What is money management? Everything You Need To Know

Save more, spend smarter and grow your money

Wealth management is one of the best financial advisory services that a wealthy person can choose to manage his financial assets. Although the service is generally accessible to extremely wealthy clients, those with a significant amount of financial assets may also find it useful.

Wealth managers across the country help their clients manage their finances and assets that contribute to their overall net worth, such as real estate, stocks, art investments and luxury vehicles. A wealth management firm can provide a variety of services, including retirement planning, tax services and estate planning. Even if you don’t consider yourself wealthy right now, there is a chance that your wealth may increase as you age, and a wealth manager can make it easier to organize your money.

What is meant by money management?

The basic definition of wealth management is an advisory service that provides financial planning and management for wealthy individuals. These can be individuals or families who want to manage their money together. The minimum investment to work with a wealth manager varies, but can range from $500,000 to $5 million or more. Depending on the firm or individual wealth manager, they may provide a number of money management services.

Possible services include:

- Financial Planning: Setting budget and financial goals.

- estate planning: Family arrangements in preparation for death, such as living trusts and wills.

- tax planning: Estimating taxes and discovering tax deductions for income and investments.

- investment Management: Developing investment strategies and overseeing investment portfolios such as stocks and bonds or exchange-traded funds (ETFs).

A wealth management company may offer all kinds of services that specialize in specific areas, or they may work with certified professionals on a contractor basis to perform those tasks. An example of this would be a firm employing an outside accountant to take a closer look at its clients’ taxes or to better handle legal documents.

Do you need money management?

If you have at least six figures (AUM) of assets under management, you may benefit from wealth management. More well-known investment firms such as UBS, Fidelity and Morgan Stanley may only accept clients who have assets of at least $1 million. For people with very high net worth, private management firms may be a better choice, as they deal with very wealthy clients and can complete their services more directly.

What are money managers?

A wealth manager is a specific type of financial advisor who either works for a wealth management firm or provides its services independently.

What do money managers do?

It can be difficult to manage money and investments, even if you have assets of less than $100,000. If you were finding it difficult to manage property for less money, it may become more cumbersome as your assets grow. This is why wealth managers and wealth management consultants are essential to many people as they guide clients in investing, helping them organize their finances, and planning for their retirement.

These advisors are extremely beneficial for those who have suddenly experienced a significant increase in salary or investment capital and are not used to having so many assets under their control.

What is a Robo-advisor and how does it work?

For those who prefer less human interaction, some money management companies have robo-advisors who provide automated services – keeping your money management on autopilot.

These autonomous advisors use algorithms and your personal preferences to implement strategies for your portfolio and other investment decisions. Robo-advisors are a completely online service, so there is minimal interaction with an actual financial advisor.

Some people prefer robo-advisors because there is less human interaction, while others do not feel comfortable placing their money in the hands of a robot.

How to choose a Wealth Manager?

When choosing a money manager, consider these factors:

- Research the different services offered and the manager’s background.

- Verify the credibility of the firm and/or managers.

- Review how the manager is paid.

- Compare the services of different management firms.

- Focus on the value of the service rather than the price.

Finding and verifying a money manager’s credentials and services is important, and minimizes the chance of you falling victim to fraudulent or deceptive services. You can verify the advisor’s credentials through the Securities and Exchange Commission (SEC). There are several ways for these managers to receive payment for their services, some of which charge a similar fee, and others a commission.

Some clients prefer to pay their manager by commission because it gives the feeling that both parties are simultaneously dedicated to the assets managed. Others may prefer a flat rate for the sake of simplicity, but it all depends on what you prefer. Regardless of how they are paid, it is important to prioritize not how much you will pay, but if their service is worth your payment.

Are Wealth Managers Worth Your Money?

If you are having difficulty organizing and planning your money, investments and other assets, money managers can be extremely useful. If the manager only takes a commission, they can use a percentage of the capital gain as a commission fee; Hence, you will not need to worry about paying directly out of pocket.

Flat fees, on the other hand, can range between $7,500 to $55,000 annually, while hourly fees typically range from $120 to $300, so you need to consider whether they are affordable for your personal budget. But if you are good with money and are confident in managing your own assets, a money manager can be more helpful than necessary.

Money Manager Vs. Financial Advisor: What’s the Difference?

All money managers are financial advisors, but not all financial advisors are money managers. There are several types of financial advisors that provide a variety of financial services, where wealth managers deal only with high-end wealthy clients. Here are some industries in which a financial advisor may specialize:

- accounting

- real estate

- Stock, bond and index funds

- College and future education plan

- budget

Wealth management firms may be able to offer services related to all of those areas, but in many cases they will have their own personal advisors who specialize in only one of those industries. Advisors under one company can provide services together to offer a complete wealth management package.

Money Management Vs. asset Management

Asset management focuses on investments such as stocks, bonds, ETFs, mutual funds and other investments. Property managers provide a more comprehensive service and focus on their client’s entire asset rather than maximizing profit for the property.

