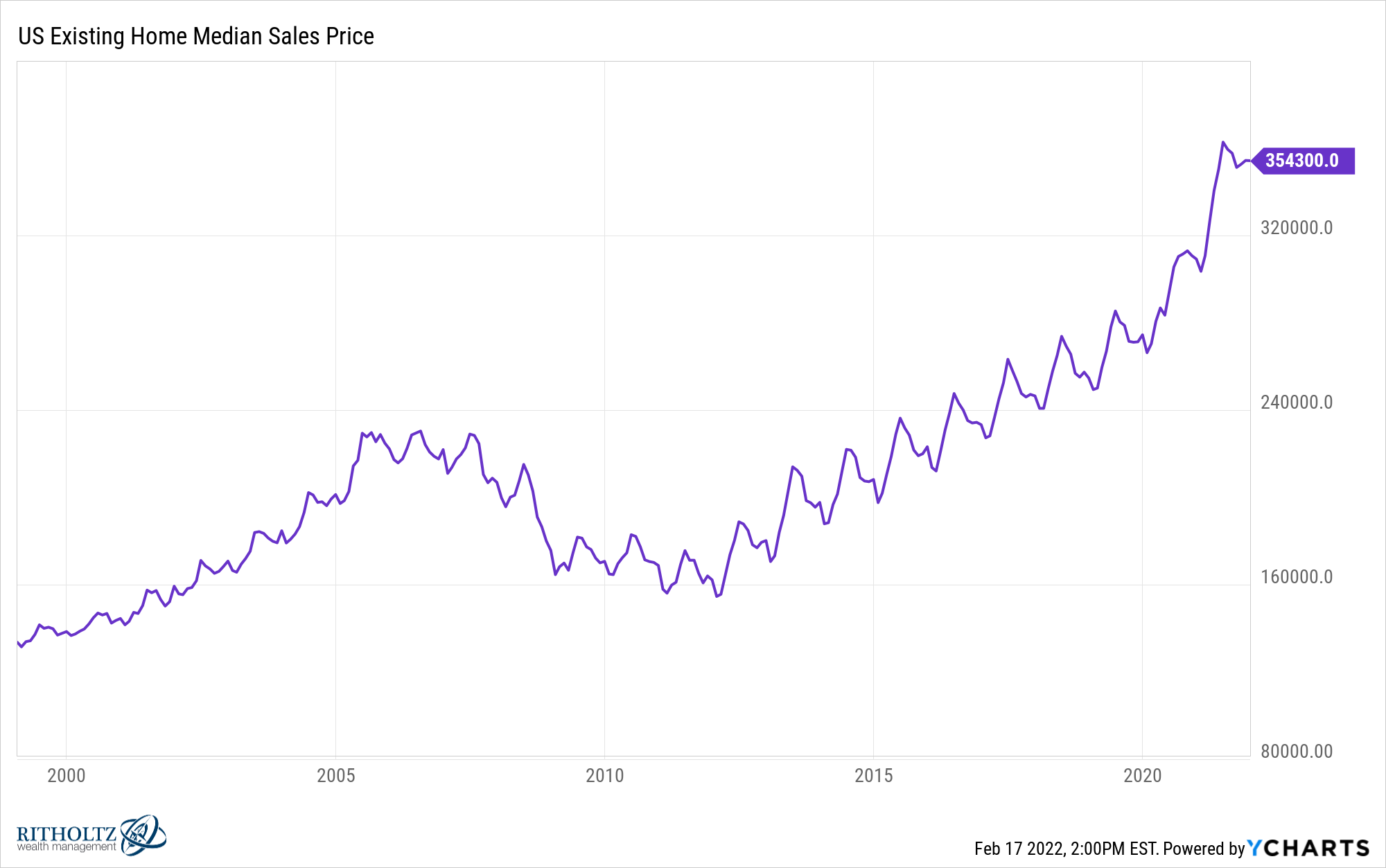

The median sale price for an existing home in the United States is now over $350,000:

