Predictive Power of Yield Curve

One of the benefits of producing material on the financial markets for an extended period of time1 It is that you are bound to see certain topics or environments that you have already covered.

For example, many market forecasters are now concerned about an inverted yield curve.

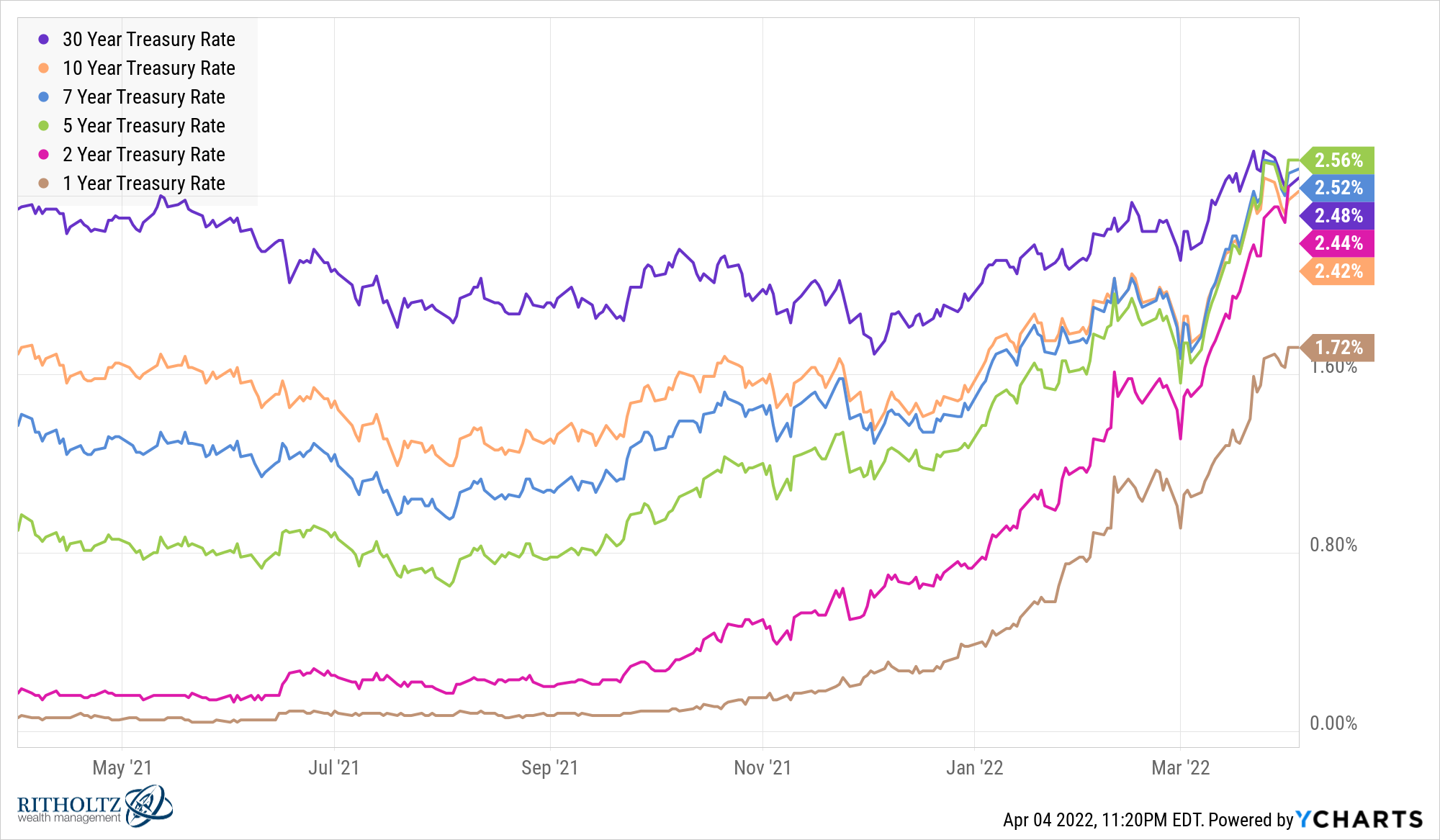

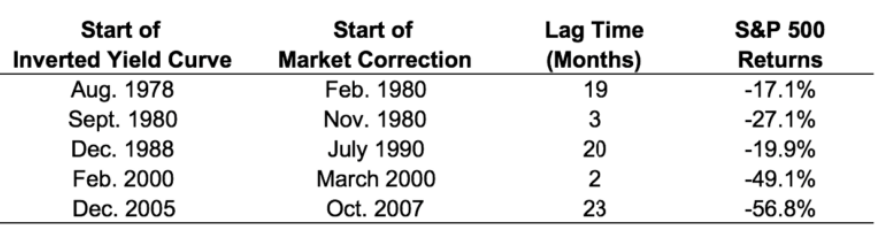

The 5-year and 7-year Treasury bonds currently yield higher than the 3o-year Treasury. Yields at 2 years, 5 years and 7 years are higher than those of 10 years (just barely).

I first wrote about the possibility of an inverted yield curve in 2016:

Bond yield spreads are commonly used to gauge the health of the economy. The wide spread between long-term and short-term bonds leads to an upward sloping yield curve, which can indicate healthy economic prospects – the potential for higher growth and inflation in the future. Narrow spreads lead to a flatter or negatively sloping yield curve, which can indicate poor economic prospects – most likely low growth and inflation.

The yield curve did not reverse that year, but short-term rates continued to rise as the Fed raised rates through the end of 2018.

In February of that year I observed the relationship between yield curve inversion and recession as well as stock market declines:

