Commodity ETFs Shine to Start 2022

Commodity ETFs have provided a safe haven for investors so far in 2022. During a record-setting year of net inflows in 2021, ETFs that are directly or in future contracts tied to the price of precious metals, energy, agriculture, or a diversified basket. Commodities fell out with investors in favor of equities or fixed income products. However, with increased inflation concerns, a spectrum of rising interest rates, and heightened geopolitical concerns, commodity-focused funds have remained in vogue in 2022.

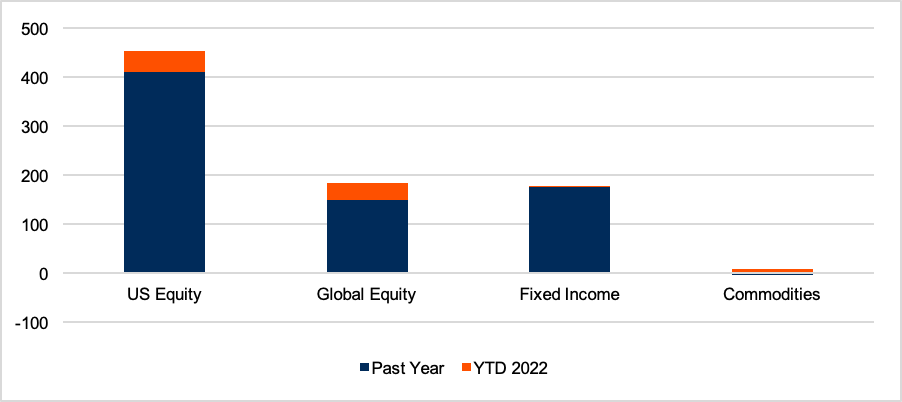

Year-to-date October 25 through February, commodity ETFs collected $8.5 billion in net ETF inflows, equivalent to about 10% of the industry’s total cash and eroding prior outflows in the previous year. Over the same period, fixed income ETFs only pulled in $1.3 trillion of new money. Thus far in 2022, US equity and global equity ETFs achieved net inflows of $42 billion and $35 billion, respectively, led by broad market products frequently used for asset allocation strategies.

Figure 1: ETF Asset Class Focused Net Inflows ($B)

Source: CFRA’s ETF Database. by February 25, 2022

Precious metals ETFs shined the most but weren’t alone. ETFs investing in gold and other metals have raised $4.8 billion since February. 25, led by $3.1 billion SPDR Gold Share Trust (GLD), which remains the largest commodity ETF with assets of $62 billion. However, Companion Gold ETFs iShares Gold Trust (IAU), iShares Gold Trust Micro (IAUM) And Goldman Sachs Physical Gold ETF (AAAU)More iShares Silver Trust (SLV), were among the commodity ETFs that pulled in more than $200 million of fresh money to start the year. The AAAU, IAU, and IAUM carry lower expense ratios than the GLD, although they have a higher average daily volume.

Investors took a broader approach to gaining commodity exposure by putting $3.6 billion in diversified commodity ETFs. For example, INevesco Optimum Yield Diversified Commodity Strategy Number K-1 ETF ,PDBC) collected $1.7 billion in net inflows at the start of the year, second only to GLD among commodity ETFs. PDBC holds futures contracts on 14 commodities in the energy, precious metals, industrial metals and agricultural sectors, such as aluminum, corn, gold, wheat and WTI crude. Diversified Commodity ETF Peers First Trust Global Tactical Commodity Strategy Fund (FTGC) And meEnvesco DB Commodity Index Tracking Fund (DBC) Raised an additional $1.2 billion this year.

Meanwhile, investors pulled out of gold miner ETFs in 2022, but favored energy-focused equity funds. VanEck offers two popular ETFs that invest in precious metals companies such as Barrick Gold, Evolution Mining Ltd. and Newmont Corp., which benefit from higher commodity prices. Still in 2022 VanEck Gold Miners ETF (GDX) And VanEck Junior Gold Miners ETF (GDXJ) Combined net outflows of $375 million and $60 million, respectively.

opposite of this, Energy Select Sector SPDR Fund (XLE)Large-cap owners such as Chevron and Exxon Mobil, which will benefit from higher energy prices, have received $1.9 billion in new money this year.

Conclusion

Demand for commodity-focused ETFs is back in 2022 as such funds largely fell out of favor in 2021. While higher commodity prices can be a catalyst for some equity ETFs, we encourage investors to understand the risk and reward of the stocks inside before investing. to work.

Todd Rosenbluth is the Director of ETFs and Mutual Fund Research at CFRA. Learn more about CFRA’s ETF research here,