Inflation is a tax, best strategies to combat inflation and grow your wealth

Inflation is a tax. Let me explain Inflation reduces the purchasing power of your cash and earnings while at the same time redistributing money to the federal government.

For example, when prices go up, we pay more sales tax at the grocery store, restaurant or gas station. Another example, even if your employer adjusts your salary with inflation, IRS tax brackets may not increase at the same pace. Several important tax limits are not adjusted for inflation.

For example, the SALT deduction remains at $10,000.

We have a limit of $750,000 on total mortgage debt for which interest is tax-deductible. There is a $500,000 limit on tax-exempt home sales. We also have a $3,000 deduction of net capital losses against ordinary income such as wages.

The income limits, at which 85% of Social Security payments become taxable, are not inflation-adjusted and have been $44,000 for joint filing couples and $34,000 for single filers since 1994.

And finally, even if interest rates on your savings account go up, you still have to pay taxes on your marginal interest income.

Effectively we would all be paying more tax on our future income

Here are some strategies that can help you fight inflation.

(no) keeping cash

Inflation is a tax on your cash. Keeping large amounts of cash is the worst way to protect yourself from inflation. Inflation hurts savers. Your money automatically loses purchasing power as inflation rises. Roughly speaking, if this year’s inflation is 8%, then $100 worth of goods and services will cost $108 a year from now. Therefore, someone who kept their cash in a checking account would need an additional $8 to buy the same goods and services that they could have bought a year ago for $100.

Here is another example. The value of $1,000 in 2000 is $1,647 in 2022. If you kept your money in your pocket or checking account, you can only buy $607 worth of goods and services for the equivalent of 2000 dollars.

investing in stocks

Investing in stocks is often considered a protection tool against inflation. Stock ownership presents a tangible claim on a company’s assets, which will increase in value with inflation. In an inflationary environment, stocks have a distinct advantage over bonds — companies that can adjust pricing — whereas bonds, and even rental properties, do not.

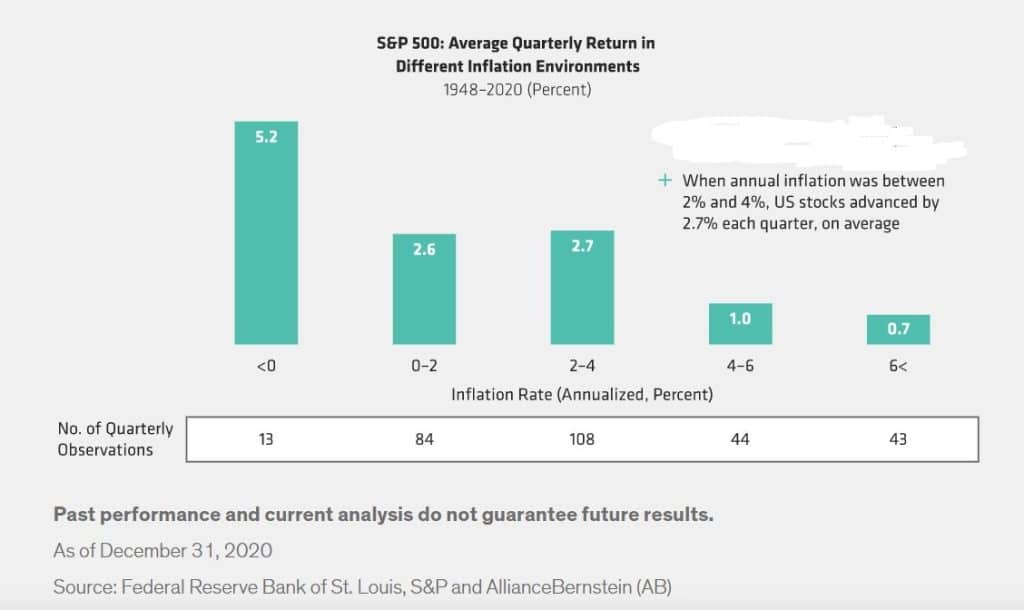

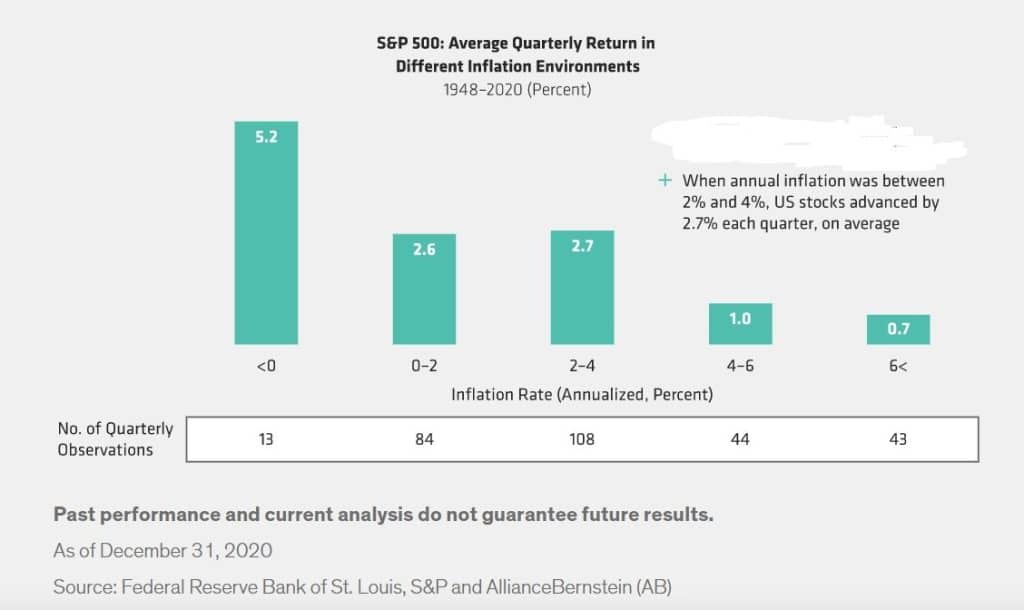

Historical data has shown that equities outperform with inflation rates below 0 and between 0 and 4%.