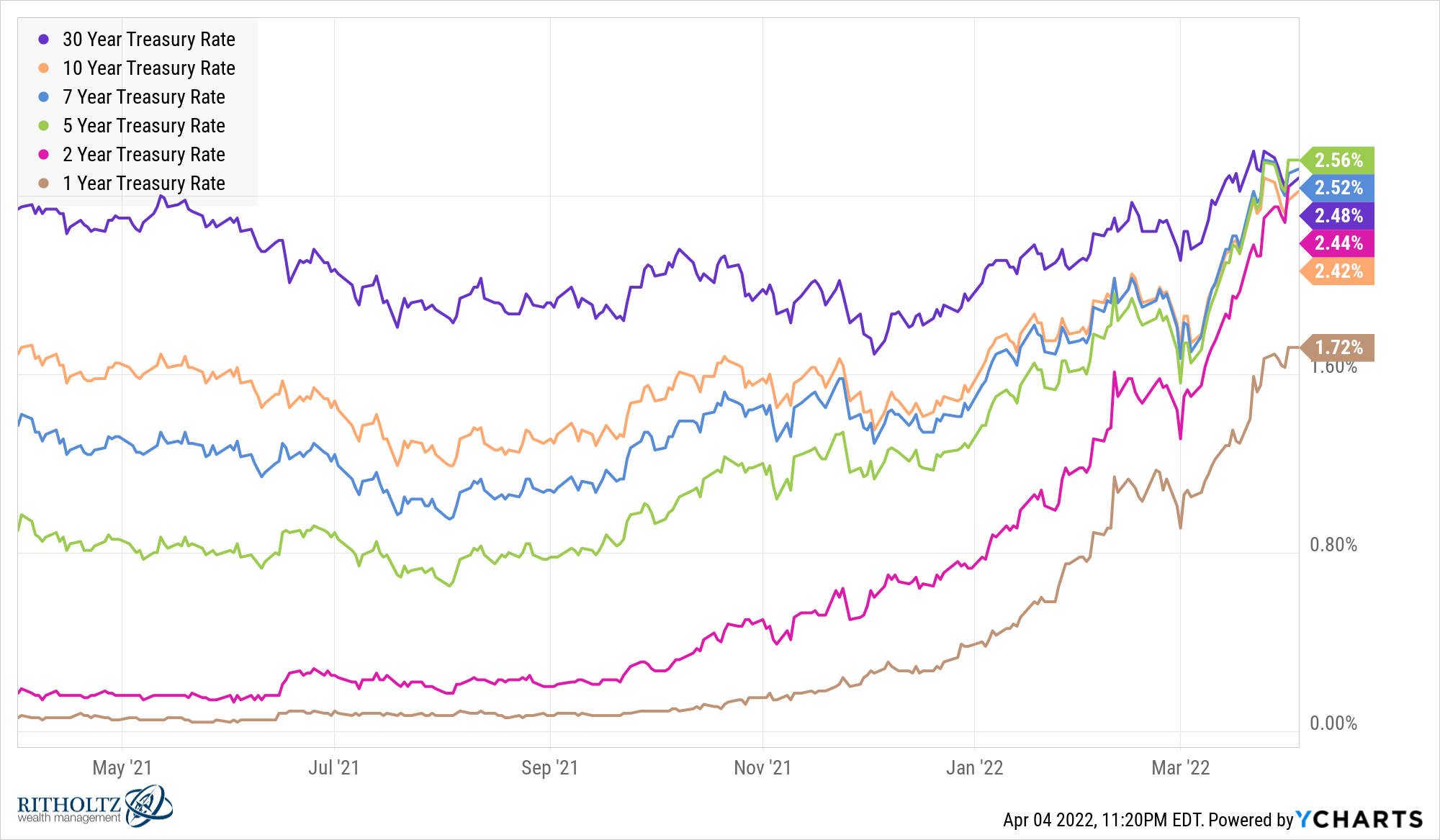

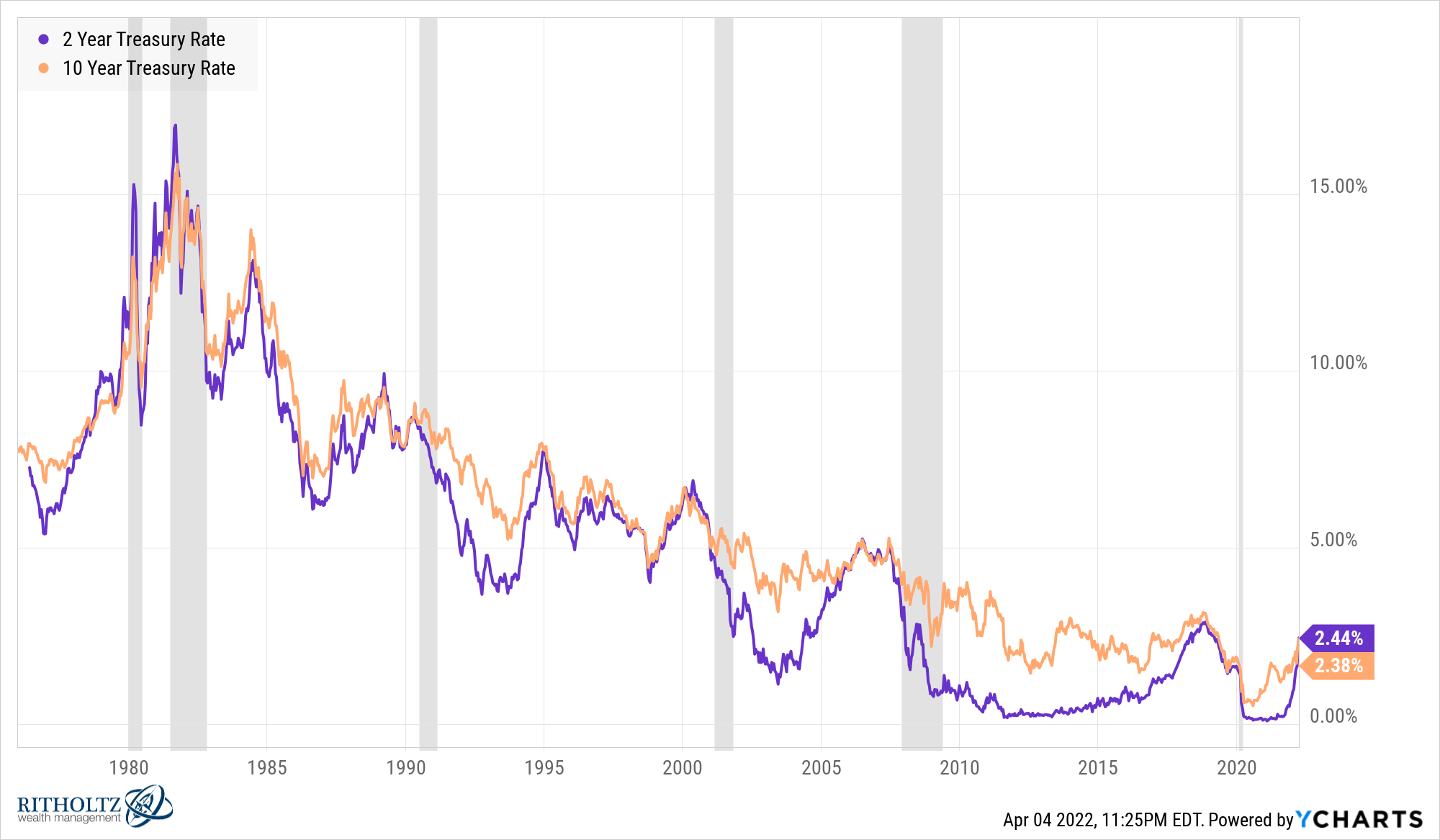

By that time, the US economy had gone into an average 17-month recession following an inverted yield curve.

