Getting After Tax Alpha and High Tax Returns on Your Investments

What is Tax Alpha?

Tax alpha is the ability to generate additional returns on your investments by taking advantage of a wide range of tax strategies as part of your comprehensive wealth management and financial planning. As you know, it is not about how much you earn but how much you keep. And Tax Alpha measures the efficiency of your tax strategy and the incremental gains in your after-tax return.

withdrawal calculator

Why is Tax Alpha important to you?

The US has one of the most complex tax systems in the world. Navigating through all the tax rules and changes can quickly turn into a full-time job. In addition, the US budget deficit is growing exponentially every year. Government spending is increasing. The only way to bridge the budget gap is to increase taxes for both corporations and individuals.

Obviously, our taxes pay our teachers, police officers and firefighters, fund essential services, build new schools and fix our infrastructure. Our taxes help keep the world around us humming. However, at times tax will become a hindrance in your decision making process. Taxes turn into a complex web of rules that are difficult to understand and difficult to enforce.

Achieving tax alpha is important whether you are a novice or an experienced investor who is sitting on significant investment gains. Making wise and well-informed decisions can help you improve the after-tax returns of your investments in the long run.

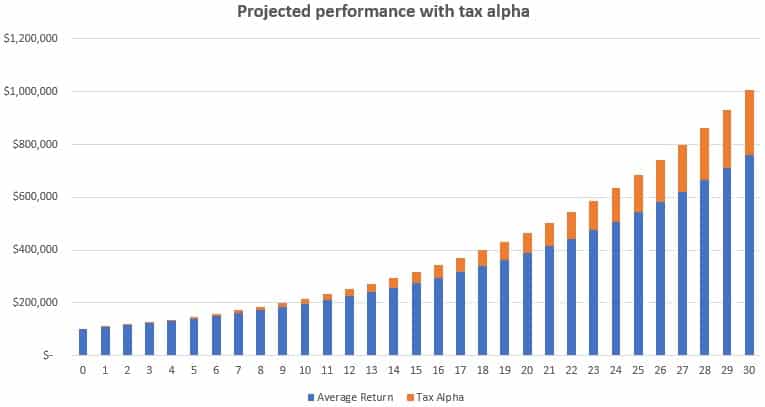

Assuming that you can generate 1% in additional annual after-tax returns in 30 years, your desire investment could increase to 32% in total dollar amount.

1. Overall Financial Planning

For our firm, obtaining tax alpha is a process that starts from day 1. Smart tax decision making is at the core of our service. Preparing you for your big day is no race. This is a marathon. It takes years of careful planning and patience. There will be uncertainty. Maybe the tax laws can change. Your circumstances may evolve. Be that as it may, it is important to be purposeful, disciplined and proactive in preparing for various results.

At our firm, we devise a comprehensive strategy that will maximize your financial results and minimize your taxes in the long run. We start with taking a complete picture of financial life and offer a road map for optimizing your tax result. Achieving a higher tax alpha only works in conjunction with your overall financial plan. Whether you’re planning for your retirement, owning a large number of stock options, or hoping for a small windfall, planning your future taxes is the quintessence of your financial success.

2. Tax Loss Harvesting

Tax-loss harvesting is an investment strategy that allows you to sell assets that decline in value to offset current or future gains from other sources. You can then replace this asset with a similar but similar investment to position yourself for future value recovery. In addition, you can use a capital loss of up to $3,000 as a tax deduction on your ordinary income. Finally, you can carry forward any remaining losses to future tax years.

The real economic value of tax-loss harvesting lies in your ability to defer taxes in the future. You can think of tax-loss harvesting by the government as an interest-free loan, which you will pay only after realizing the capital gains. Therefore, the ability to generate long-term compounded returns on the TLH strategy may appeal to disciplined long-term investors with low to moderate trading practices.

How does Tax-Loss Harvesting work?

Example: An investor owns 1,000 shares of Company ABC, which he purchased for $50 in his taxable account. The total cost of the purchase was $50,000. During a market sell-off a few months later, the stock drops to $40, and the initial investment is now worth $40,000.

Now the investor has two options. She may hold the stock and expect the price to rise again. Alternatively, she could sell the stock and realize a loss of $10,000. After the sale, he will have two options. She can either buy another stock with a similar risk profile or wait 30 days and repurchase ABC stock with the proceeds. By selling ABC’s shares, the investor would realize a capital loss of $10,000. Assuming that she is paying a 15% tax on the capital gains, the loss’s tax benefit equals $1,500. In addition, she can use losses in her investment portfolio or other sources to offset future gains.

3.Direct Indexing

Direct indexing is a type of index investment. It combines the concepts of passive investing and tax-loss harvesting. The strategy relies on the purchase of a custom investment portfolio that reflects the composition of an index.

Similar to buying an index fund or ETF, direct indexing requires purchasing a broad basket of individual stocks that closely track the underlying index. For example, if you want to build a portfolio that tracks the S&P 500, you can buy all or a small number of 500 stocks within the benchmark.

Owning a basket of individual securities gives you more flexibility to customize your portfolio. First, you can take advantage of tax-loss harvesting opportunities by replacing stocks that are declining in value with other companies in the same category. Second, you can remove unwanted stocks or sectors that you might not otherwise be able to do when buying an index fund or ETF. Third, direct indexing allows you to diversify your existing portfolio and avoid capital gains, especially if you have significant holdings on a low-cost basis.

4. Rent Tax

Tax placement is a strategy that positions your diversified investment portfolio according to the risk and tax profile of each investment. In the US, we have a wide range of investment and retirement accounts with different tax treatments. Individual investment accounts are fully taxable for capital gains and dividends. Employer 401k, SEP IRA and Traditional IRA are tax-deferred savings vehicles. Your contributions are tax-deductible while your savings are tax-free. You only pay taxes on your actual retirement withdrawals. Lastly, Roth IRAs, Roth 401k, and 529s require pre-tax contributions, but all of your future earnings grow tax-free. Most of our customers will have at least two or more of these different instrument vehicles.

Now, enter stocks, bonds, commodities, REITs, cryptocurrencies, hedge funds, private investments, stock options, and more. Each investment type has a different tax profile and a unique level of risk.

At our firm, we create a customized asset allocation for each client based on their circumstances and goals. Taking into account the tax implications of each asset in each investment or retirement account, we carefully tailor our tax location strategy to take advantage of any opportunity to achieve tax alpha.

5. Smart Tax Investing

Smart Tax Investing is a personalized investment strategy that combines various portfolio management techniques such as tax-loss harvesting, asset allocation and asset location, diversification, dollar-cost averaging, passive versus passive. Active investing, and rebalancing. The main focus of Tax Mindful Investing is to generate high post-tax returns on your investment portfolio. Along with your comprehensive financial planning, smart-tax investing can be a powerful tool to enhance your financial results.

- Tax Brackets for 2022 – January 12, 2022

- 401k Contribution Limit 2022 – January 8, 2022

- Roth IRA Contribution Limit 2022 – January 8, 2022

- Choosing Between RSUs and Stock Options in Your Job Offering – November 2, 2021

- Getting After Tax Alpha and Higher on Your Investments – June 11, 2021

- 5 reasons to leave your robo-advisor and work with a real person – May 1, 2021

- Step by Step Guide to Planning Initial Stock Option Exercises – January 29, 2021

- Effective Roth Conversion Strategies for Tax-Free Growth – June 23, 2020

- 5 smart 401k moves to make in 2021 – August 4, 2021

- tax saving ideas for 2021 – September 16, 2021

View All Posts