there is no defense for everything

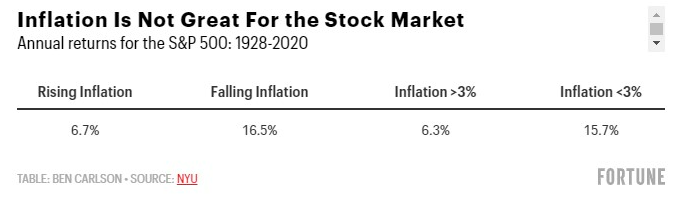

The S&P 500 returned 5.9% per year in the 1970s. The problem is that inflation was 7.1% per year so the real return was negative.

That means inflation must be bad for the stock market, right?

Well into the 1980s inflation averaged 5.5% a year, but the stock market was up 17.3% on an annualized basis, about 12% higher after adjusting for higher prices.

What about low inflation?

Inflation averaged 1.8% per year in the 2010s and the stock returned 13.4% on an annualized basis.

Although inflation was 2.6% per year in the 2000s, the S&P 500 experienced a lost decade, falling nominally at 1% per year.

The stock market is a wonderful long-term hedge against inflation but sometimes it doesn’t work so well in the short term:

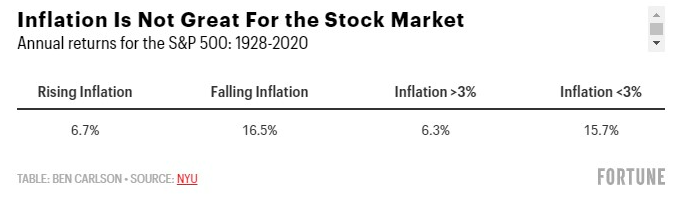

Treasury bonds1 Stocks are a great hedge against market downturns. This is below each year for the US stock market since 1928 as well as the corresponding return for the 10-year Treasury:

The average loss in a down year for the stock market is -13.3%. The average return for Leap over the same years is +5.1%, which is enough for an average outperformance of around 19%.

Unfortunately bonds are not a great hedge against high inflation in the long run.

Inflation averaged 4.3% per year from 1950–1981. The nominal annual return for 10-year Treasuries during that stretch was +2.8%. So accounting for inflation, bond investors lost more than 37% of their investments on a real basis.

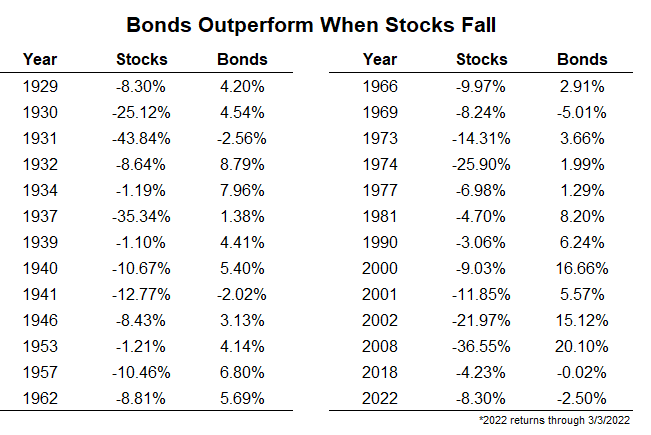

Gold was a major hedge against inflation in the 1970s, rising by over 1,300% or 31% per year. Even after accounting for 7% annual inflation, gold was up more than 23% per year.

So gold must be a wonderful inflation hedge, right?

Since the start of 2020, we have achieved the highest inflation rate in four decades and gold is flat.

Because of inflation, a dollar in 1980 would be worth 44 cents by 1999. Gold was down 43% in this two-decade period. In fact, gold is still below its 1980 high when adjusted for inflation:

Even after accounting for inflation, the S&P 500 is up more than 3500% since 1980.