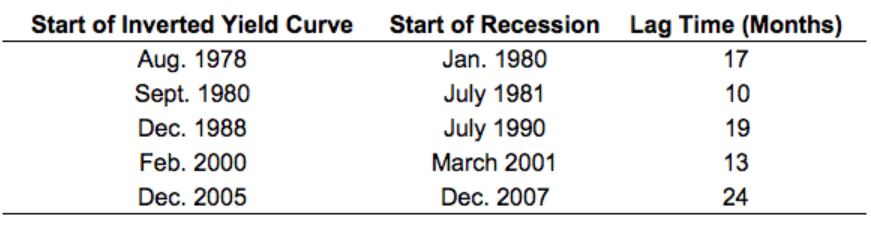

These downturns led to two corrections in the stock market, a bear market and two terrible crashes:

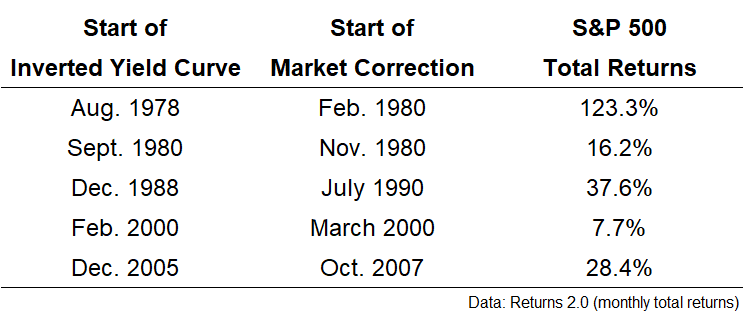

It also makes sense to look at returns between the inversion of the yield curve and the start of these stock recessions:

The markets are moving fast these days but this shows that the stock market doesn’t always care immediately.