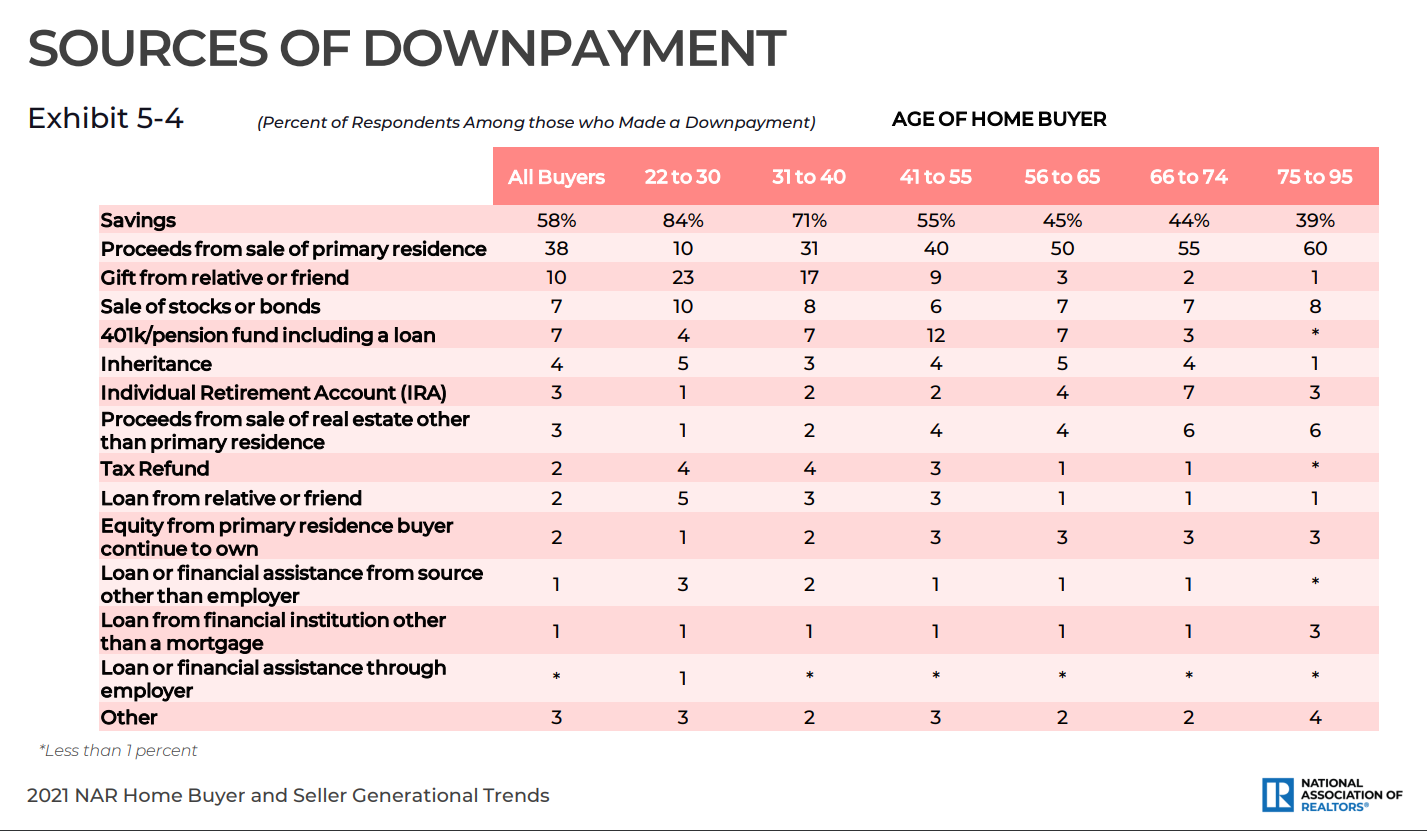

You can see that most of the down payment money for people in their 20s and 30s comes directly from savings:

Here are the down payment at various points for a $354,300 home:

- 5% – $17k

- 10% – $35k

- 15% – $53k

- 20% – $71k

If you saved for 5 years for a house at this price that’s about $1,200/month for a 20% down payment. Not everyone can save $1,200/month for 5 years for the luxury of buying a home.

A 20% down payment on a home in the $650k-$850k range is $130k-$170k.

The down payment we made on our first home was just 5%.

And it’s not like we were trying to use as much leverage. That was all we could afford at the time to be able to move into a house. It would have taken us years to come up with 20%.

There are options for young people who don’t want to live on ramen noodles every night so they can save up for the down payment.

An FHA loan only requires payments as low as 3.5%.