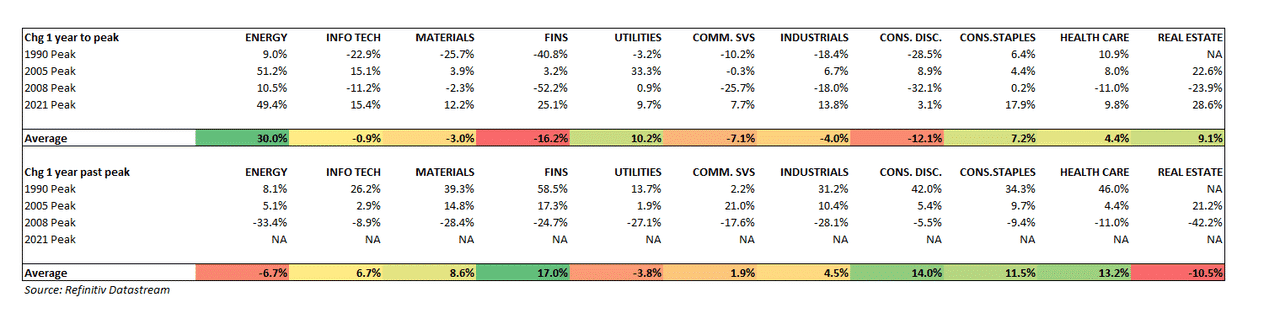

Historically, energy, staples, health care and utility companies have outperformed relatively during periods of high inflation, while consumer discretionary and financial companies have underperformed.

While it may seem tempting to think that specific sectors can withstand inflation better than others, the success rate will drop across individual companies’ business models. Firms with strong pricing power and unfettered product demand can pass on higher costs to their customers. In addition, companies with strong balance sheets, low debt, high profit margins and stable cash flows tend to perform better in an environment of high inflation.

You also need to remember that every financial system is different. Today we are less dependent on energy than in the 1970s. Corporate leadership is also different. Companies like Apple and Google have high cash flow margins, low debt and a small physical footprint. Technology plays a more important role in today’s economy than in the other four inflationary periods.

investing in real estate

Real estate often stands out as a popular inflation protection vehicle. However, historical data and research show Nobel laureate Robert Schiller shows otherwise.

“Traditionally housing is not a great investment. It takes maintenance, depreciates, and goes out of style”, says Schiller. On many occasions, it can be subject to climate risk – fire, tornadoes, floods, hurricanes, and even volcanic eruptions if you live on the big island. The price of a house can also be quite volatile. Just ask people who bought their homes before the housing bubble in 2007

Investors seeking inflation protection with real estate should consider their liquidity requirements. Real estate is not a liquid asset class. It takes longer to sell than a stock. Each transaction involves paying fees to banks, lawyers and real estate agents. Additionally, there are maintenance costs and property taxes. Rising inflation will lead to higher overhead and maintenance costs, potential renter delinquency, and higher vacancy.

invested in gold and other commodities

Commodities, and gold in particular, offer some short-term protection against inflation. However, it is a very volatile asset class. Gold’s volatility, measured by a 50-year standard deviation, is 27% higher than that of stocks and 3.5 times greater than 10-year treasury volatility. Other non-market-related events and speculative trading often affect short-term inflation protection benefits.

In addition, gold and other commodities are not readily available to retail investors in the form of ETFs, ETNs and futures. Buying genuine items can incur significant transaction and storage costs, making it almost prohibitive for individuals to physically own them.

The relationship between gold and inflation has weakened in recent years. Monetary policy expansion, benign economic growth and low and negative interest rates in Japan and the European Union have made gold less important to the global economy.

gang up Roth IRA

If higher inflation means higher taxes, there’s no better tool for lowering your future taxes than a Roth IRA. I’ve written a lot about why you need to set up a Roth IRA. A Roth IRA is a tax-free retirement savings account that allows you to create after-tax dollars. Investments in your Roth IRA grow tax-free, and all your earnings are tax-empty.

If you are a resident of California, highest possible tax rate you can pay

- 37% for federal income taxes

- 13.3% for state income taxes

- 2% for Social Security income tax for income up to $147,000 in 2022

- 35% for Medicare Tax

- 20% Long Term Capital Gains Tax

- 8% for your MAGI for net investment income tax (NIIT) exceeds $200,000 for singles and $250,000 for married filing jointly

Having a Roth IRA helps you reduce the tax noise on your earnings and improves the tax diversification of your investments.

Here’s how to increase your Roth contribution based on your individual circumstances:

- Roth IRA Contribution

- Backdoor Roth Contribution

- Roth 401k Contribution

- Mega-Back Door 401k Conversion

- your IRA. to Roth conversion

- Inflation is a tax and how to fight it – March 28, 2022

- Tax Brackets for 2022 – January 12, 2022

- 401k Contribution Limit 2022 – January 8, 2022

- Roth IRA Contribution Limit 2022 – January 8, 2022

- Choosing Between RSUs and Stock Options in Your Job Offering – November 2, 2021

- Getting After Tax Alpha and Higher on Your Investments – June 11, 2021

- 5 reasons to quit your robo-advisor and work with a real person – May 1, 2021

- Step-by-Step Guide to Planning for Initial Stock Option Exercises – January 29, 2021

- Effective Roth Conversion Strategies for Tax-Free Growth – June 23, 2020

- 5 smart 401k moves to make in 2021 – August 4, 2021

View All Posts