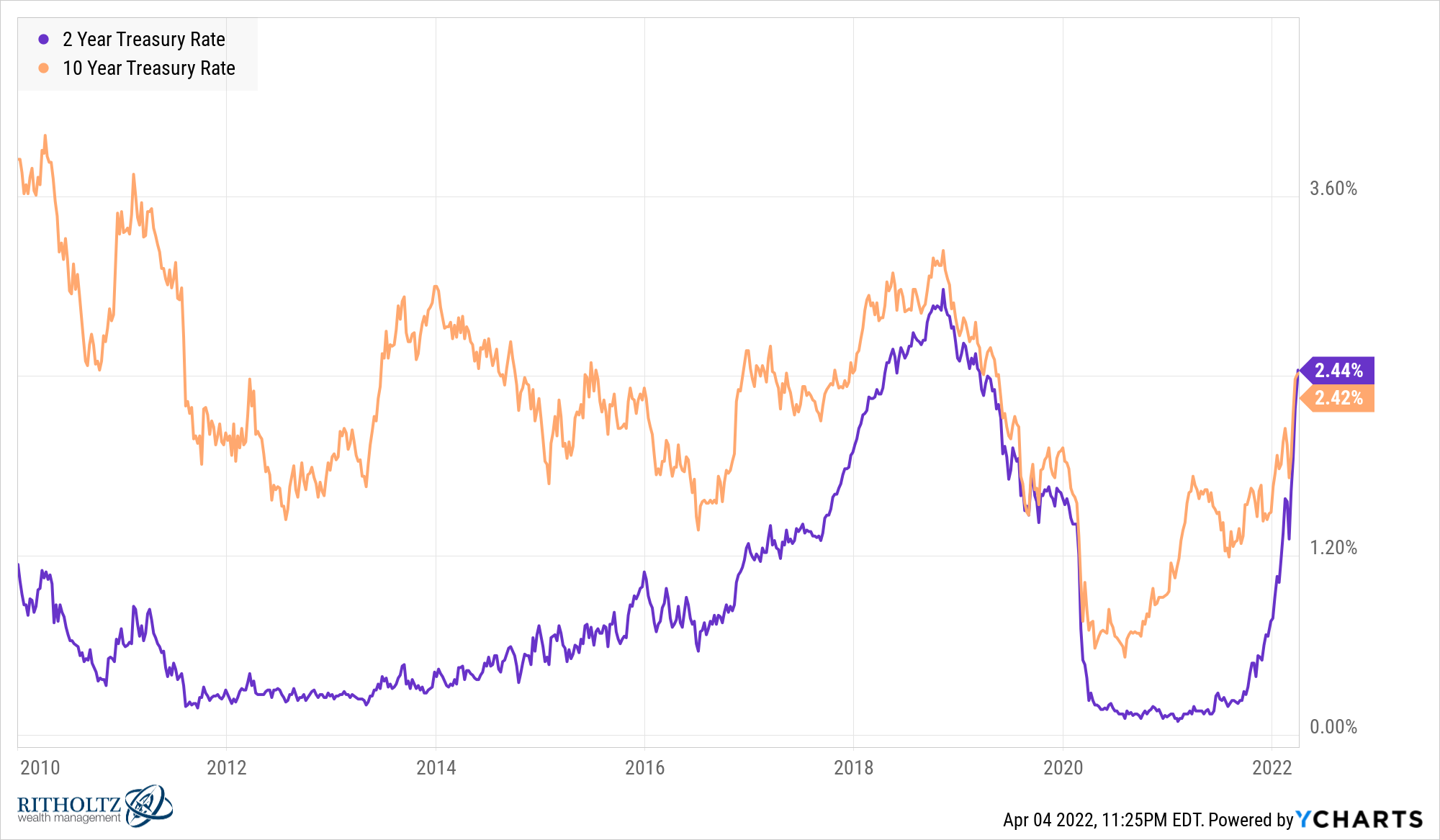

You can see that the 10-year and 2-year yields were on a collision course until the end of 2019 when they finally reversed:

The pandemic quickly ended it as the Fed slashed short-term rates to prevent an economic collapse.

Now that they are raising rates again, short-term yields have caught on in a hurry.

Does this mean that the economy is bound to go into recession?

I don’t know

On the one hand, there’s a reason why marketers get so nervous about inverted yield curves.

Signal has a solid track record.

On the other hand, things that have never happened before happen in the markets all the time.

Maybe something really different this time.

Maybe the Fed can arrange a soft landing.

Maybe inflation will slow down on its own now because people are not getting checks from the government to increase their spending.

The Fed’s control over the yield curve through bond purchases may have changed the usefulness of this signal.

I often feel like Tobias Funke when making arguments like this but nothing would surprise me in the markets at the moment.

Now, let’s say you have 100% confidence in the yield curve as a macroeconomic indicator. Even though it has predictive power when it comes to economic downturns, it doesn’t necessarily help you when it comes to market timing.

In late August 2019, a few months before everyone’s world was turned upside down (upside down you might say), I wrote that you probably can’t use the yield curve to time the stock market:

Eugene Fama and Ken French recently published a research paper on the topic Inverted Yield Curve and Expected Stock Return. Fama and French took their dataset of 11 major stock and bond markets back in 1975 to determine whether an inverted yield curve could predict the stock market’s underperforming short-term Treasury bills (a proxy for cash). Is. They compared six different yield spreads, switching from stock to T-bill when any of these yield curves inverted. Then they looked over the next one, two, three and five-year periods to see what happened when they switched from stocks to cash.

The conclusion of both states, “We found no evidence that inverse yield curves predict that stocks will underperform Treasury bills for forecast periods of one, two, three and five years.” They compared three broad market indexes using the US Stock Market, the World Stock Market and the World Ex-US Stock Market. The switching strategy from stocks to cash weakened a long-only buy-and-hold strategy in all 24 examples using US and world markets. The yield curve signal also performed poorly in 19 of the 24 world ex-US backtests.

Even if the yield curve predicts bearish again, you cannot predict:

- When the recession comes

- If/when the stock market will start falling.

- The magnitude of the recession and the correction in the stock market.

- What will the Fed do in the meantime?

Changes in the economic system often lead to increased volatility in the market. But this does not make it easy to earn money in the stock market.

Further reading:

You Probably Can’t Use the Yield Curve to Time the Stock Market

1I have been working on this blog for over 9 years now.