‘Great retirement’ puzzles US economists

(Bloomberg) — The pandemic forced millions of older Americans out of the labor force. It should have sparked a boom in Social Security benefit applications — but it didn’t. Maybe because he hasn’t retired.

The disconnect has left economists wondering how many of these baby boomers may return to the workforce — a key question when job openings have remained near record levels for months.

Here’s a look at the data and the debate over it:

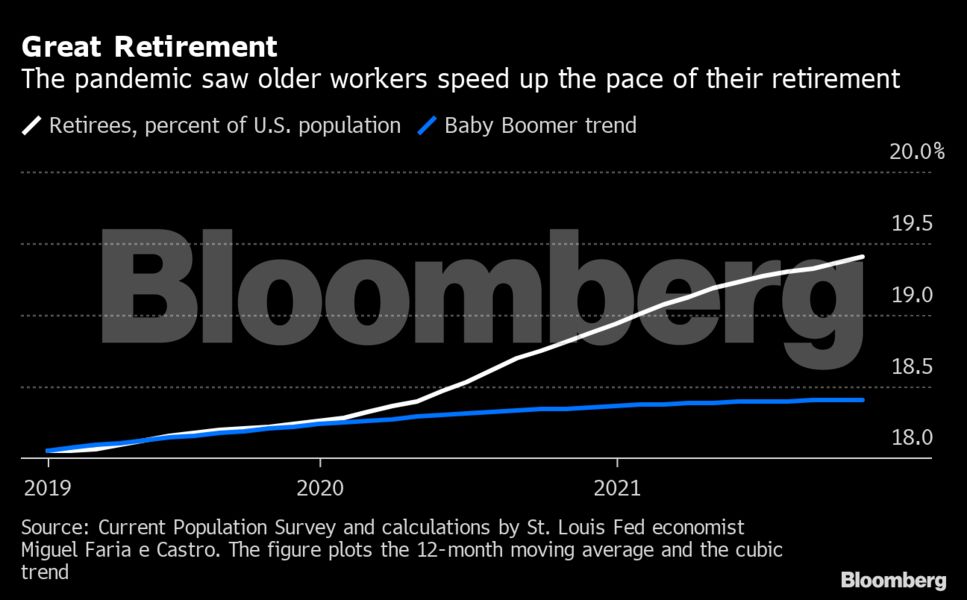

According to a Federal Reserve analysis, the retired share of the population is now much higher than it was before Covid-19. About 2.6 million older workers retired above normal trends since the start of the pandemic two years ago, based on estimates by Miguel Faria e Castro, an economist at the Federal Reserve Bank of St. Louis.

Under America’s federal retirement program, eligible workers receive a percentage of their pre-retirement income in monthly payments from the government. Workers can begin receiving Social Security payments as early as age 62, with full benefits at age 66 or 67, depending on their date of birth.

