Stock Market History as a Rorschach Test

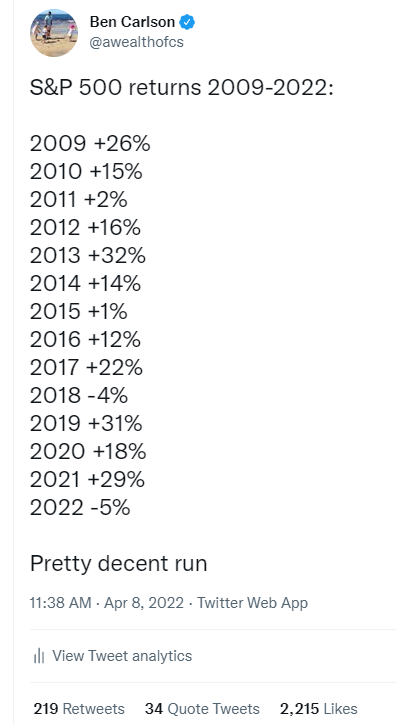

I was updating some spreadsheets last week and revisited the healthy trend in US stocks since 2009.

It’s been a remarkable run:

This tweet did some numbers (not for bragging), so there was definitely a lot of pushback because people who are online are fond of burrowing holes in historical market data.

There is nothing wrong with some healthy debate. Everything is not always as it seems.

So I wanted to look at some of the biggest opposition people who have these numbers:

What about earnings this time? This is a fair question. It makes sense to wonder whether the fundamentals have increased with the price.

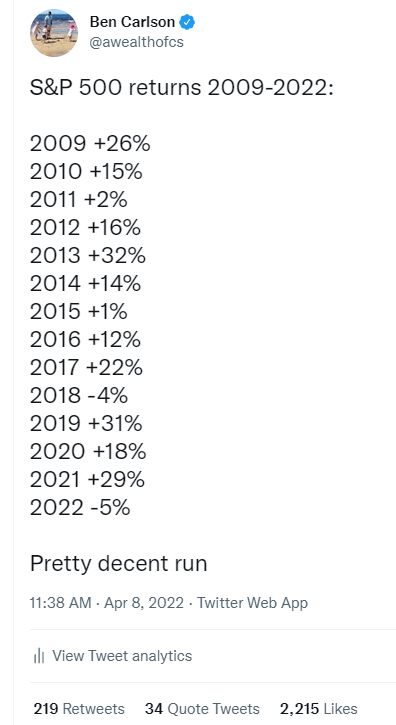

Take a look at the yearly growth earnings as well as the yearly annual returns:

The S&P 500 was up 15.8% year over year from 2009 to 2021. Look at the earnings figures, though – they were up 22.0% year over year. Earnings beat the stock market!

Now, even these numbers need some context.

Look at that massive spike in 2009, when earnings were about 250%. This growth stemmed from the wipe-out in corporate earnings in 2008 when they fell nearly 80%, primarily from banks that saw their businesses in financial trouble.

Okay, let’s throw that number out. Earnings still grew 12% per year from 2010 to 2021, with shares up 15% per year over that time.

This bull market has not been created on the back of a massive Chinese rush on the part of investors. Fundamentals also played a part.

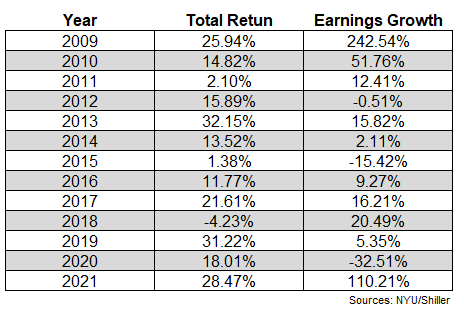

Yes sure, but compare these numbers to the Fed’s balance sheet. Its de facto monetary policy has been easier than beating the Detroit Lions for some time now.

Interest rates on the floor. quantitative easing. buy bonds. It would be redundant to suggest that the Fed has had no effect on the stock market for the past decade.

But what about Japan?

Their central bank has maintained a similar monetary structure. Look at central bank assets as a percentage of GDP (via Yardeny Research):

Central banks in both Japan and Europe have commissioned printing presses as in the US, yet those stock markets have not experienced nearly the same momentum as we have.

