Goldman Sachs bets on trading prowess to lure RIA

Goldman Sachs has remained silent about the details of its custodial offer to registered investment advisors since acquiring Folio Financial’s clearing and custody technology in 2019. But the firm recently shared with. WealthManagement.com Some details about what is quietly building up, and how the firm is establishing itself out there among RIA patrons.

For one, it will not be the guardian of all types of advisors; Neither will it be the cheapest option, said Richard Lofgren, managing director and head of business development for RIA Custody in Central America, who joined in 2020 from Schwab Advisory Services. Instead, Goldman, with its broad exposure, is looking to serve high-net-worth and ultra-high-net-worth clients looking for bespoke investment products such as structured products and other options not readily available outside of firms like Goldman. will target a class of consultants. Teams and relationships with businesses and institutions. These clients have more complex portfolios, Lofgren said, and will look for unique opportunities.

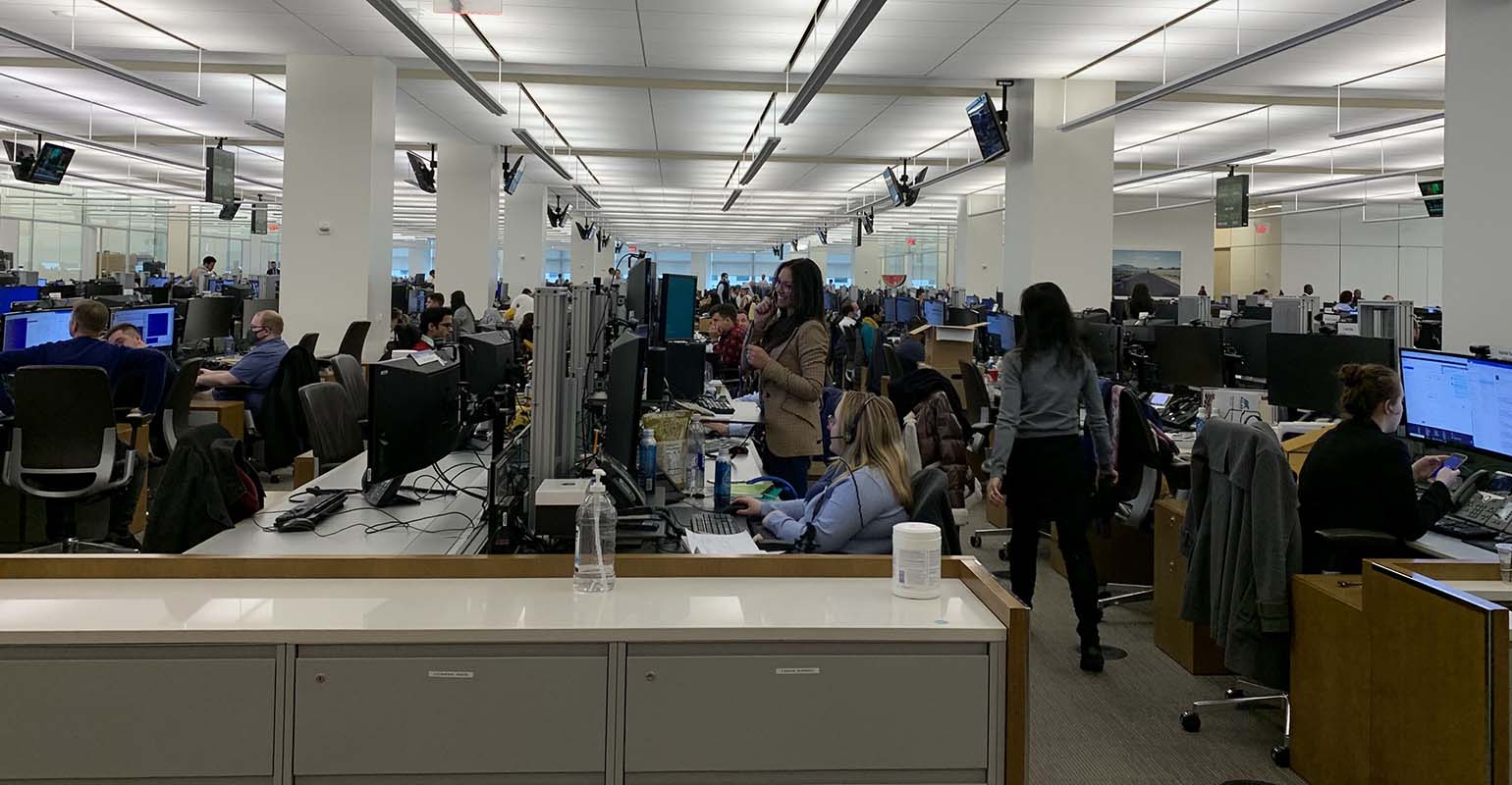

“My understanding is that we don’t want to be all things to all people, but we want to be everything to the right types of customers,” Lofgren said in an exclusive interview at their lower Manhattan offices. “It is an SEC-registered advisor covering high and ultra-high-net-worth clients that really expresses the need for those complex solutions around trading and execution and perhaps access to structured products and some alternatives. The investments that are out there. Those are the things that maybe someone with a high wallet might find attractive, priceless.”

Lofgren said the RIA’s custody unit is within Goldman Sachs’ global markets division, and that’s for good reason. The trading desk of the firm is powerful; Goldman provides execution and custody services to a number of large institutional investors, transacting on more than 97% of the world’s equity and derivatives exchanges. This capability will be available to its independent advisory clients.