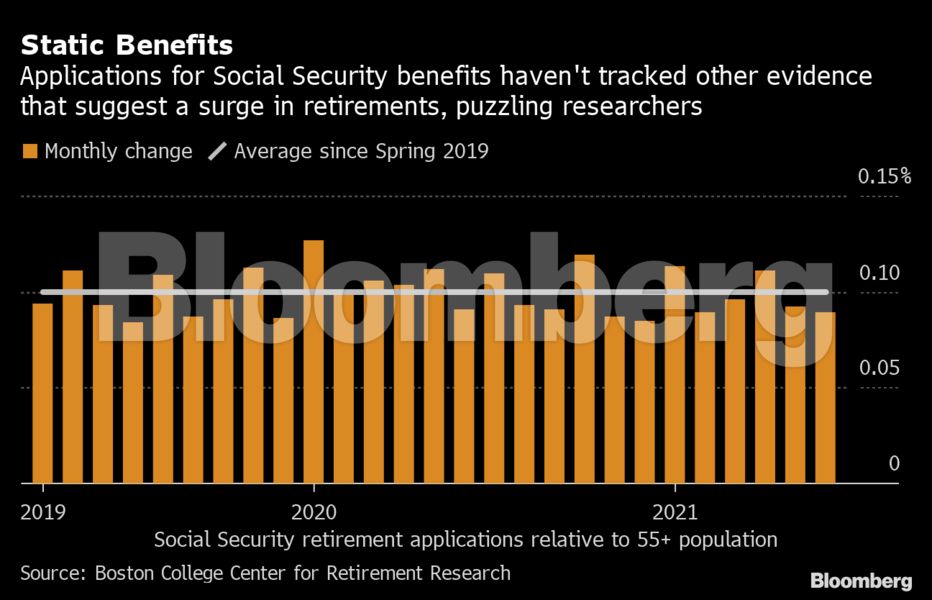

Based on calculations by the Boston College Center for Retirement Research, surveys of baby boomers who said they retired, applications for Social Security benefits, have been fairly flat. About 0.1% of the US population 55 and older applied each month, which is in line with what was happening before the pandemic.

The lack of Social Security filings is a mystery to Laura Quinby, a senior research economist at the Center for Retirement Research. Older Americans often feel the need to apply for benefits in person, so the closure of the Social Security Administration’s local offices during the pandemic may prevent some people from applying.

Others may be waiting to reach their late 60s to be eligible for full benefits, Quinby said. Thanks to the Covid-era boom in stock and real estate prices, individuals who own assets and have savings may delay applying.

Lowell R., a data scientist at the Institute for Economic Equity at the St. Louis Fed. The increase in wealth made it “an opportune time for some workers to move out of the labor force and stay out of the labor force,” Ricketts said.

“But we’re still expecting a steady, steady trend that some might want to come back,” he said, especially with the advent of remote and hybrid work, which could drive seniors back into the job market.

Unlike other developed countries, since retirement is not a permanent change in the US before Covid, it was not uncommon that Americans would “un-retire” from financial hardship or personal choice. It is too early to tell whether the pandemic has changed that enduring dynamic.

The Social Security Administration’s Office of Chief Actuaries suggests that older people can “retire” from one job and continue to work in another. This would explain why they are not applying for benefits.

And people younger than 62 wouldn’t qualify for Social Security anyway. Among them is 61-year-old Hope Cabot, who left her teaching job in Roswell, Georgia, in December. The stress of caring for and teaching a single mother caused her to retire sooner than she expected. She plans to become a substitute teacher to keep busy and bring in some extra cash to help keep inflation down, she said.

“During the pandemic, it was crazy,” she said. “I wasn’t planning on retiring until the end of this year or the end of next year.”

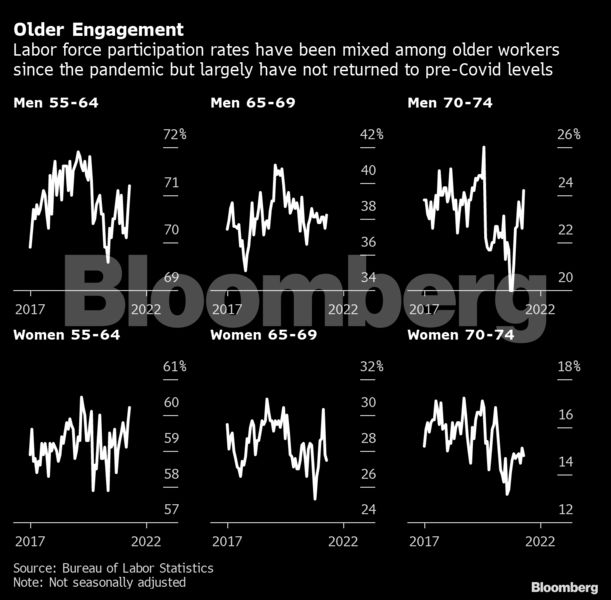

So far, Bureau of Labor Statistics data on labor participation shows that some baby boomers are back, while many have remained.

It is possible that COVID-19 has done a reckoning for a generation that has reached retirement age when a global pandemic disproportionately hit their age group and put lives at risk as we knew it. This makes it even more difficult to predict when and if they might look for a job again.

“As is the case with younger workers, who have seen opportunities to think about their lives differently, people in this demographic are thinking, ‘What do I really want to do with my life,'” said Doug Dixon. Said, who chairs Encore Boston Network, which helps older workers find jobs or volunteer opportunities. “Are they really retired or are they just defaulting to that language because that’s the easiest way to portray it?”

read this furtherFrom great resignations to lying flats, workers are kicking out

To contact the authors of this story:

Michael Sasso in Atlanta [email protected]

Alexandre Tanzi in Washington [email protected]