Biden’s billionaire tax will penalize long-term investors

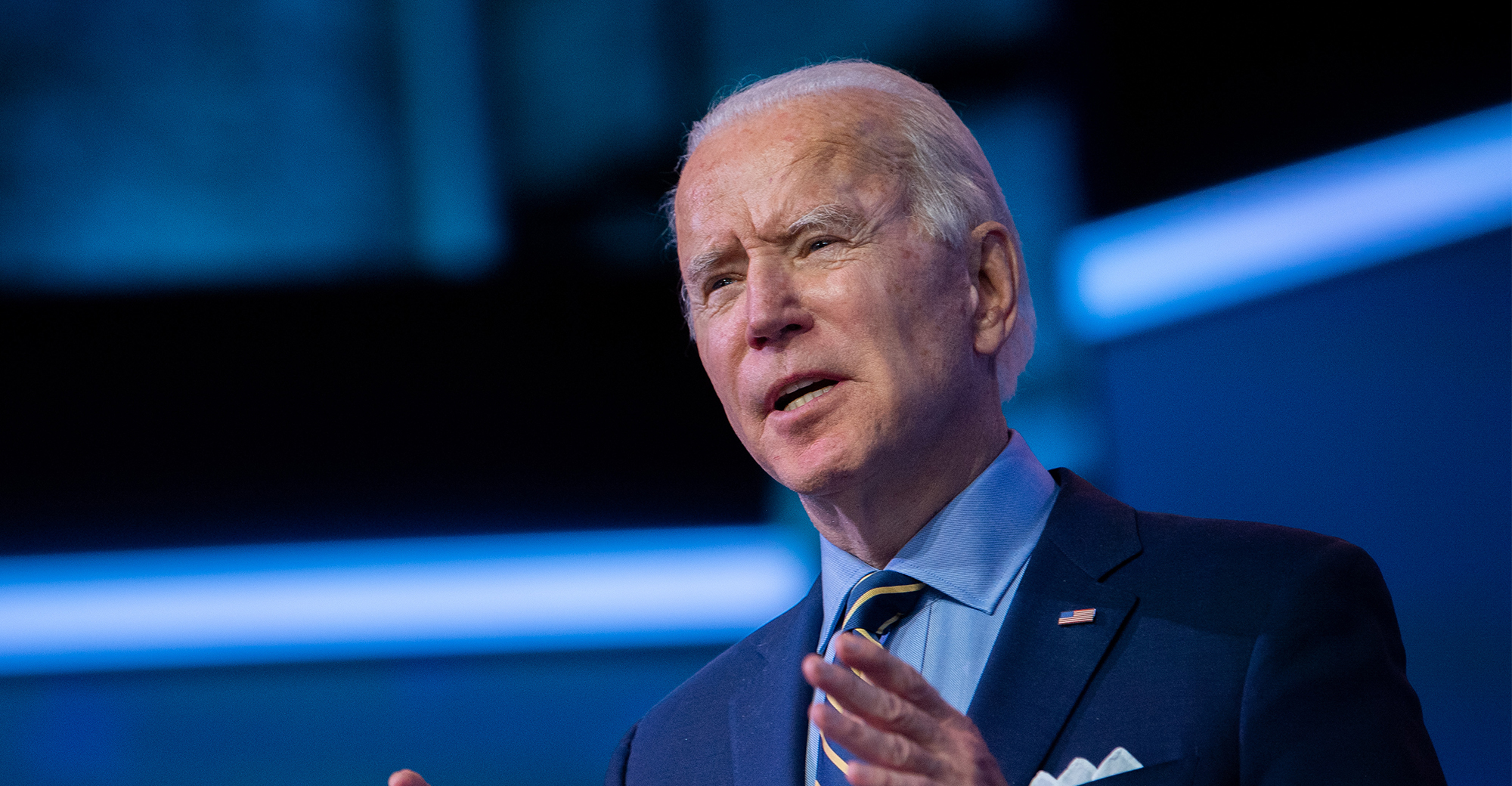

(Bloomberg Opinion) — In his upcoming budget, President Joe Biden proposed reviving the property tax, a concept popularized by his rivals in the Democratic presidential primary two years ago. The proposal – now called the “Billionaire Minimum Income Tax” – includes some improvements in the 2020 version. Yet, it remains a complex mess whose primary benefit can only be achieved by rectifying a loophole in the current tax code.

One of the main difficulties faced by initial wealth tax proposals is whether they are constitutional. The Constitution stipulates that any direct tax on citizens must be levied in such a way that each state pays the same amount per person, a difficult requirement that makes the levy of a property tax nearly impossible. However, the 16th Amendment made income tax legal. So, instead of levying a 2% tax on wealth each year, as Senator Elizabeth Warren envisioned, Biden’s plan would impose a one-time fee of 20% whenever an asset would increase in value.

This structure is similar to the familiar capital gains tax, with one important wrinkle: Taxes are owed regardless of whether the underlying asset has been sold.

The problem is that the taxpayer may not have enough cash to pay the tax. To mitigate this, the president’s proposal allows taxpayers to make payments over time — up to nine years from when the tax first goes into effect. An additional provision allows owners of illiquid assets to defer their payments for an even longer period, but with interest.

The question is also what will happen if the value of the property falls. Consider an early investor in the dot-com boom who saw his paper assets vanish as the market crashed. Will he have received credit for any outstanding tax in future?

This proposition puts even very long-term investors – the type who are inclined to ignore the ups and downs of the market – at a disadvantage. They may be forced to sell at the peak, but they may not have the means to buy back during a trough. So they necessarily focus more on the short term, at least towards realizing sufficient cash profit to cover their tax liability.

It’s not just technical. It goes to the heart of what a progressive tax system is trying to achieve. To the extent one puts his wealth in investments, instead of spending it, he is providing the economy with the tools and equipment needed to increase productivity and wages. This is exactly what the capitalist system should encourage.

The current system encourages this by not taxing investments; Instead, the more ostentatious their lifestyle, the more taxes the wealthy pay. The theory is that it is better to tax this largely unproductive consumption than to tax capital gains, even though they allow great wealth to be earned.

Biden’s proposal undoes that trade-off, but strangely enough. Even liberal economists acknowledge how punitive strict enforcement of the 20% tax on the most long-term investors would be. The only merit of this approach is that it would prevent the ultra-rich from completely avoiding capital gains taxes, as many people now hold their assets until they die.

At that point, their assets are subject to inheritance tax – but so are any cash benefits that have already been realized. The loophole for wealth tax is that if the heirs sell their inherited property immediately, they do not have to pay any capital gains tax. They pay capital gains only on the amount that has increased in the value of the asset because they have inherited it.

This feature, known as a step-up in basis provision, encourages heirs to liquidate their inheritance rather than invest in the economy. By eliminating this provision, Congress can reap most of the benefits of Biden’s proposal without further complicating the tax code and discouraging long-term investment strategies. This is the approach Congress should adopt.

Related to Bloomberg opinion:

To contact the author of this story:

Carl W. Smith et [email protected]