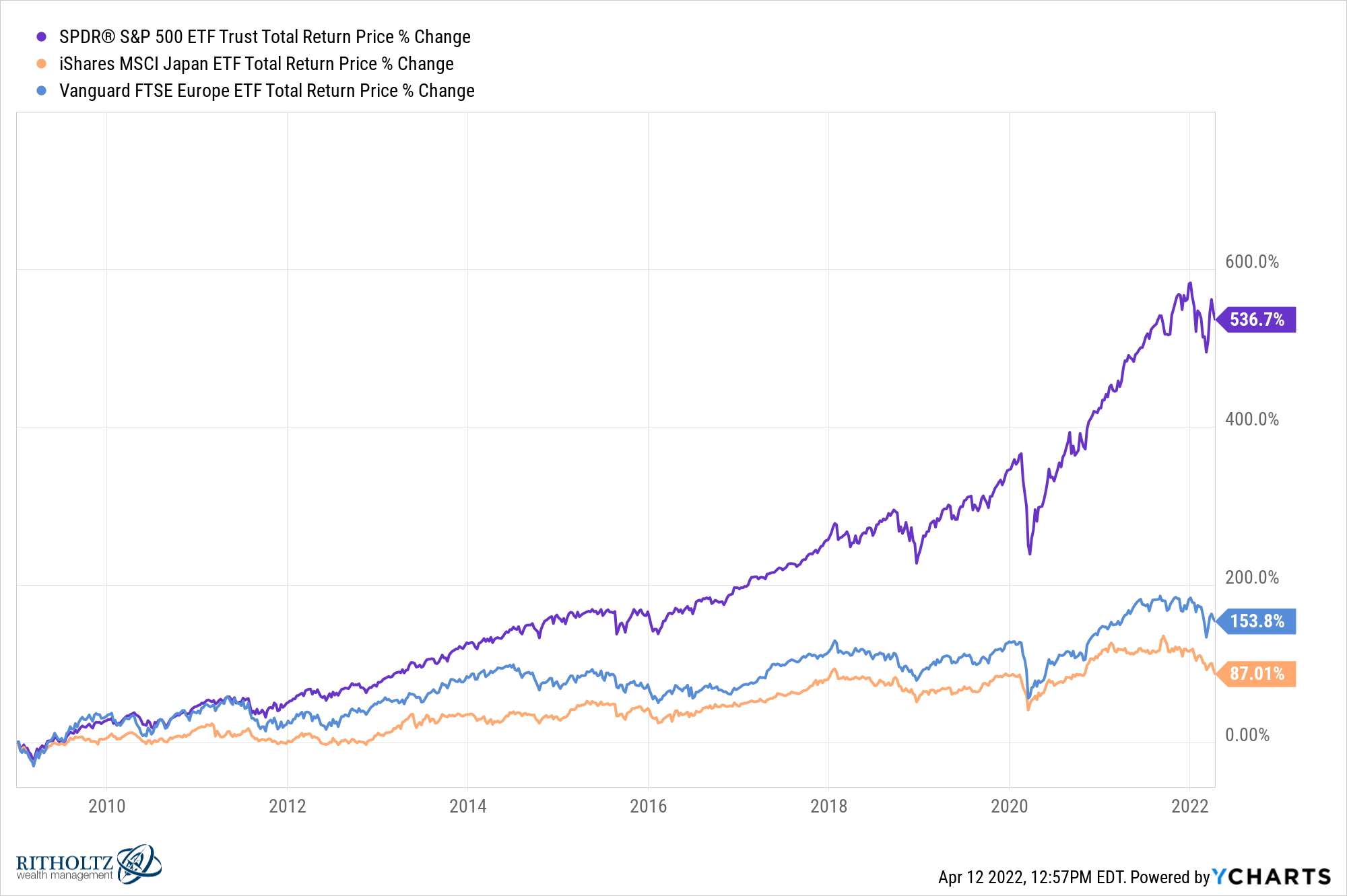

Japan’s central banks began buying stock ETFs for their balance sheets. View returns since 2009:

US stocks have been crushing these developed markets, despite plenty of help from their central banks over the years.

Yes, the Fed plays a huge role in the markets but monetary policy is not everything.

Sure, but what if you started this comparison in 2008? Yes, 2008 was indeed one of the worst years on record for the US stock market. The S&P 500 fell nearly 37% that year.

Starting in 2009 the total return is around 540% or more than 15% per year.

Starting in 2008 the total return exceeds 300% or 10.3% per annum.

Those returns are still good, and not eye-catching.

As always, change your start or end dates and when it comes to historical market data, you can tell just about any story you want.

If you go back to 2000 things don’t look nearly as good. Speaking of changing start dates, it is also true that the year 2000 was not a good starting point for US stocks.

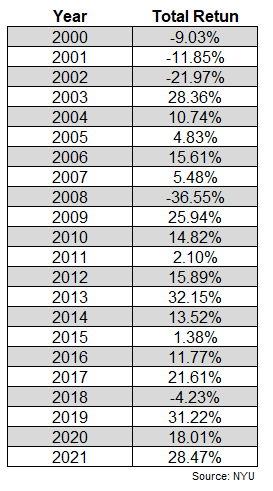

You can see that the list of annual returns was not as kind as in the first decade of this century:

Three years in a row to kick things off after the 2008 debacle.

The total return of the S&P 500 from 2000-2009 was -9%. That’s right – an annualized return of about -1% per year. Lost decades aren’t fun (unless you’re a dollar-cost average).

So if you include that lost decade and use the starting date of 2000, we’re looking at a total return of about 365% and an annualized return of 7.1%.

All things considered – a global pandemic as well as a lost decade duel 50% of crashes in bookings – and you still get over 7% per year, possibly not terrible from the worst entry point in history .

And if we go back to 1996 we are now talking about an annualized return of about 11% per annum.

We could do this all day.

in his excellent book how to lie with statisticsDarrell Huff writes:

The cryptic language of figures, so engaging in a fact-minded culture, is employed to sensationalise, inflate, confuse, and overshadow. Statistical methods and statistical terms are essential for reporting social and economic trends, business conditions, “opinion” surveys, mass data from the census. But without writers who use words with honesty and understanding and readers who know what they mean, the result can only be semantic nonsense.

Statistics require nuance because different people may look at the same data point and come to polar opposite conclusions.

The thing to remember about market history is that you can use it to tell just about any story – why things will be different in the future, why they will remain the same, how relationships change, rules of thumb, How to beat the market, etc.

Data is often in the eye of the beholder. The past can provide context and perspective but it cannot predict the future.

The good news is that we need these divergent views. That is what makes the market.

Further studies:

How to Conquer Any Argument About the Stock Market