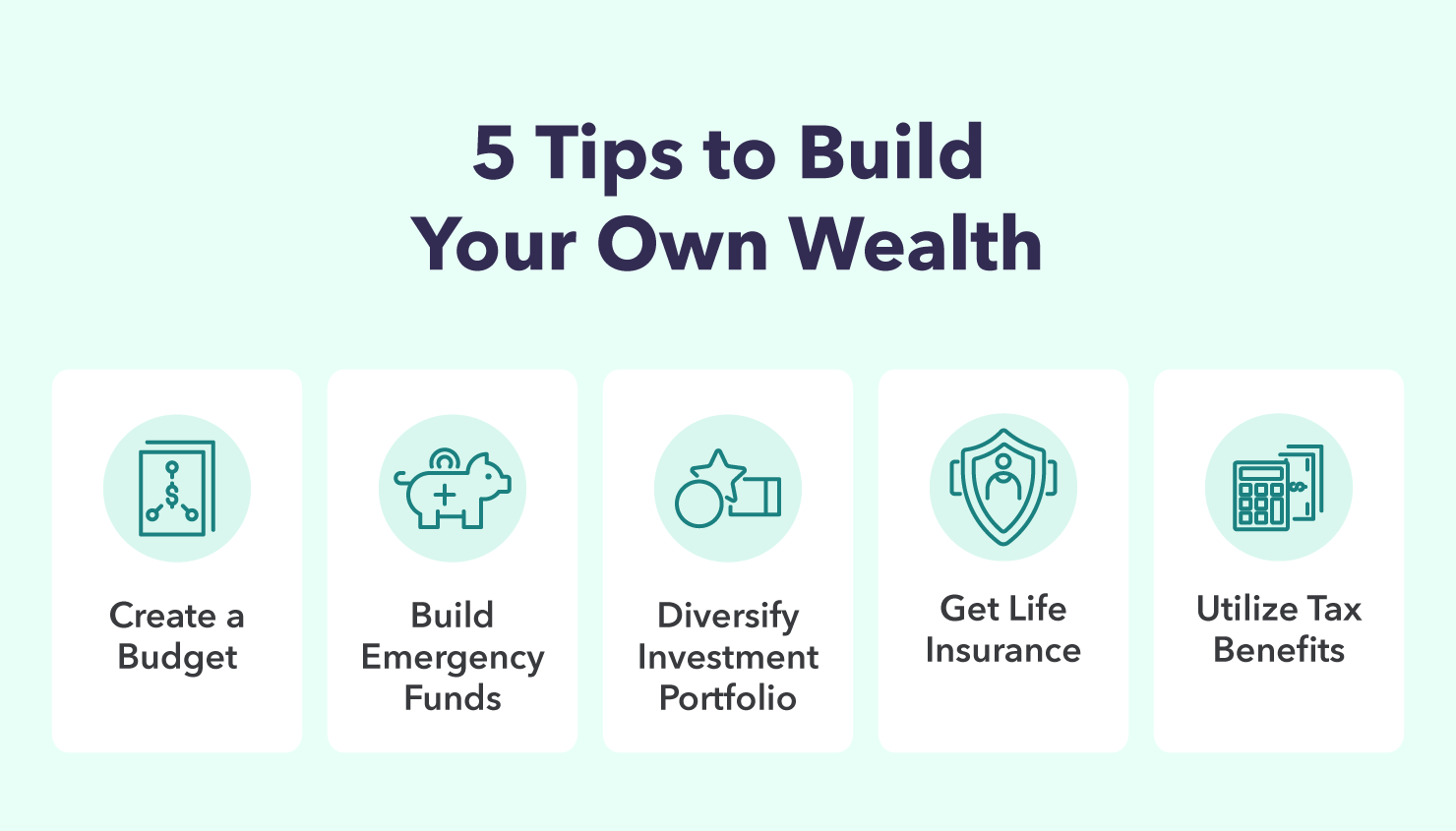

Best Money Management Strategies

Whether or not you decide to hire a money manager advisor, there are a few tips to keep in mind to help keep your money stable:

- Create a budget for your spending.

- Have a savings account or some kind of emergency fund.

- Diversify your investment portfolio.

- Get life insurance in case of sudden life threatening situation.

- Discover ways to fully utilize tax benefits.

While a money manager may be able to manage all of your wealth for you, it is often best to work as a team and practice good habits. Advisors can recommend budgeting, setting aside extra money for savings, and other helpful tips. However, if you don’t practice these methods in your daily spending, you will put your money at risk of squandering – especially in times of unforeseen events such as an economic downturn. Implementing your own money management strategies can make planning easier for you and your manager.

money management options

If you are looking for a more specialized type of money management services, there are professionals such as stockbrokers, real estate agents, asset managers and accountants who can provide specialized services.

If you have most of your money in stocks, stockbrokers specialize in executing trades and other stock transactions for their clients. For those who just want help managing their real estate properties, a real estate agent can handle the activities associated with those investments. And if you just want help with taxes, an accountant is all set to assist you.

money management frequently asked questions

Many people may be unfamiliar with the concept of money management, so we have collected some of the most common questions on the topic and answered them for you.

What is the fee for Wealth Manager?

Wealth management fees vary from company to company, where they can be either a flat annual fee, an hourly fee, or an annual commission on the amount of assets being managed. Commission fees can range from 0.59 percent to 1.18 percent annually, but robo-advising can be cheaper. Flat annual fees can range from $7,500 to $55,000, while hourly fees typically cost from $120 to $300.

How do wealth managers make money?

Wealth managers make money from the rates and commission fees they charge customers. If it is a wealth management firm, they will split those income between employees and qualified contractors based on their own standards.

What if I don’t have enough money for money management?

If you don’t have enough money to be a money manager, you can practice good money management habits and use the resources Mint provides. Whether it’s budgeting, calculating your net worth, or estimating your retirement savings, Mint has various tools at your disposal – such as the cost of living calculator – to help you organize and build your wealth. .

Manage Your Money with Mint

Along with the calculators that Mint offers, we also have the Mint app, your all-in-one personal finance hub that allows you to monitor finances, track your credit score and much more. Be your own money manager by managing all your assets, accounts, bills and credit cards in one place. By using strategies and tools like the Mint app, you can build wealth and increase your net worth more effectively.

sourcing

Save more, spend smarter and grow your money

-

previous post

What to do with your money now that savings rates…