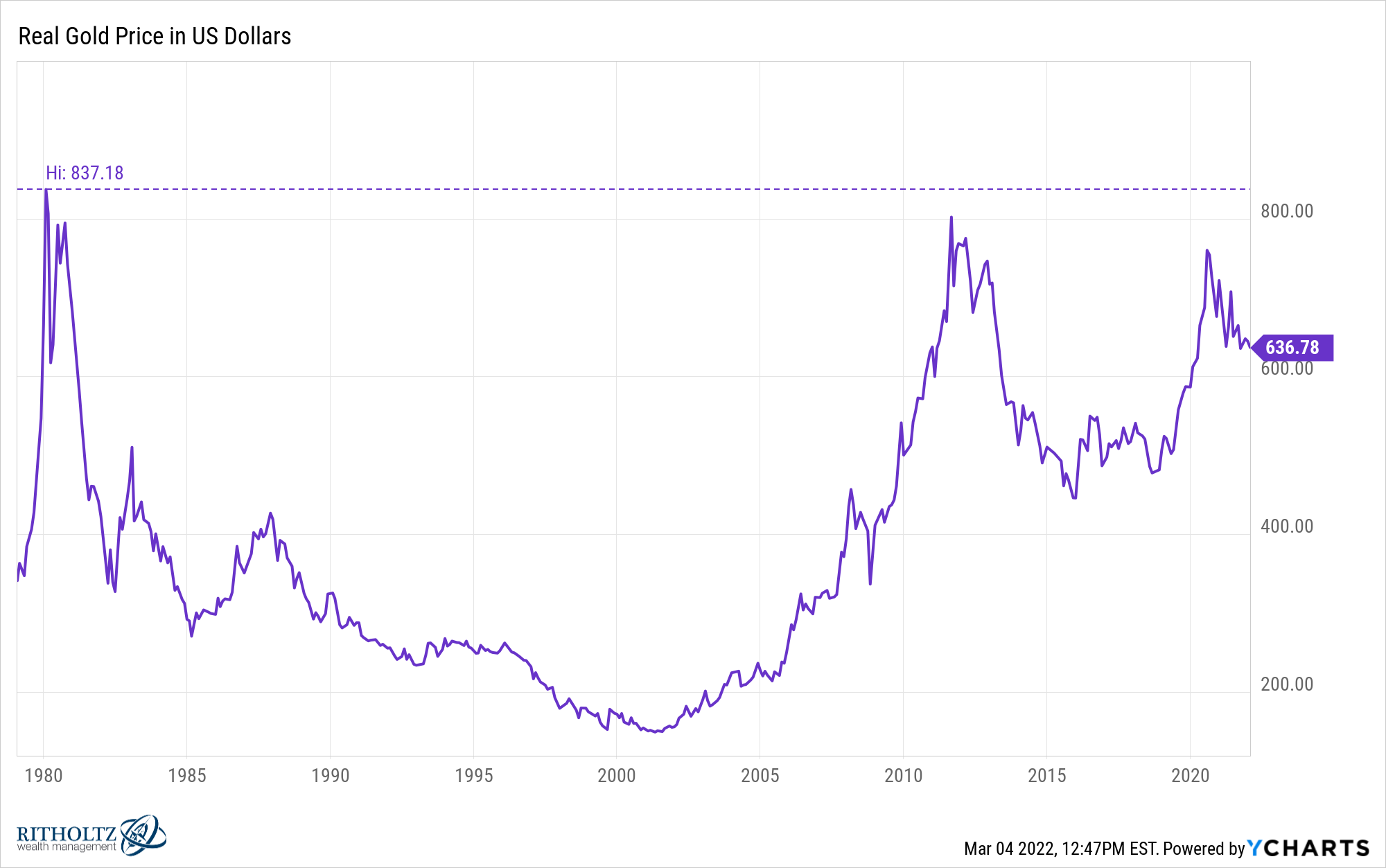

So gold can’t keep up with the stock market?

Indeed, since the Gold ETF (GLD) was launched in late 2004, it has more or less worked well with the stock market in mind. These are the annual returns since the inception of GLD:

not bad.

Some think bitcoin is the newest addition to the inflation hedge. It is currently in the midst of a decline of 40% from an all-time high despite inflation at 7.5% in the latest reading.

Now you can quibble with some statistics here. You can win any argument about the markets by simply changing the start and end dates.

And the markets are looking forward.

The issue here is that there is no absolute property. Nothing protects you against every single risk at all times.

Investing involves uncertainty.

You cannot predict how certain investments will react to every situation.

Investing involves risk.

You cannot protect your portfolio from every risk.

Investing also involves trade-offs.

You can’t have it all.

There is no hedge that works for inflation, deflation, up market, down market, rising rates, falling rates, peace, war, recession, expansion and everything else.

The good news is that once you realize that there is no perfect asset, you can begin to build a portfolio that takes into account the fact that nothing works in the markets forever and ever. .

Michael and I talked about defending against inflation, geopolitical events, and more on this week’s Animal Spirits video:

Subscribe to Compound so you never miss an episode.

Further reading:

Diversification is not undefeated, but it never ends

Now here’s what I’ve been reading lately:

1I am using the S&P 500 and 10-year Treasuries here.