On the platform, RIAs will have access to the trading desk, which sits on the fourth and fifth floors of Goldman’s New York headquarters, where they can receive assistance in liquidity events, concentrated equity positions and other complex positions.

,[Folks on the trading desk] Love the challenges of the math aspect of it, looking for how to build something that’s in demand, like solving a problem, need solving, an end customer,” Lofgren said. “And I think if we figure it out If you can figure out how to harness that for an independent consultant and bring it all together, it’s going to make it super unique.”

Goldman Sachs’ Richard Lofgren

He said Goldman will also bring other capabilities from the firm to its advisors, such as asset management, securities-backed lending and global research.

“If you think about places around the world, it doesn’t strike me that the sun never sets over the Goldman Empire,” Lofgren said.

They can leverage the firm’s investment banking capabilities for those RIAs considering a liquidity event or sale, or capabilities on the consumer funds side, including Marcus, its digital banking solution.

RIA will pay Goldman a platform fee, and will be given a choice between paying basis points on assets under management or a flat dollar amount. Lofgren declined to say how much the consultants would be charged; He added that the firm is not interested in a race to zero, and that costs related to its technology stack will be included in the fee.

Traditionally, most RIAs do not pay for custody services; Custodians make money in other ways, such as fees from asset managers paying for cash balances, order flow, transaction fees, and shelf space. But many of these revenue sources are drying up, coming under more scrutiny or seeing their margins shrink from competition and innovation. Some custodians have spoken of charging for custody. For example, in 2019, Mike Durbin, head of Fidelity Institutional, pointed out WealthManagement.com That a “insignificant minority” of advisors custodial with the brokerage firm already operates under a fee-based model.

the technology

According to Lofgren, the purchase of Folio Financial by Goldman was about acquiring both technology and technologists. It also brought the folio clearing and custody business under Goldman’s control.

Lofgren said Folio’s forward-looking fractional share technology and digital account opening capabilities were particularly attractive to Goldman. An unknown number of RIA clients are currently using the Folio Tech Stack on the platform.

“What I find attractive about fractional stocks is it allows people a high degree of accuracy in portfolio creation,” he said.

Lofgren says that about one-third of the detention unit’s workers are software engineers; They are also leveraging Goldman engineers at the broader firm, which will account for about one-quarter of its 40,000 employees at the end of 2021.

Still, they’re not building an in-house soup-to-nuts platform, and Lofgren admits that many RIAs are multi-custodial. Much of the engineering work will be integrated with external technology providers, including CRM platforms, trade order and portfolio management software, and financial planning systems. Lofgren said the firm has received a lot of in-bound calls from RIA tech providers who want to be in the mix.

“I don’t believe you’re going to see us eliminate the need for a trade order management system or a portfolio management system, or [dedicated] technology provider,” he said. “We see a lot of them as really good, capable solutions. We’re asking ourselves how can I tie them together through an API structure where people can use it and work with their customers.” Can you get a good snapshot of what’s going on with?

Lofgren declined to name the specific tech providers he would work with. In November, InspireX announced that it was offering a white-label version of its BondNav fixed income market technology to custodians’ RIAs.

Talent

Goldman Sachs is putting together an experienced leadership team from both internal divisions and external RIA custodians to lead its efforts. The firm has tapped Adam Siegler, head of the private investor product group at Goldman, and Cameron Bryan, an engineer at Goldman, to co-lead the division.

In addition to Lofgren, Goldman also hired Bill Dalton, former regional director of business development at Pershing, as regional business development executive. The firm also brought on Jim Lafman, a former vice president of transition account management at Pershing, as head of customer transition and account management. Craig Sintron, Head of Institutional Technology Consulting at TD Ameritrade Institutional, joined last February as Head of Consulting, and Darla Sipolt, Managing Director of Sales at TD Ameritrade for 17 years, also joined the mentor. Kayla Keneally, former head of financial wellness at Face Wealth, joined as vice president in February 2021.

“We have people who have come in, people with traditional custody, sales and business development backgrounds, people who have come out of major private banks. We have people who come out of the wirehouse. We had people who come in from RIAs ; We have technologists from our competitors,” Lofgren said. “And so it’s really been a broad swath of different groups of people.”

While some published reports indicated that Goldman had a certain amount of time to announce the official unveiling of its custody business to the broader market, Lofgren said the firm has never publicly stated that it will end on a certain date. Will be done.

“We are intentionally not coming up with a public date,” he said. “This journey and what we are building – this is a no-and-done. It is an ever-evolving platform. We believe we will continue to roll out capabilities and solutions and things from the firm at different times. Will keep.”

For many independent advisors, Goldman represents another large Wall Street firm that is pursuing proprietary investing, as opposed to the business model they say appeals to them and their clients. Goldman was, after all, one of the firms at the end of the mortgage-backed securities market that led to the 2008 financial crisis. The firm has since made a financial resumption of its role, and is now subject to high regulatory oversight. Still, some critics have argued that offering custodial services may be a tough pill to swallow for a seemingly independent RIA.

Lofgren knows that point of view, but isn’t worried; He believes the strength of the Goldman Sachs brand and the firm’s “state-of-the-art thought leadership and capabilities” will be valued by many consultants, particularly those new to the independent space.

“For those starting their own firm, [the brand] Will bring a sense of comfort and stability which will probably help them convince their customers to follow them,” he said. “There’s a certain mystery surrounding Goldman Sachs. There’s a belief in creating something that’s unique, not widely available to other people.”

Editor Davis Janowski contributed to this story.