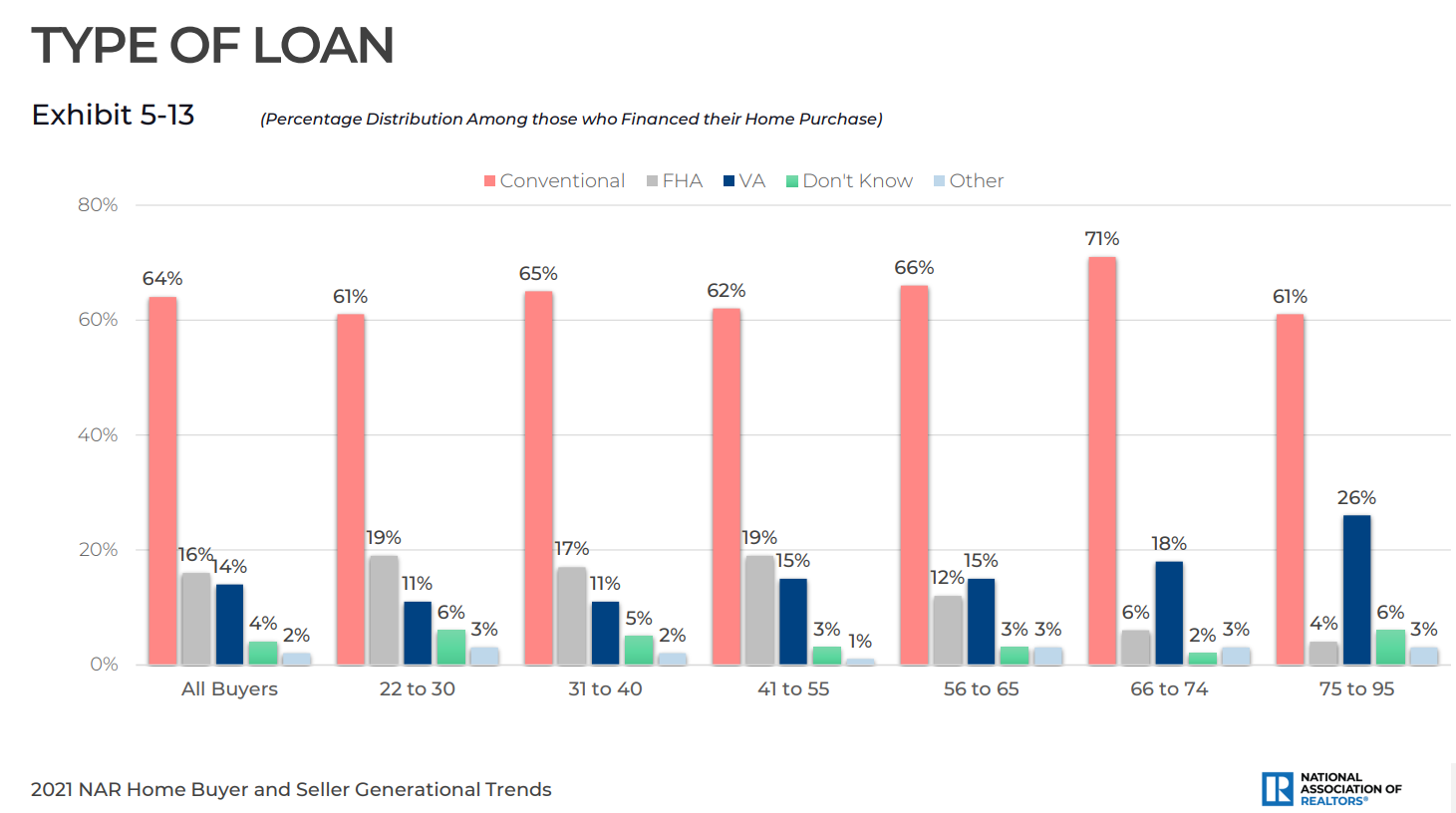

Now some people scoff at this number and say that FHA loans are rare. They are certainly not the most prevalent loans. Here is the analysis by loan type:

It seems that 1 in 5 homebuyers in their 20s and 30s are able to secure one of these. It would be nice if that number was higher but it’s not out of the question.

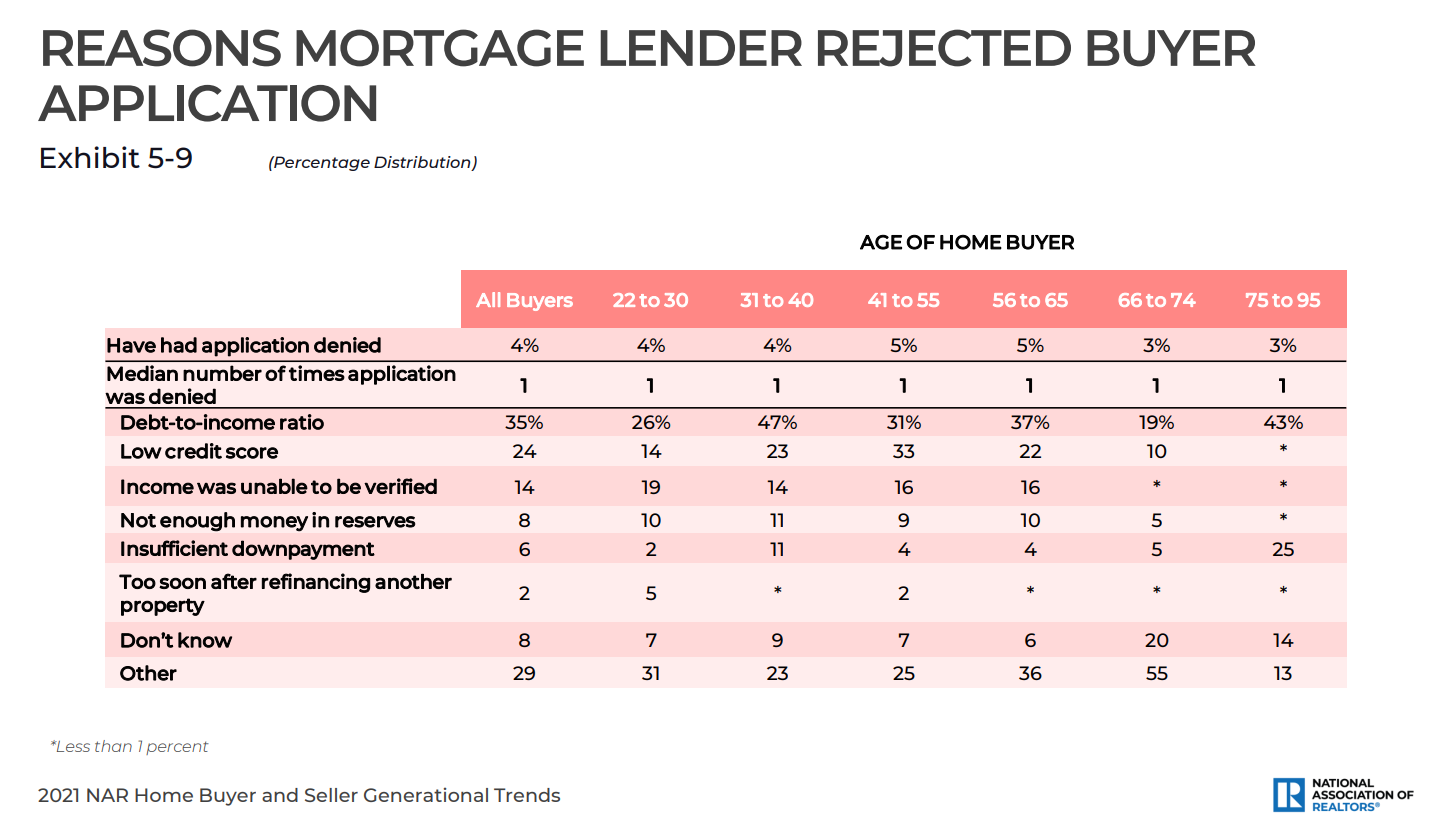

This question probably depends on the lender you choose and Your credit score and financial status. The NAR has a list of reasons people get rejected on a mortgage application:

It is actually very rare that an application is denied but the number one reason is a poor debt-to-income ratio.

This is good news for the reader asking this question. There is no debt on them. The variable income component may come up in the application process but so I would suggest shopping around for several different lenders.

The internet makes it very easy to compare rates, fees and the like. Apart from banks, you can also look for credit unions and online lending platforms.

Here’s what I would do in this situation:

Shop around for a lender. See what type of down payment they are looking for. See how much money they are willing to lend you. See what type of mortgage you are pre-approved for.

And if your variable income is a problem, at least you know you’ll probably need a bigger down payment.

Find a payment you can handle based on some down payment. The down payment is important to get started but the only thing that really matters is your ability to meet the monthly payments, taxes, insurance and maintenance involved in homeownership.

Start looking for homes. This process can take longer than you’d expect, especially with supplies so short these days. I would worry more about finding a home than reaching some mythical down payment goal.

You can always pay off your mortgage early if you go below the 20% down payment limit to get out of PMI payments.

The thing I wouldn’t do is try to time the housing market by waiting for a price drop or recession or some other macro event.

Buy a house because you like it, you can buy it, you can pay off the debt and you want to live in it for many years.

We talked about this question on this week’s Portfolio Hedge:

I had too blair duquesne Back to answer some questions about 529 plans and employee stock options.

And if you’d prefer to listen to this episode in podcast form, watch it here:

Further reading:

What should a first time home buyer do now?